In the United States, a shift is occurring in the way transactions are conducted. An increasing number of businesses across various cities are adopting a “no cash accepted” policy. This trend has profound implications for the approximately 6 million Americans who do not have a bank account.

These individuals, often referred to as “unbanked,” find themselves excluded from participating in basic economic activities in stores and restaurants that no longer accept cash.

Understanding the Unbanked in America

According to the Federal Deposit Insurance Corporation (FDIC), the issue of being unbanked is more widespread than many realize. In the U.S. alone, around 6 million people do not have a bank account. This situation is not unique to America; globally, the number of unbanked individuals exceeds a billion, as per information from The World Bank.

Jay Zagorsky, a business school professor researching society’s transition from cash to electronic payments, revealed to The Conversation what he observed in Seattle, “Numerous shops had one sign proudly proclaiming how welcoming and inclusive they were — next to another sign saying ‘No cash accepted.'”

Reasons Behind Avoiding Bank Accounts

The FDIC conducts a survey every two years to understand why some Americans choose not to use banks. The 2021 survey revealed that the primary reason, chosen by over 40% of respondents, was the inability to maintain the minimum balance required by banks.

This is particularly true for poorer households; the FDIC found that about one-quarter of those earning less than $15,000 a year are unbanked, as reported in The Conversation.

The Costs of Banking

The Conversation explains that for many Americans, the decision to remain unbanked is influenced by the costs associated with having a bank account. A significant portion of unbanked individuals feel that the fees for maintaining a bank account are too high or unpredictable.

According to a Bankrate survey, basic monthly service fees for a bank account range between $5 and $15. Additionally, banks charge $4 to $5 for ATM withdrawals or services like cashier’s checks, and overdraft fees can be about $25 per instance.

The Scale of Unbanked and Underbanked in the U.S.

The latest data from the FDIC shows that there are almost 6 million unbanked and 19 million underbanked households in the United States.

This means that there are over 15 million people living in homes with no connection to banks, and another 48 million in homes with only a tenuous connection. Consequently, one out of every five people in the U.S. has little or no connection to banks or other financial institutions.

The Unaccounted Unbanked: A Higher Estimate

The actual number of unbanked individuals might be higher than the FDIC’s estimates. The survey methodology, which involves questions added to a survey given to people at their homes, likely misses key groups like homeless people, transients without a permanent address, and undocumented immigrants, The Conversation notes.

These groups are often unbanked due to requirements like a verified address and a government-issued tax identification number to open a bank account.

Global Perspective on Unbanked Populations

The World Bank provides a broader view of financial inclusion globally. Their data shows significant variation in banking access across different regions.

For instance, in Euro-using countries, almost everyone has a bank account, but in regions like the Middle East and North Africa, only about half the population does. According to The World Bank, around one-quarter of the world’s adults do not have access to a bank or a mobile-phone account.

The Burden of Going Cashless on the Unbanked

The Conversation reports that as businesses increasingly reject cash, the unbanked are compelled to use expensive alternatives like prepaid debit cards.

These cards involve multiple fees: a purchase fee, a monthly service charge, and a fee for loading cash. This can add up to a significant expense for individuals who are already financially constrained.

Debate Over Cashless Business Practices

In Washington, D.C., the shift to cashless transactions has sparked debate and legislative action.

Critics argue that cashless policies discriminate against residents without bank accounts and undocumented immigrants. Council member David Grosso commented to The Chicago Tribune, “By denying the ability to use cash as a payment, businesses are effectively telling lower-income and younger patrons that they are not welcome.”

Massachusetts AG Advocates for Cash Payments

Massachusetts Attorney General Andrea Campbell has expressed her intention to ensure that cash payments remain an option for consumers at all retail locations, including sports venues such as TD Garden, Gillette Stadium, and Fenway Park.

This initiative is a reassessment of a stance taken by her predecessor, now-Governor Maura Healey. Campbell’s office conveyed to Boston 25 News that it is important for all forms of legal tender to be accepted at retail establishments. The move aims to uphold consumer protection and economic justice, ensuring that those without access to non-cash payment methods can fully participate in the marketplace.

Rethinking Cashless Payments at Fenway Park

Boston 25 News reports that the discussion around cash payments has been reignited with a specific focus on Fenway Park. Previously, Healey had approved Fenway’s move to a cashless payment system, under which patrons could convert cash to a Mastercard debit card for use within the stadium.

This system was deemed to meet legal requirements as stated by Healey in August 2022. However, Campbell’s recent statements suggest a potential reevaluation of such systems to ensure cash remains a viable payment option.

