Representatives Ro Khanna of California and Debbie Dingell of Michigan have introduced a bill titled the “Made in the USA Tax Credit Act,” aimed at boosting domestic consumption and supporting local manufacturers.

This proposed legislation offers financial incentives to American consumers to encourage the purchase of locally made products. By providing up to $2,500 in tax credits for individuals and $5,000 for couples, the bill is planned to promote the buying of American-made goods and support small businesses in the United States.

Focused Support for Small Businesses

The Made in the USA Bill is specifically designed to benefit small businesses in the U.S., particularly those with fewer than 500 employees.

The bill aims to make American goods more affordable to consumers, thereby fostering job creation and enhancing worker dignity. By focusing on small businesses, the legislation intends to stimulate economic growth and support the backbone of the American economy.

Criteria for Made in the USA Certification

Newsweek reports that under the new bill, products must meet the Federal Trade Commission’s standards to qualify for the tax credit.

The FTC mandates that a product must be “all or virtually all” made in the U.S. to receive the Made in the USA label. This requirement ensures that the tax credit supports genuinely American-made products, aligning with the bill’s goal to strengthen domestic manufacturing.

Exclusions and Limitations

The legislation excludes luxury items, tobacco, firearms, and vehicles from the tax credit.

This focus is intended to ensure that the tax credit benefits essential consumer goods and supports industries that contribute positively to the American economy.

Statements from the Lawmakers

Representative Dingell expressed her support for the bill, stating, “Investing in American manufacturing drives innovation, prosperity, and progress.”

“I’m proud to introduce the Made in the USA bill with Rep. Khanna to encourage consumers to support the family-owned small businesses here in our communities, and to look to American products first.”

A Vision for American Manufacturing and Workers

Representative Ro Khanna expressed pride in collaborating with Representative Dingell on the Made in the USA Tax Credit Act, highlighting the bill’s potential benefits for both consumers and American industry.

“This bill will make items more affordable for consumers and help support American businesses and workers. It’s an important piece of what needs to be a sweeping set of policy actions designed to restore American manufacturing and technology leadership and a call to respect workers who will help our country achieve that goal.” Khanna articulated.

The Impact of Declining Manufacturing

The decline in American manufacturing has been a significant concern, with more than 70,000 factories closing since 1998.

The Made in the USA Tax Credit Act is positioned as a response to this trend, aiming to reverse the decline and stimulate growth in the manufacturing sector. By incentivizing consumers to buy American-made, the bill seeks to address the job losses and economic challenges that have accompanied the decline in manufacturing.

Why Has American Manufacturing Declined?

The history of America’s declining manufacturing capabilities is thought to have started after workers put down their tools after World War II. After this costly and exhaustive war, people moved out of the manufacturing industry and the country experienced a time of deindustrialization.

The United States instead of building up and modernizing its manufacturing chose to invest resources in rebuilding areas devastated by the war.

Less Efficient

It’s hard to point to one particular cause for the decline of American manufacturing, but a big reason it has diminished historically is that other countries got newer and better manufacturing during the rebuilding of WWII while the United States didn’t consider it a priority.

There was almost a natural shift towards relying more and more on foreign products not produced in America over time.

Employment Falling in Manufacturing

In modern times, the struggling manufacturing industry has been having to deal with the consequences of changing technology. The manufacturing sector has become much more capital-focused than labor-focused.

Because of automation and advanced machines, there are much fewer manufacturing workers overall in the country. There has also been a changing skill gap occurring in the employment market, where workers don’t have the right skills to adapt to the new landscape.

Less Migration

Another factor that has limited the number of people able to work in the manufacturing industry is the lack of enthusiasm for people to move for these jobs.

In the past, the United States saw a greater willingness for people to move for manufacturing jobs which would in turn change the local population. Now, people moving for these jobs have a much smaller impact on the industry.

American Ethos

Historically, Americans have had a country ethos of being settlers, self-made individuals, and pursuing the American dream.

