Once a staple in Midwest homes, Oberweis Dairy finds itself in a rocky situation, navigating through Chapter 11 bankruptcy.

The brand, beloved for its ice cream and dairy products, owes over $4 million to its top 20 creditors.

The Debt Pileup: A Closer Look

Among those lining up for payments is Greco & Sons, the largest unsecured creditor with a claim of over $721,000.

The financial woes extend to local taxes, with Oberweis Dairy also owing Cook County treasurer more than $173,000.

Secured Debts and Financial Struggles

Oberweis’s troubles are deepened by approximately $14 million in secured bank debt.

Adam Kraber, the company’s president, candidly noted that the company”faced increasing financial challenges.”

The Misstep of Market Expansion

Ambitious yet flawed strategies have led to this crunch.

The Chicago Tribune reports that the company’s foray into Asian markets and its shift to amber-colored milk bottles in stores did not resonate well with customers, resulting in significant setbacks.

Cost Cuts and Last Resorts

Despite millions in cost-cutting, the financial hemorrhage didn’t stop.

This forced the owners, Jim and Julie Oberweis, to consider selling the business, a decision made with heavy hearts but seen as necessary.

Humble Beginnings to Major Expansion

The company’s website explains that in 1915 Peter Oberweis started by selling surplus milk from a horse-drawn wagon.

His enterprise officially became Oberweis Dairy in 1930, eventually growing into a major regional player under his grandson Jim’s leadership.

Ice Cream and Regional Treats

1951 marked Oberweis Dairy’s largest expansion with the opening of its first ice cream store.

Today, over 40 locations serve frozen treats across several states.

Market Expansion

In 1997, a new production facility in North Aurora symbolized growth.

Joe Oberweis, Jim’s youngest son, took over in 2007, pushing the brand into new territories and starting That Burger Joint and Woodgrain Pizzeria, The Chicago Tribune reports.

