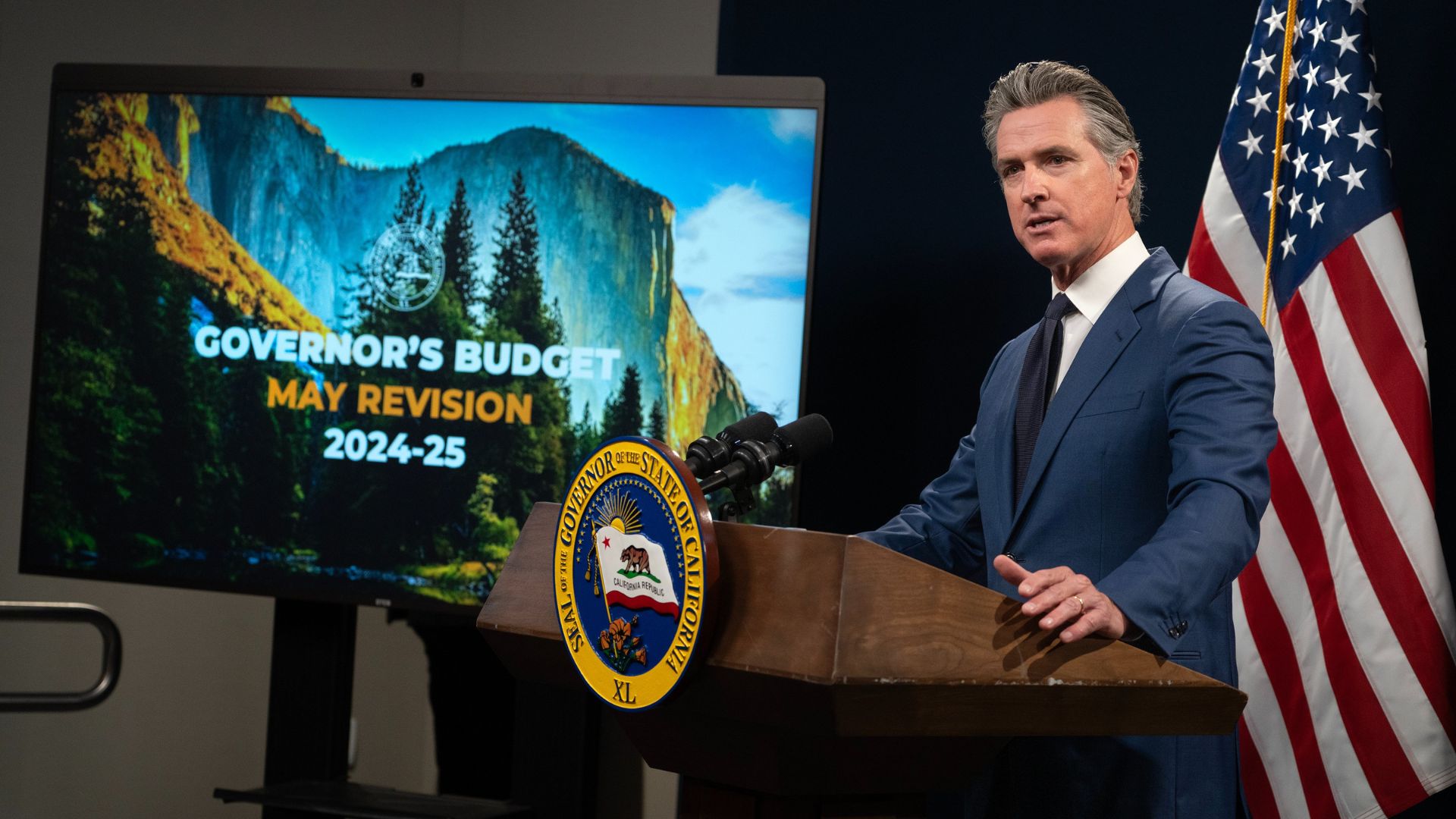

Governor Gavin Newsom has announced a proposal to significantly reduce spending in order to manage California’s growing budget deficit, now estimated at $45 billion.