People are waking up in the modern day to find those values are harder to find. This has led to a resurgence in seeking out things “made in America” to try to recapture that old spirit.

Outsourcing

The term outsourcing is thought to have originated in the 1970s. During this transitionary decade, many manufacturing jobs in industries like steel, textiles, automotive, and electronics became moving outside of the country.

In the beginning, these jobs moved south to Latin America, but eventually, they would start moving to the continent of Asia as the region started developing at a rapid pace.

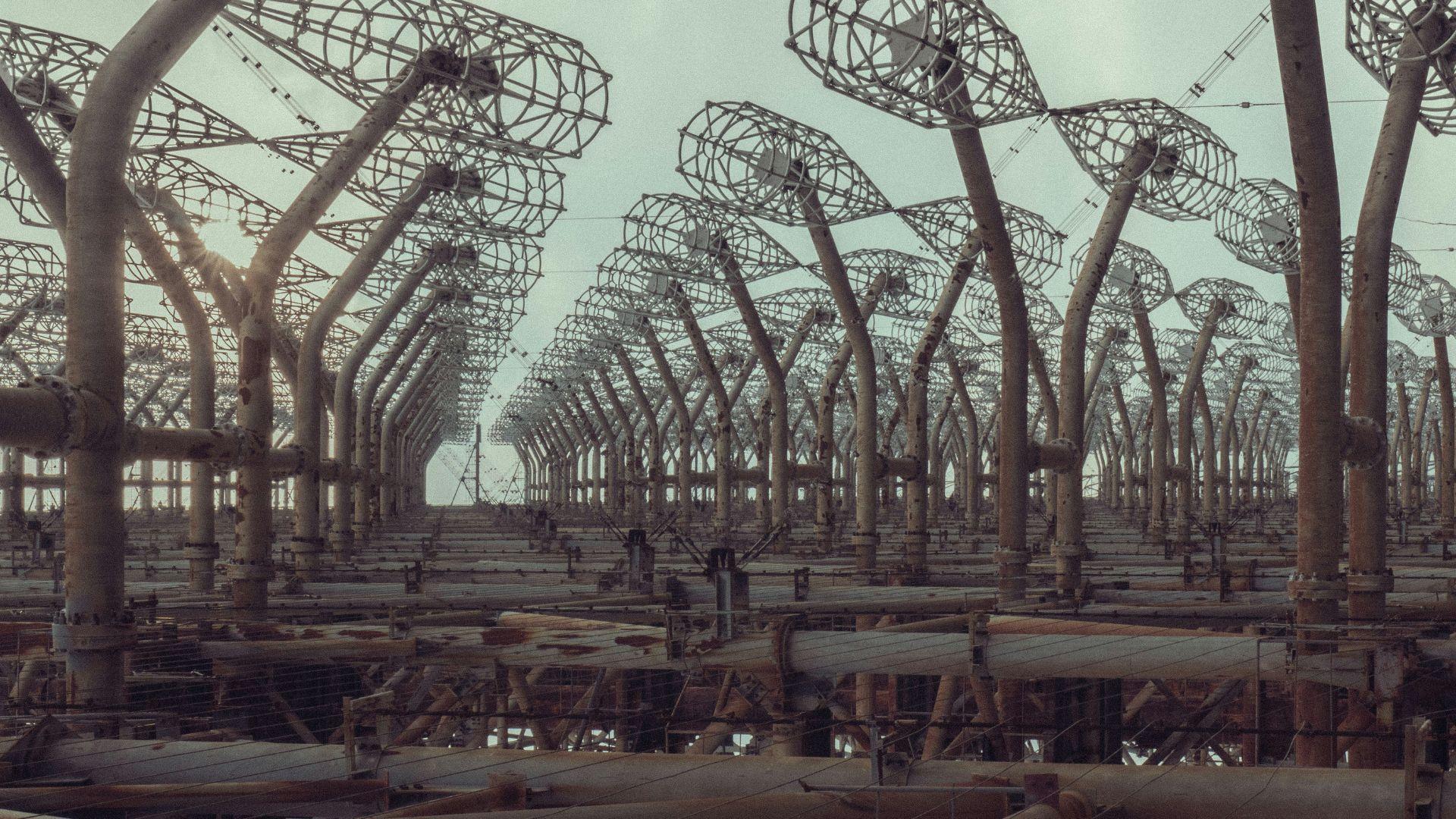

Why Did Manufacturing Move to Asia?

