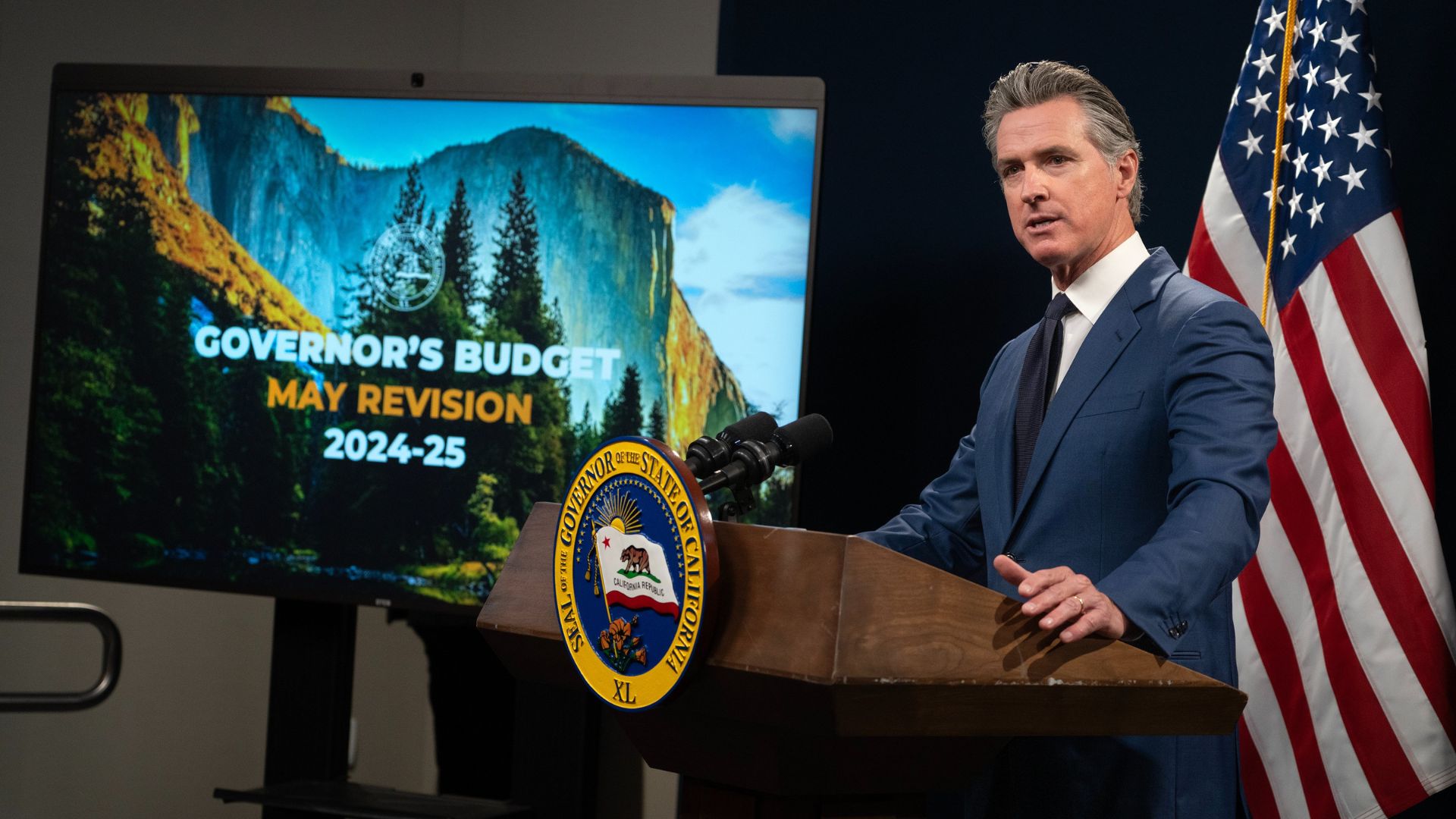

California Governor Gavin Newsom’s May budget revision reveals a $7 billion gap from a balanced fiscal plan for 2024-2025.

Despite this shortfall, it’s an improvement from previous, steeper deficit forecasts. “The May Revision puts the state on better fiscal footing,” noted the LAO in their report.

Trimming the Fat: Budget Cuts and Pauses

Newsom’s proposal outlines $15.2 billion in cuts and a strategic pause on $14.8 billion in program expansions.

These adjustments aim to create a more manageable deficit, refining the state’s fiscal outlook significantly from earlier projections.

Using the Reserves: A Contingency Plan

To help close the fiscal gap, the plan includes using $4.2 billion of California’s reserves.

However, relying too heavily on these funds could spell trouble down the line, especially in more financially turbulent times.

Borrowing and Beyond: Finding Fiscal Balance

The budget proposal also seeks $7.5 billion through borrowing and non-tax revenues.

These efforts combine to project a hopeful $3.4 billion surplus, a stark contrast to the LAO’s more cautious $7 billion deficit warning.

Legislative Challenges Ahead

“The Legislature would need to take $7 billion in additional budget actions to balance the budget,” the LAO asserts.

This sets the stage for potentially tough decisions in the state legislature to meet fiscal goals.

Future Fiscal Forecasts

Projections for 2026-2027 suggest that maintaining a balanced budget will require revenues to exceed current forecasts significantly.

The state’s financial health seems stable for now, but future uncertainties loom large.

Taxation Trepidation: No New Taxes Promised

Governor Newsom has promised no new taxes to address the deficit.

This complicates efforts to raise additional funds through conventional means, and highlights political challenges ahead.

Ballot Battles: The TPA and Fiscal Policy

The LAO hints at potential complications from the Taxpayer Protection and Government Accountability Act (TPA), a measure Newsom and other Democrats are actively opposing as it heads to the November ballot.

This act, if passed, would add new complexities to California’s tax regulation landscape.

Closing Loopholes: The TPA’s Tight Grip

The TPA, if voters approve it, would require a two-thirds majority in the legislature for any new statewide tax increases.

This is a stringent condition aimed at closing current loopholes that facilitate easier tax approvals at the local level.

Dueling Measures: Democrats’ Counter Strategies

Facing the TPA, California Democrats propose two measures, ACA 1 and ACA 13.

The aim is to lower voting thresholds for new taxes and debts, setting up a significant fiscal showdown this November.

Electoral Impact: November’s Decisive Moment

The November elections will be critical in shaping California’s fiscal policy.

The outcomes will determine the future of the TPA and other measures, directly influencing how the state manages its financial health.

Looking Ahead

As California addresses these fiscal challenges, the choices made today will deeply affect its economic stability.

The mixture of budget adjustments, legislative actions, and voter decisions will define the financial future of the state for years to come.