These proposed cuts will impact a range of services including education for kindergarteners and health care for immigrants and low-income parents, challenging the state known for its robust economy.

The Depth of the Financial Shortfall

Governor Newsom has publicly stated that the budget deficit stands at $27.6 billion. However, when accounting for prior spending cuts agreed upon in March, the actual figure approaches $45 billion.

Additional reductions in public education, which have not yet been included, could increase this deficit even further, according to a nonpartisan Legislative Analyst’s Office report.

Impact on National Politics and Personal Aspirations

The size of the deficit is particularly significant as it not only impacts California but also affects Governor Newsom’s national role as a major advocate for President Joe Biden’s reelection.

This financial challenge comes after years of budget surpluses under Newsom’s administration, which have fueled speculations about his potential presidential ambitions.

Major Initiatives Remain Untouched

Despite the fiscal challenges, Governor Newsom has not yet made cuts to some of his major initiatives, such as free kindergarten for all 4-year-olds and free health insurance for all low-income adults, regardless of immigration status.

These programs represent substantial advancements in state policy under his leadership.

Details of the Proposed Cuts

Governor Newsom’s proposal includes significant reductions, such as discontinuing state payment for the care of 14,000 disabled immigrants, which would save approximately $94.7 million.

He also suggested cutting $550 million intended to help school districts build facilities necessary for expanded kindergarten services.

Child Care and Healthcare Adjustments

In a shift from earlier commitments, Governor Newsom has proposed pausing the expansion of child care services at 119,000 slots, down from a promised 146,000.

Additionally, a $6.7 billion allocation for improving Medicaid reimbursements to doctors has been canceled under the new budget plan.

Responses to the Budget Proposal

The proposed budget cuts have sparked a range of reactions.

Anthony Wright, executive director of Health Access California, commented on the impact of the healthcare cuts: “Further impoverished or end up in much more expensive nursing home care.” Yolanda Thomas from Child Care Providers United also expressed concern, stating that the child care cuts mean “we cannot build a stronger economy when our lowest paid workers… don’t have somewhere safe to send their children during their shifts.”

Governor’s Reluctance to Make Cuts

Governor Newsom expressed his reluctance about the proposed reductions.

He said, “I prefer not to make this cut. These are programs, propositions that I have long advanced, many of them. But you’ve got to do it. You have to be responsible.”

Revenue Growth and Economic Changes

Before the pandemic, California’s revenues were consistently growing, but the post-pandemic period has brought financial challenges.

The state saw a remarkable 55% revenue increase during the pandemic, buoyed by federal aid and a booming stock market. These gains have now reversed, and the state must adjust to the new economic reality.

The Challenge of Budget Forecasting

The Newsom administration has revised its revenue forecasts, now expecting $83.1 billion less for the fiscal years 2022-23 and 2023-24.

This significant shortfall highlights the difficulties in predicting financial flows and planning state budgets accordingly.

Defense of Previous Budget Decisions

In defense of his administration’s financial management, Governor Newsom pointed out that the state Constitution mandated a return of a large portion of the surplus to taxpayers through rebates.

He explained, “I feel like we were doing the best we could under that circumstance.”

No New Major Taxes Proposed

Amidst these financial challenges, Governor Newsom has committed to avoiding major new taxes on individuals but proposes suspending a popular tax deduction for businesses.

He reassured that his budget plan would not lead to layoffs, furloughs, or salary cuts for the state’s employees, as part of his efforts to manage the budget responsibly without adding undue burden to the workforce.

Impact on Social Services and Vulnerable Populations

Governor Newsom’s proposed budget cuts will significantly impact California’s most vulnerable populations, including the elderly, disabled, and low-income families. Reductions in Medi-Cal and disability support services will lead to decreased access to essential healthcare and assistance.