Several economic factors drove the move of manufacturing jobs to places like China and East Asia. These countries positioned themselves as attractive places to do business because they had a strong focus on developing transportation infrastructure.

As up-and-coming developed nations they also offered cheap labor that was also skilled. The result was that companies could save a lot of money by outsourcing these jobs.

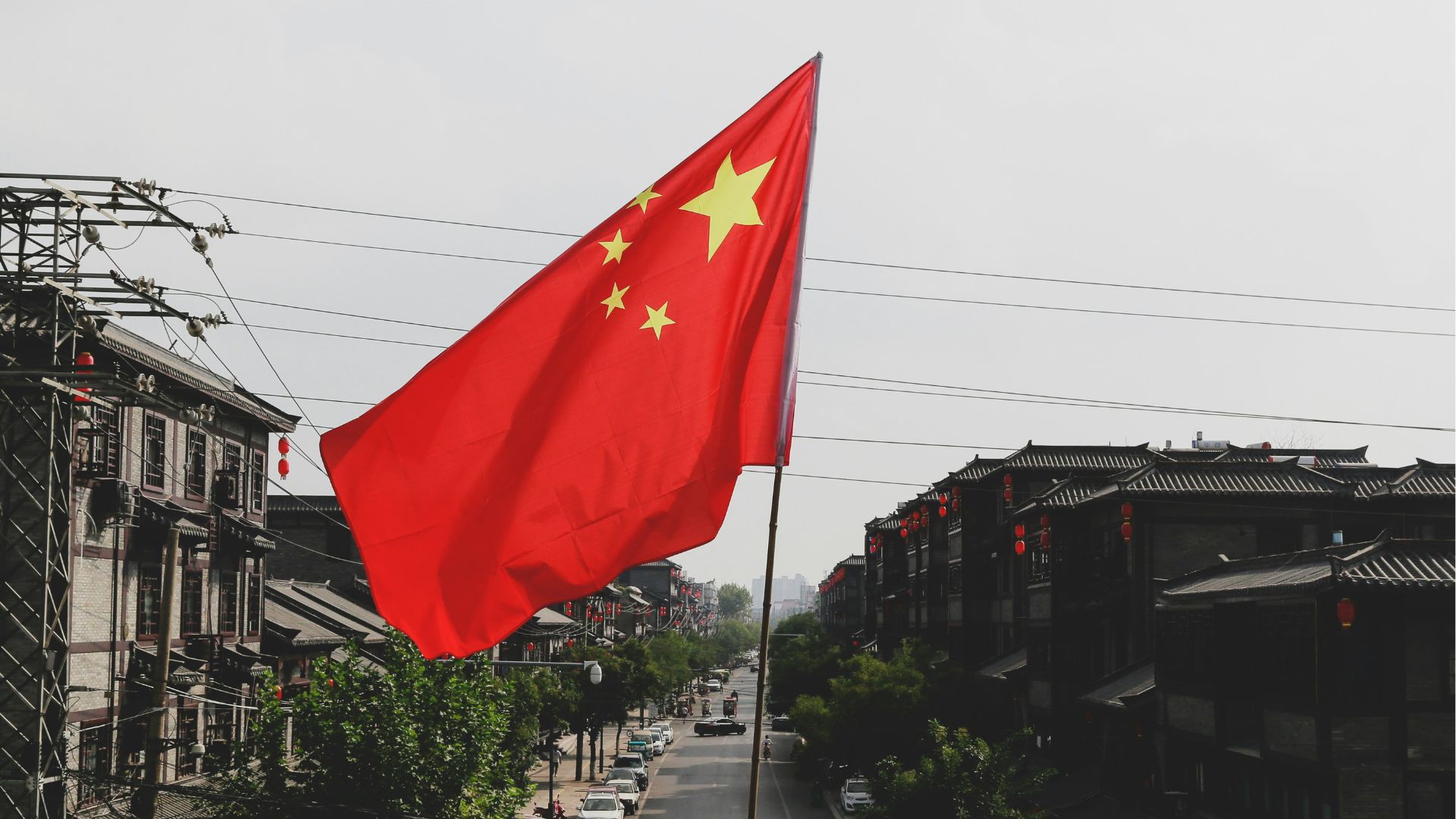

China’s Development

In the short span of a few decades, China turned itself from a closed-off, hermit nation to a global trade and manufacturing leader in the world.

Starting in the 1970s, China shifted its policy goals toward global markets and opening its country to the rest of the world. The result was a massive urbanization that was driven by the production and manufacturing industries.

Populous Nation

For years, China reigned as the most populous area on the planet, a title that was only recently usurped by India in 2023. In the past, China had high birth rates and was also able to keep its death rates low.

After World War 2 was over and the country had an opportunity to recover, its population nearly doubled in just 30 years. China went from a population of 540 million in 149 to 969 million in 1980.

Can These Jobs Come Back to America?

It’s tough to say whether or not manufacturing jobs could reverse their outsourcing trend and come back to America again, even if lawmakers are actively trying to make it happen. The United States is logistically behind many other countries at this point.

For example, Taiwan manufactures over 60% of the world’s semiconductors and it would take other countries years to catch up to their technology if they had the urge to.

Advanced Microchip Products

Taiwan is also responsible for 92% of the world’s production of smaller logic semiconductors. These advanced microchips are smaller than 10 nanometers are have efficient processing power.

They are a vital strategic world resource for the use they have in military applications. These chips are one of the reasons why the United States and China are embroiled in a struggle to influence the nation.

Manufacturing Slowdown

