California’s Governor Gavin Newsom has faced significant backlash after raising the minimum wage for fast food workers throughout the state to $20 per hour. Now, just a few months later, Ohio announced they may be following suit.

Ohio Senator Bill Blessing recently proposed Senate Bill 256, which outlines a gradual increase in the state’s minimum wage over the next three and a half years. But while Blessing and many other Ohio residents support the bill, others wonder if it’s the right call.

What Is the Minimum Wage in Ohio?

Although the federal minimum wage in the United States is still $7.25, each state has the freedom to set its own hourly rate. In Ohio, the current minimum wage is $10.45.

But while that’s certainly higher than in some other states, many Ohio residents have argued for years that it’s not nearly enough to combat the growing cost of living across the country.

Ohio Senate Bill 256

In response to the frustration of his constituents, Sen. Bill Blessing (R-Colerain Township) has introduced Senate Bill 256 (SB256). The bill proposes two important changes for the income of Ohioans: Raising the minimum wage and modifying the earned income tax credit.

SB 256 first states that the minimum wage would rise to $12.00 by 2025, $13.00 by 2026, $14.00 by 2027, and finally, $15.00 per hour by the start of 2028.

Tipped Workers Are Included in SB 256

Additionally, all tipped workers in the service industry would also see a pay rise. Currently, they receive $5.25 per hour; if SB 265 passes, that will increase to $7.50.

The bill also outlines that establishments cannot provide evidence that proves their employees are making at least $15 per hour between wages and tips, it will be their responsibility to make up the difference.

The “Kicker” Is the EITC Clause

Sen. Blessing explained that while raising the minimum wage will help millions of Ohioans, the real “kicker” of the bill is the clause regarding earned income tax credit (EITC).

According to the IRS, EITC “helps low- to moderate-income workers and families get a tax break.” However, just how much help the EITC provides differs by state. Washington DC, for example, offers one of the best EITC refunds in the country, whereas New Hampshire has no state EITC tax break at all.

Ohio May Be Changing Its EITC From Non Refundable to Refundable

As of 2024, Ohio does offer a state-wide EITC; however, it is non-refundable. That means it can only offset state income tax liability and provides far fewer benefits than states that render refundable EITCs.

And while Blessing admits that there is some “administrative burden” to adjusting the state’s EITC program to be refundable, it will absolutely be worth it in the long run.

Keeping Ohio Businesses in Mind

Sen. Blessing believes that modifying the state’s EITC is a fantastic way to ensure its residents are compensated fairly without gouging its businesses. He said, “These people are still getting a lot of money through the refundable earned income tax credit, which doesn’t impact employers the same way minimum wage does.”

Of course, raising the minimum wage will absolutely affect Ohio businesses, especially the small ones. But Blessing claims that the plan to stagger the increase across the next three and a half years will help minimize the disruption to their labor costs and subsequent revenue.

Ohio Residents Want $15 Per Hour

While many Ohioans support SB 256, others say a three-and-a-half-year time period is far too slow. Popular organization One Fair Wage Ohio has been working desperately to get the state to increase its minimum wage to $15 immediately. But Blessing and many others say this isn’t the way to go about it.

He and other financial experts argue that raising the minimum wage slowly but surely will guarantee that wages grow with inflation without causing it to spike.

Increasing the Minimum Wage Could Cause Inflation

Raising the minimum wage by about 30% overnight could undoubtedly lead to significant inflation throughout the state of Ohio, as companies would be forced to raise their prices to combat their increased labor costs.

President and CEO of the Ohio Restaurant and Hospitality Alliance John Barker explained, “When you think about a business, if they were paying $10.45 and they have to go to $15 that quickly, that will cause inflation again.”

