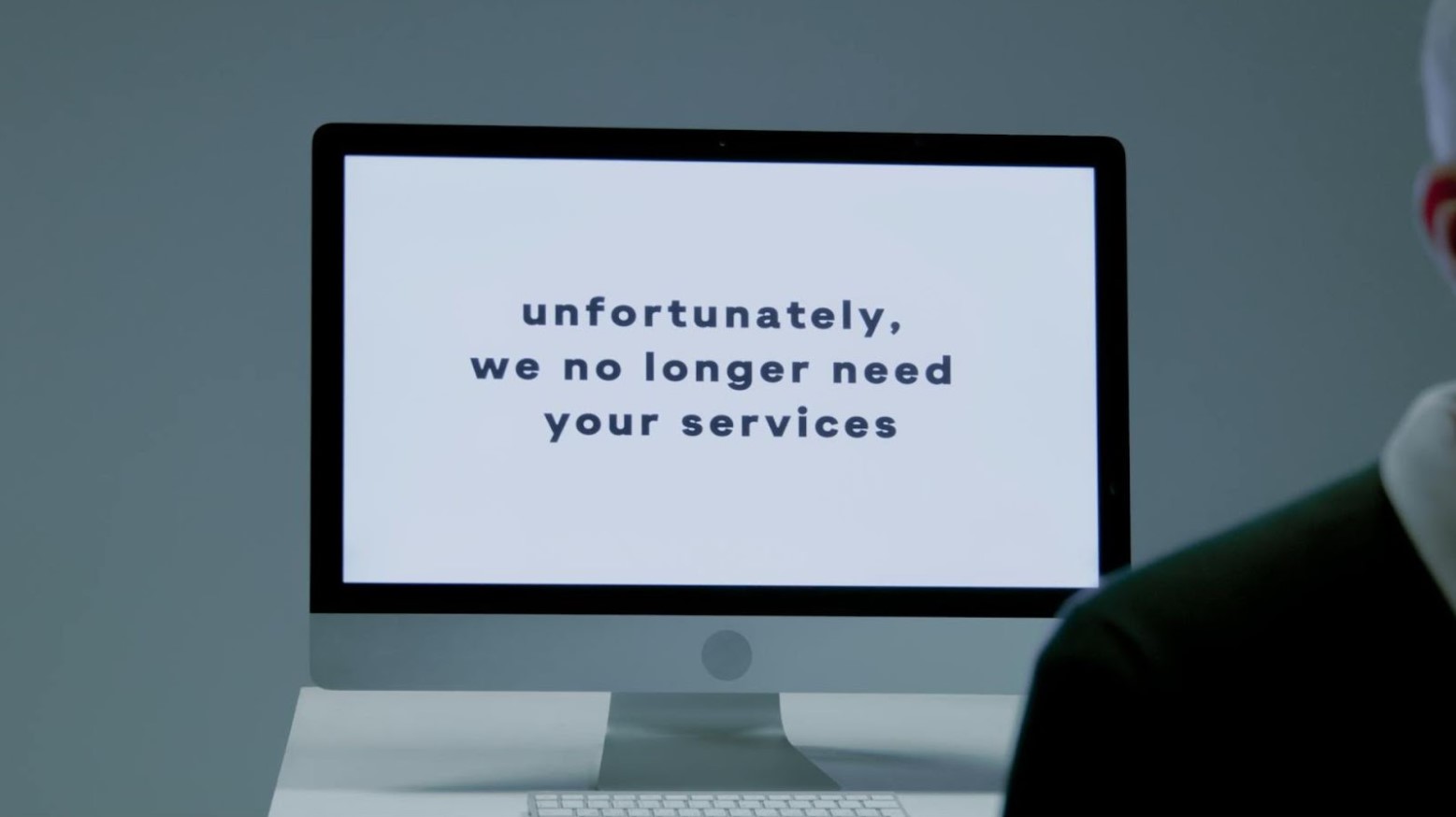

Troubling times are ahead for the connected fitness platform Peloton as it prepares to lay off nearly 15% of staff and reduce the number of retail showrooms.

Barry McCarthy, former Spotify and Netflix Executive, who became the CEO of Peloton in February 2022, has announced he is stepping down from his role as the company continues to reduce its workforce. As part of restructuring and cost-cutting, Peloton will also close down many of its retail shops to balance the fall in demand for its products, post-pandemic.

Peloton Was Once Considered the Pioneer of the Fitness Revolution

Peloton was the first-of-its-kind tech-based fitness platform and community that took the fitness world by storm upon the initial release of its exercise bikes. Although pricey, the bikes helped individuals stay on top of their fitness game from the comfort of their homes at times most suitable for them.

