Postponing major life events due to debt is not an uncommon occurrence. In fact, based on a new study, the delay seems to be the norm.

Many student loan borrowers are forced to wait to move on with the big things in life due to their debt. These big things include buying a home, getting married, or even getting out of their parents’ home.

College-Based Study

The study was done by the Lumina Foundation with Gallup, surveying the 2024 State of Higher Education.

According to the study, 71% of all students currently enrolled in colleges, or previously enrolled but stopped before completing it, say they’ve delayed at least one major life event… all thanks to their student loans.

No Higher Degree for Borrowers

Student loan debt also prevents 35% of them from re-enrolling in a postsecondary program and finishing their degree.

This number exceeds the percentage of those whose delayed events are more practical, such as buying a home, a car, and starting their own business.

No House or Car Ownership

To be precise, 29% of borrowers delayed purchasing a home, followed closely by 28% of borrowers who have yet to buy a car.

22% of borrowers surveyed delayed moving out of their childhood homes while 20% delayed starting their own businesses.

Delayed Marriage and Parenthood

The debt also affects family planning and parenthood. With 13% of borrowers delaying marriage, an even bigger percentage delayed having children.

Those delaying having children made up 15% of all borrowers surveyed. With the average cost of raising two children amounting to $310,605, this delay does make sense.

Slight Gender Difference

Based on gender, male borrowers are slightly more likely to delay major life events due to loans than their female counterparts (76% vs. 64%).

Meanwhile, the highest age group most likely to delay a major life event is 26- to 35-year-olds. That’s probably because “they have entered a life stage in which these events are more relevant than for younger borrowers and because they generally have higher amounts of student loans than their older peers.”

Debt Size Matters

Ethnic groups don’t matter much when it comes to student debts, though. White, black, and Hispanic borrowers (around 70%) have all delayed one major life event due to debt.

What matters more is the size of their debt. Borrowers with higher amounts of student loan debt are more likely to say they delayed buying a house or a car, moving out of their parents home, or going through a big life event.

But Any Debt Will Delay All

More than 9 in 10 of borrowers with at least $60,000 in student loans have cited debt as their hurdle from having a major life event.

But even those with modest debts have also experienced delays. 63% of those who borrowed less than $10,000 in student loans also delayed a major milestone due to their debts.

Biden’s SAVE Plan

President Joe Biden is making all sorts of efforts to help lighten the burden of debt. His SAVE (Saving on a Valuable Education) plan is helping 153,000 borrowers enrolled in the program.

But there are 7.5 million enrolled participants in the program since it was launched in August 2023. If eligible, these borrowers can have their monthly repayments reduced to $0.

More Cancellations Planned

Earlier in April, Biden announced another batch of student loan debt forgiveness for 277,000 borrowers. The debt cancellation amounts to $7.4 billion.

And even more amazingly, the Biden administration is planning yet another cancellation plan that would eventually add up to $559 billion.

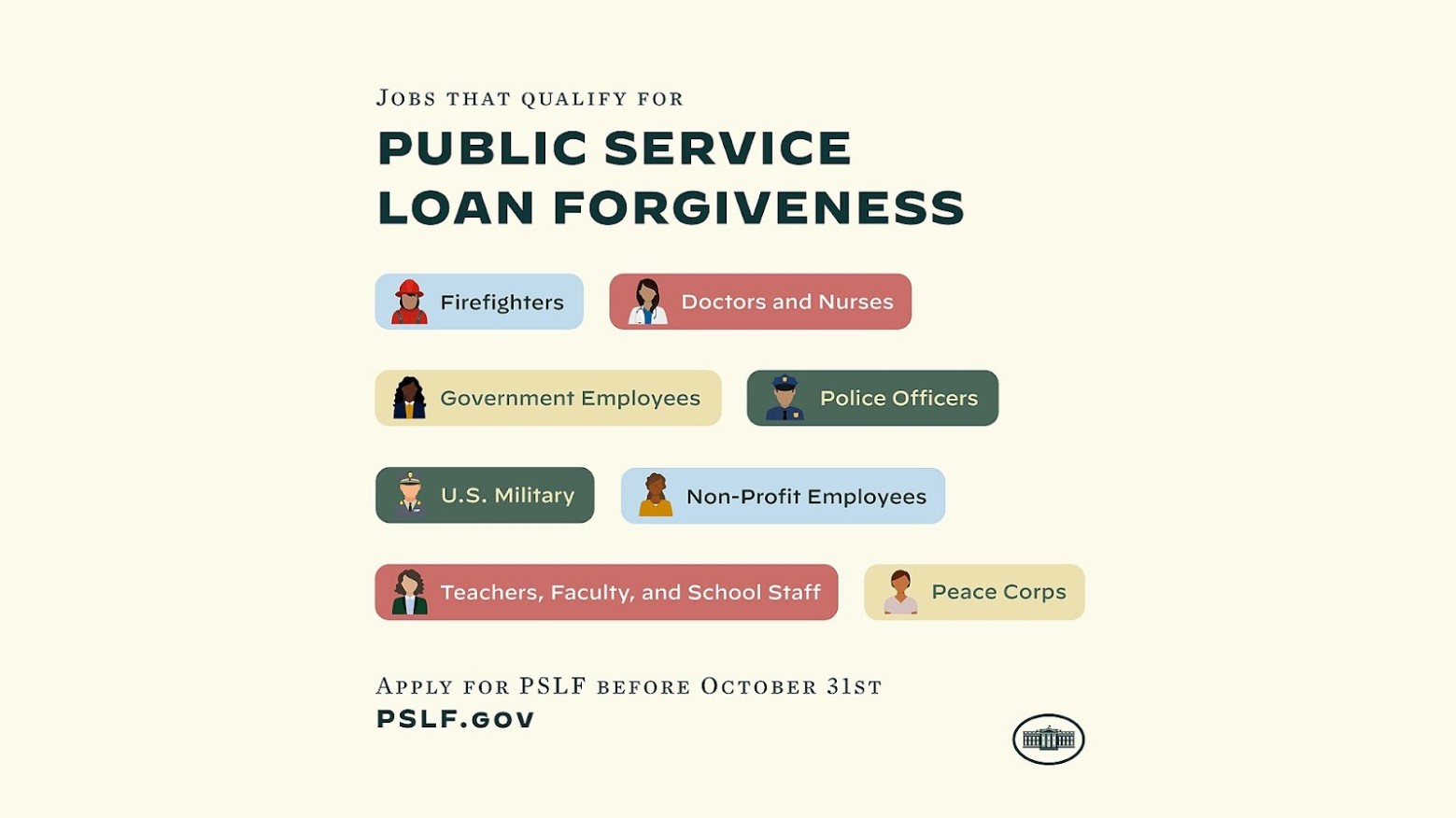

Public Service Loan Forgiveness

If that’s not enough, there’s still the Public Service Loan Forgiveness program. This plan relieves the loans for people working in government jobs or positions that give back to the community.

It’s all part of Biden’s attempt to fix various administrative problems that riddled the program. It wouldn’t be far-fetched to imagine that the current POTUS would one day be known as the president who erased most student loan debts.

Crucial Understanding

A modest amount of student loan debt may be a worthy investment. However, today, more than 40 million Americans went to college but finished without a degree. And many more struggle to repay loans connected to their incomplete training and education.

These loans undoubtedly have a massive impact on enrolled students’ lives. Understanding them is crucial to supporting them as they attempt to reach their personal goals, including completing their education so they could have a better life.