Expanding the Cash Payment Debate to Other Venues

The conversation extends beyond Fenway Park to include other major sports venues in Massachusetts, such as TD Garden and Gillette Stadium, Boston 25 News notes.

Attorney General Campbell has indicated that her office is receiving significant public input on this issue and is in the process of reviewing the legalities and compliance requirements. Campbell highlighted the importance of inclusivity in payment options, recognizing that not all consumers have access to credit cards or smartphone apps for payments.

The Safety Versus Accessibility Argument for Cashless Transactions

The shift towards cashless transactions has been met with both support and criticism.

Some businesses, like the Texas-style taco chain HomeState in Los Angeles, moved to digital-only payments citing safety concerns and the desire to protect their staff and premises from burglaries, as per information from The Los Angeles Times.

Sweetgreen Reverses Its Cashless Policy

The case of Sweetgreen, a salad chain, illustrates the potential for reversal on cashless policies.

The Los Angeles Times reports that after initially deciding to stop accepting cash in 2016, Sweetgreen faced backlash and subsequently reintroduced cash payments.

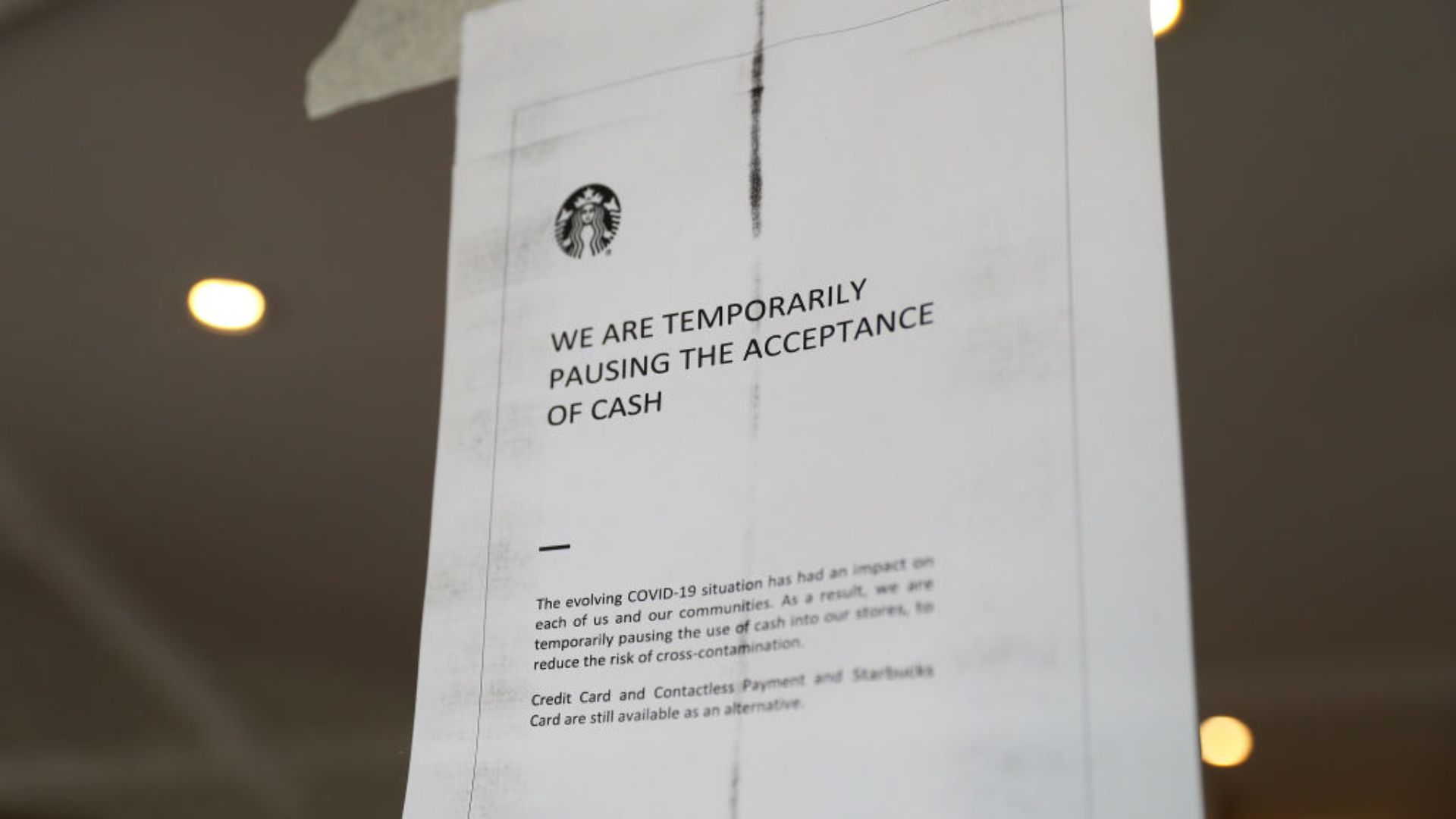

COVID-19 and the Acceleration of Cashless Payments

The Los Angeles Times explains that the COVID-19 pandemic played a significant role in accelerating the adoption of cashless payments. Concerns over virus transmission through physical currency led to an increase in the use of digital payment systems.

According to Bill Maurer, a professor of anthropology at UC Irvine, , this change in consumer behavior has shown a tendency to persist beyond the pandemic, suggesting a lasting shift towards cashless transactions.

Consumer Spending Behavior and Cashless Payments

The psychology of spending is also influenced by payment methods. Maurer said to The Los Angeles Times “there is data to show that when you offer any cashless means of payment, people will spend more.”

The absence of the physical act of handing over money may reduce the psychological impact of spending, leading to higher transaction values.

Benefits for Businesses Going Cashless

For businesses, the shift to cashless transactions is not just about efficiency but also about data collection, The Los Angeles Times explains.

Digital payment systems like Square enable businesses to collect customer emails and other information, facilitating direct marketing efforts. This aspect of digital payments highlights the dual benefits for businesses: improved operational efficiency and enhanced marketing opportunities.

DC Enforces Cash-Only Law to Combat Discrimination

Washingtonian reports that as of October 1st 2023, Washington DC enforced a new law banning businesses from operating on a cashless basis.

This law, introduced in 2018 and enacted in 2020, aims to ensure inclusivity for those without access to bank accounts or credit cards. Despite the proliferation of cashless businesses during the pandemic, this move seeks to prevent financial discrimination, ensuring everyone has access to goods and services regardless of their banking status.