Millions of health and fitness enthusiasts around the world jumped on the bandwagon and invested in these innovative exercise bikes to make the most of the many live and on-demand classes that were accessible through a reasonable monthly subscription. Even today, despite all its shortcomings and financial woes, Peloton boasts a whopping 6.4 million subscribers.

The Pandemic Boost and Peloton’s Rise to the Top

The pandemic turned out to be a blessing in disguise for Peloton as it made record profits and became a Wall Street favorite during the lockdowns in 2020. As people were forced to stay at home for lengthy periods, they turned to these innovative fitness bikes to remain healthy and fit during the COVID-19 pandemic.

By mid-2020, the company reported a 66% increase in sales and a 94% increase in subscribers, with sales spiking 172% by September since the same quarter the year prior and revenue rising to $607 million. The company closed the year at a market value of $34 billion.

The Post-Pandemic Let Down and Subsequent Financial Troubles

Despite the rise in demand and sales during the pandemic, the company frequently failed to meet the increased logistical demands and even had to deal with several unhappy customers who were delivered faulty equipment and endured long replacement procedures. The cracks became more apparent post-pandemic as the demand fell and the quality of equipment suffered at the same time.

By November 2021, Peloton stocks fell 34% after its fiscal first-quarter revenues, further causing investors and customers to lose confidence in the company. To add to their woes, Peloton suffered some serious reputational damage, partly due to some erroneous decision-making by its CEO and founder John Foley, and started facing competition from similar, yet cheaper alternatives like Echelon. All this led to a steep downfall which Peloton has not completely recovered from.

Cycling Through Financial Turmoil Under New Leadership

Peloton was already struggling financially and had let go of a significant number of employees after its “pandemic profit boom” when McCarthy took over from John Foley in 2022.

He was brought in to strategically balance the spending with revenue, a behemoth task considering the past mishaps suffered and the high cost of production for its products and services.

Barry McCarthy’s Vision for Peloton

Barry McCarthy came with extensive experience in heading two subscription giants, Netflix and Spotify. His primary focus at Peloton was attracting subscribers on as many devices as possible without the need for expensive hardware. Under his leadership, Peloton also teamed up with big names in sports like the Liverpool Premier League Club, NBA and WNBA, as well as other star companies like Lululemon and Samsung.

However, none of these efforts were enough to bring back the glory it enjoyed during the pandemic. In the two years that McCarthy was chief at Peloton, the company continued to experience limited revenue growth. As a result, the management had to make more job cuts where necessary to reduce spending and increase profit margins.

Once Hailed ‘The Future Of Fitness,’ Now Struggling to Stay Relevant

Peloton redefined the concept of workouts when it introduced its revolutionary exercise bikes in 2013 to 2014. Although high-end, its products and solutions were viewed as the “future of fitness” thanks to their accessibility, ingenuity and efficacy.

But despite all its benefits, endorsements from celebrities and athletes, and a sizable investment, the future now looks uncertain for this fitness technology brand as it struggles to generate new demand and continue giving its subscribers and customers great value for money.

Peloton Pulling All the Strings to Stay Afloat

The market capitalization of Peloton has sadly fallen to about $1.2 billion from the 2021 peak of almost $50 billion. Yet, this fall from grace comes across as no big surprise considering all the financial and reputational damage it has suffered after the pandemic. The future looks particularly bleak after the departure of Barry McCarthy and the 15% workforce reduction, mainly in marketing, sales and showrooms. The restructuring will reduce Peloton’s expenses by $200 million by the end of 2025, which will be considered a respite for its depleting worth.

The company is now looking for a new CEO to take charge. Meanwhile, McCarthy will stay onboard as a strategic advisor to Peloton until the end of 2024, as company chair Karen Boone and director Chris Bruzzo will serve as interim co-chief executives. There are talks that Peloton will foray into new territory by entering the workplace as a workplace benefit for employees in hospitality, business, healthcare and other sectors.

What’s Next for Peloton?

Like most companies laying off staff to cut costs, reduce expenses and divert cash to its crucial areas, Peloton also expects that restructuring will allow it to sustain a positive free cash flow while enabling it to continue investing in software, hardware and content innovation.

It is also hoping to make necessary improvements to its member support experience and optimizations to marketing efforts to scale the business. But with its stock still sitting at the lowest it has ever been, only time will tell whether Peloton will make it to the other side or become another casualty of the economic doom.

Conclusion

Peloton is not the only company that has let go of staff in recent years due to reduced revenue growth. Several other juggernauts have also reduced their workforce to survive in this fluid economy. A majority of tech and retail giants, including Amazon, Nike, Tesla, Google and Microsoft, have announced job cuts in the first quarter of 2024.

While a recession is a big reason for companies to let go of staff, other factors that are also to blame include artificial intelligence and cautious consumer behavior due to inflation. This trend, sadly, is likely to continue in the coming years until global economic stability is reached.