Experts project that the American manufacturing industry will continue to slow down as it experiences labor shortages. It remains to be seen if the Made in the USA Tax Credit Act will be enough to revitalize the industry or if additional steps need to be taken.

Ultimately, people will need to vote with their wallets to ensure there is sufficient demand for products that are born from domestic supply chains.

Eligibility for the Tax Credit

To be eligible for the tax credit, individuals must earn less than $125,000 per year, and couples filing jointly must earn less than $250,000.

Additionally, individuals’ investment income must be below $20,000, and for couples, it must be under $40,000. These criteria aim to target the tax incentive to middle-class Americans, ensuring that the benefits support a broad segment of the population.

Adjustments for Inflation

Acknowledging economic fluctuations, the bill includes provisions to adjust the tax credit amount in line with inflation.

This ensures that the financial benefit remains relevant and effective over time, maintaining its value and impact as economic conditions change.

The Legislative Journey

Newsweek explains that for the Made in the USA Act to become law, it must pass through various legislative stages.

These include approval by the House, the Senate, and ultimately, endorsement by President Joe Biden.

Looking Towards the Future

As the Made in the USA Tax Credit Act progresses through the legislative process, its potential to reshape American manufacturing and consumer behavior looms large.

Dingell emphasized, “We must continue to strengthen our domestic manufacturing and supply chain capabilities, bring home good-paying jobs, and invest in American workers, and that’s exactly what this bill does.”

Corporate Investment Complements Legislative Action

The legislative initiatives like the Made in the USA Tax Credit Act are also being reinforced by significant investments from private companies.

Schaeffler, a notable player in the industry, is channeling over $230 million into a new facility in Ohio dedicated to producing automotive electric mobility solutions. This venture is expected to generate 650 jobs by 2032.