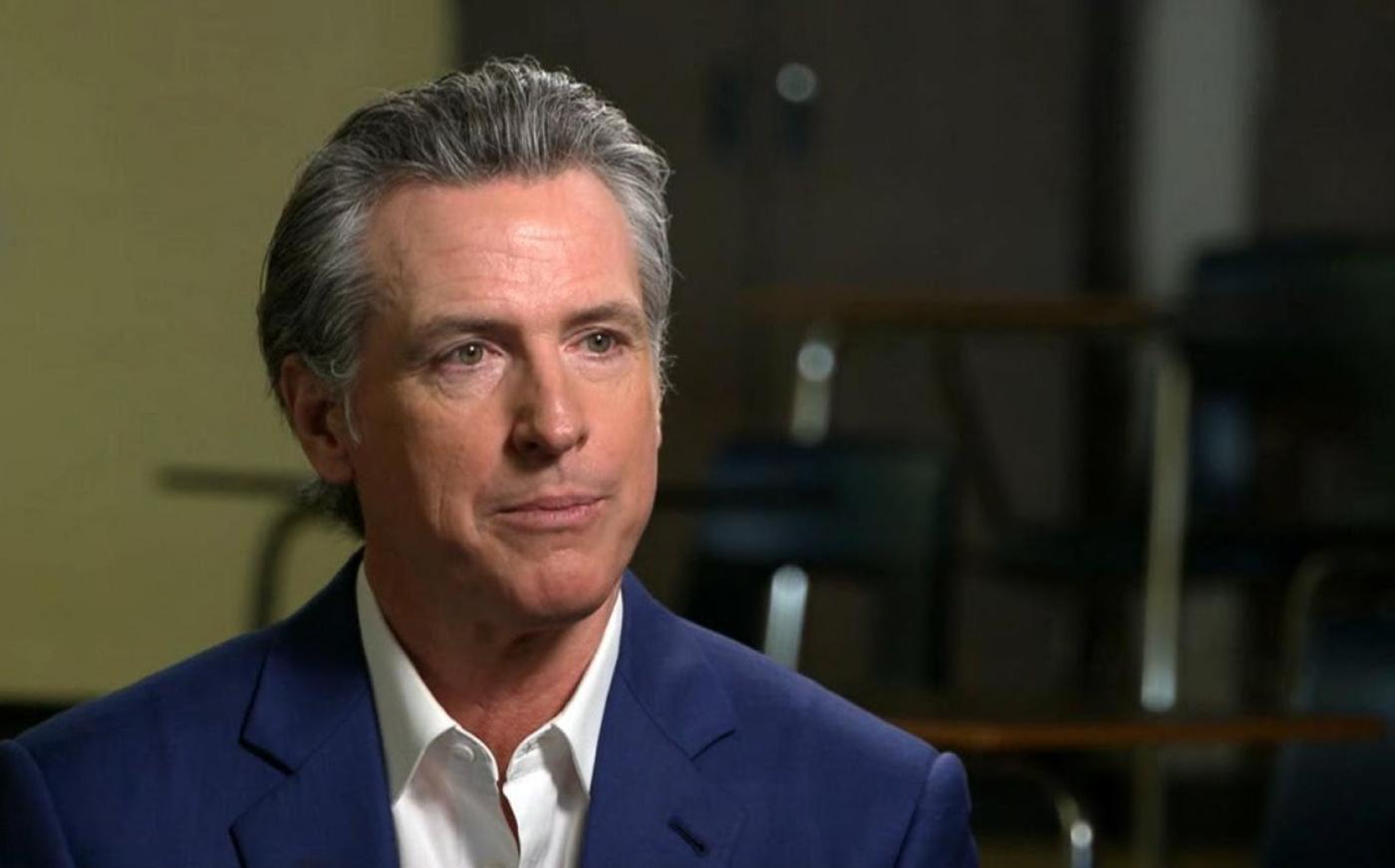

California Gov. Gavin Newsom Is Dealing With Inflation Issues

A perfect example of this reality is happening right now in California. On April 1, 2024, Governor Gavin Newsom’s bill to increase the minimum wage for fast food workers from $16 to $20 went into effect, and now, the state is dealing with the consequences.

Many of the state’s most popular fast food chains, including Chipotle and McDonald’s, have already announced that they will be raising their prices this year in response to the legislation. This means some Californians will be paid more, but every one of them will be spending more on fast food.

SB 256 Still Has to Pass in the Senate and House

It’s important to understand that SB 256 has only been introduced to the Senate; it still needs to be passed by the Senate, House, and governor before it becomes law.

And while the process is underway, One Fair Wage Ohio is still fighting against it in favor of a new piece of legislation that increases the hourly rate to $15 immediately.

Ohio Is Willing to Leave It Up to Its Residents

Sen. Blessing told NBC4 that because there is still time before the bill passes, if One Fair Wage gets the signatures it needs to propose its own legislation, Ohio may offer residents the choice to vote.

Blessing said, “There is time that the General Assembly could, in theory, pass a joint resolution and put something competing on the ballot if we were so inclined…I really believe that combining the minimum wage with the EITC at a slower rate is the way to go. If that means doing something on the ballot, I am fine with that.”