Los Angeles Considers Banning Cashless Retail Businesses

In Los Angeles, the debate over cashless businesses has also prompted legislative action. City Councilmember Heather Hutt introduced a motion to ban cashless retail businesses within the city, The Los Angeles Times reports.

The motion argues that refusing cash payments systematically excludes low-income individuals and people of color, highlighting the socioeconomic implications of cashless policies and the need for equitable access to goods and services.

The Potential Impact of Los Angeles’ Cashless Business Ban

The potential ban on cashless businesses in Los Angeles, as proposed by City Councilmember Hutt, represents a critical moment in the ongoing debate over cash and cashless transactions.

The decision by the City Council could have significant implications, potentially setting a precedent for other cities and influencing the broader conversation on payment inclusivity and economic justice, as per The Los Angeles Times.

The Ongoing Debate Over Cash in the Digital Economy

As the digital economy continues to evolve, the role of cash in retail transactions remains a topic of active discussion. Initiatives led by figures such as Massachusetts Attorney General Andrea Campbell and Los Angeles City Councilmember Heather Hutt are at the forefront of examining payment inclusivity and economic justice.

These efforts highlight the critical need to assess how technological advancements can coexist with ensuring equitable access to the marketplace for all consumers, regardless of their preferred payment method.

Legislative Responses to Cashless Trends

The Chicago Tribune details that the trend toward cashless transactions is facing resistance in various jurisdictions. For instance, legislation has been introduced in Washington, D.C., to require retailers to accept cash.

Similar legislation was proposed in Chicago, though it was unsuccessful.

Expanding Payment Options for the Unbanked

Advocates for the unbanked emphasize the need to provide them with more payment options. A notable initiative in this regard is the partnership between the D.C. government and financial groups, known as Bank On D.C., which has successfully opened 11,000 accounts since 2010, as per information from The Chicago Tribune.

Tanya Bryant, a spokesperson for the city’s financial regulatory agency, highlights this effort as a step toward broader financial inclusion. By offering more accessible banking options, the aim is to reduce the reliance on cash and integrate the unbanked into the digital economy.

Addressing the Core Issue of Financial Inclusion

David Rothstein of the Cities for Financial Empowerment Fund, which collaborates with Bank On D.C., points out to The Chicago Tribune, “If someone is buying a salad or something, and it’s $6, and they need to swipe instead of using cash, the real underlying issue is they don’t have a bank account with debit card functionality.”

This statement highlights that the challenge extends beyond the mere use of cash. It’s fundamentally about ensuring financial inclusion and facilitating access to the banking system for those currently excluded.