Social workers and healthcare professionals warn that these cuts could exacerbate health disparities and reduce the quality of life for those already struggling.

Long-term Economic Consequences

The long-term economic consequences of these budget cuts could be severe. Reductions in education and healthcare funding may hinder California’s future workforce development and innovation capacity.

Investing less in these areas today could result in a less skilled and healthy workforce tomorrow, ultimately slowing economic growth and competitiveness in the state.

Comparison with Other States

California’s budgetary challenges are not unique. States like New York, Illinois, and Texas also face significant deficits. New York has implemented targeted tax increases, while Texas focuses on cutting administrative costs.

Comparing these strategies, California might find inspiration in adopting a balanced approach, combining moderate cuts with revenue enhancements to address its financial shortfall more effectively.

Public Reaction and Advocacy

The proposed budget cuts have sparked significant public outcry and mobilized advocacy groups across the state.

“These cuts to our social safety net are simply not acceptable,” said Moreno Valley Assemblymember Corey Jackson at a protest rally. “We are not going to balance this budget on the backs of our most marginalized and our poorest residents.”

The Role of Federal Support

Federal support plays a crucial role in mitigating state budget deficits. Past federal aid during the pandemic provided a lifeline for California’s finances.

Potential future support from new federal policies could ease some of the current financial pressures. Policymakers are closely watching developments in Washington, hoping for additional aid to alleviate the need for such deep budget cuts.

Innovation and Alternative Solutions

Innovative solutions are being considered to address California’s budget deficit without resorting to severe cuts. Public-private partnerships, efficiency improvements, and technology-driven solutions offer potential pathways.

For instance, enhancing digital infrastructure such as expanding online services and automating processes could streamline state operations, reducing costs while maintaining service quality.

Political Implications and Future Elections

The political implications of Newsom’s budget cuts extend beyond California. These financial challenges could influence his standing within the Democratic Party and affect his future political aspirations.

Critics argue that the cuts may diminish his support base, while supporters believe his decisive actions demonstrate fiscal responsibility. The outcome of this budgetary crisis will likely play a significant role in upcoming elections.

Educational Outcomes and Inequities

The proposed budget cuts to education threaten to widen existing inequities in California’s school system. Reductions in funding for public schools and early childhood programs disproportionately affect low-income and minority communities.

Less funding means larger class sizes and fewer resources, exacerbating educational disparities and impacting student success rates.

Community Health and Well-being

Cuts to healthcare funding will have ripple effects on community health and well-being. Reduced Medi-Cal reimbursements and paused expansions in childcare services will strain public health systems.

This situation could potentially put older individuals into poverty or force them into costly nursing home care. It also shines a light on the larger impact on public health and economic stability.

Effects on State Workforce

Despite avoiding major layoffs, the budget cuts could impact the state workforce indirectly. With reduced funding for key services, state employees may face increased workloads and stress.

Additionally, suspended projects and initiatives might result in decreased job satisfaction and morale, affecting overall productivity and service delivery within state departments.

Environmental and Infrastructure Projects

Environmental and infrastructure projects are also at risk due to California’s budget deficit. Planned investments in sustainable energy and public transportation may be delayed or scaled back.

This could hinder California’s progress toward its climate goals. Cutting green projects is also contradictory to the state’s fight against climate change.

Navigating Policy Advocacy During a Budget Shortfall

Navigating the choppy waters of budget shortfalls requires advocates to leap higher hurdles and face intensified scrutiny with every new spending proposal. Championing new revenue streams and advocating for a fairer tax system can shield the state from the sting of harmful cuts.

Advocates should also prioritize public education and awareness to ensure the public understands the direct impact of budget cuts on key services and programs that benefit their communities. By engaging with policymakers, educating the public, and advocating for fair taxation, advocates can help mitigate the negative effects of a budget deficit on vulnerable populations and essential services in California.