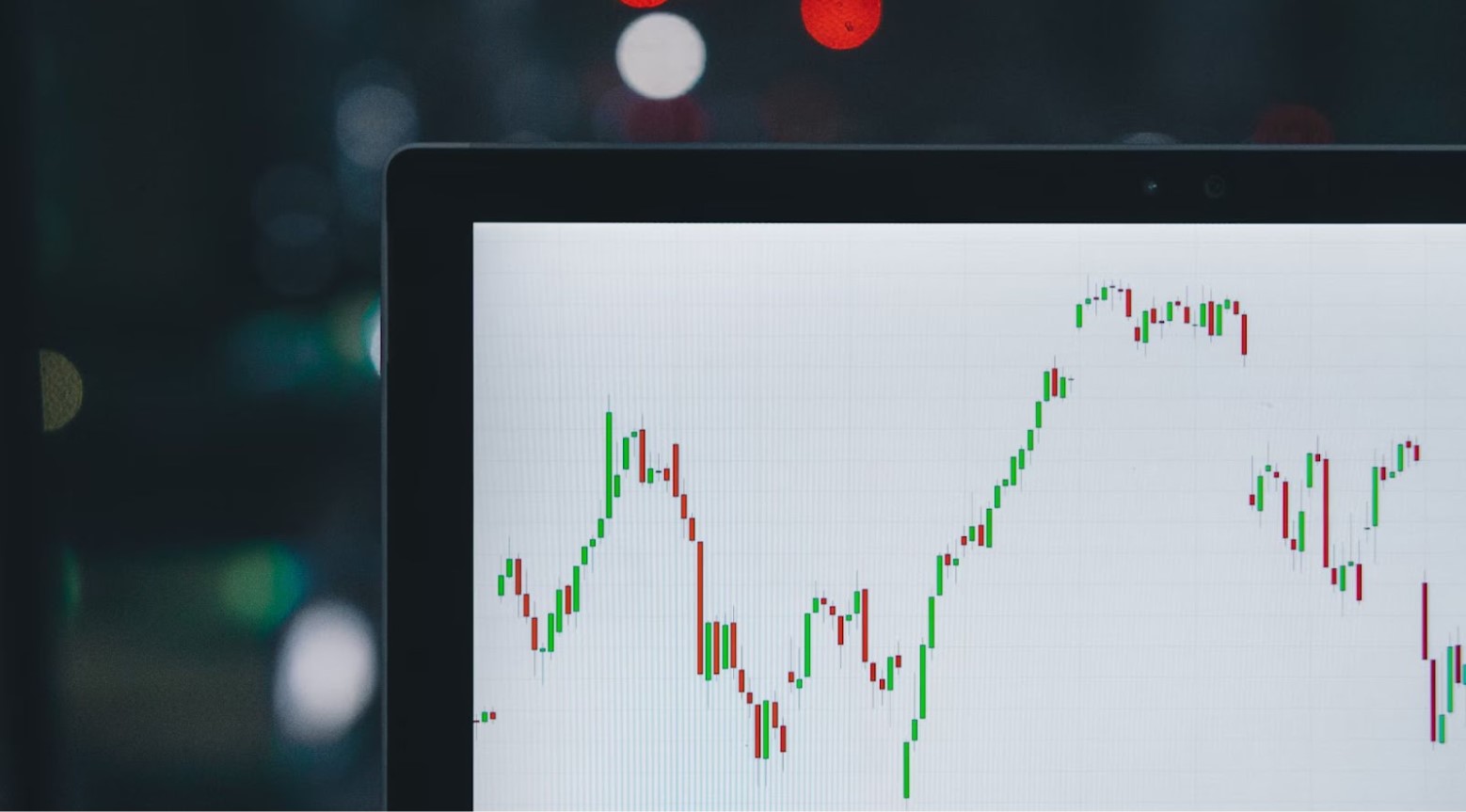

Pandemic Peak and Post-Pandemic Plummet

The home delivery service boomed during the pandemic, with revenues peaking at $116 million in 2020.

Yet, the post-pandemic period was harsh, with revenues falling to $95 million in 2023, illustrating volatile market dynamics.

Leadership Changes Amidst Crisis

Joe Oberweis stepped down in May 2023, signaling a significant leadership change during turbulent times.

His departure marked a new chapter of challenges as he confirmed, “I left about a year ago and am not involved.”

Search for a Savior

With the business teetering, Oberweis Dairy engaged Livingstone Partners to scout for buyers.

A glimmer of hope appeared with a letter of intent in January, but the absence of other offers led the prospective buyers to back out.

Political Aspirations and Business Realities

Jim Oberweis isn’t just known for dairy.

CBS News reports that his numerous runs for political office, including for U.S. Senator and Governor, intersected his business life, adding a public dimension to the private struggles of Oberweis Dairy.

Employee Impact

Following the bankruptcy announcement, Oberweis Dairy plans to lay off 127 employees at the North Aurora facility (via the Daily Herald).

This job reduction, set for June 11, signals significant changes in operations, directly affecting the lives of many families and contributing to local unemployment challenges.

Community and Local Economy

Oberweis Dairy’s operational changes and potential store closures could have a profound impact on the communities where they operate.

Particularly in North Aurora, where the main facility is located, the loss of jobs and reduced business activity might lead to economic downturns, affecting local businesses and services that rely on Oberweis as an economic anchor.

Customer Loyalty and Brand Reputation

The bankruptcy filing by Oberweis Dairy risks shaking customer confidence in a brand known for quality and tradition.

Maintaining customer loyalty will be crucial during this period. In a statement, Oberweis Dairy has pledged to continue delivering “the highest quality, delicious milk and ice cream,” which could at least help retain their customer base amid uncertainty.

Legal Process of Chapter 11

According to U.S. Courts, Chapter 11 bankruptcy allows Oberweis Dairy to reorganize while attempting to become financially stable without halting operations.

This legal protection aims to keep the business running and creditors at bay while the company seeks ways to pay off debts and potentially emerge stronger and more financially organized.

Potential Buyers and Future Ownership

Oberweis Dairy’s search for a buyer has been public since last October (via Yahoo! News). With the bankruptcy filing, the urgency to find a suitable buyer who can revitalize the brand increases.

A change in ownership could introduce fresh capital and new strategies that might revive the company’s fortunes.

Impact on Suppliers and Partners

The financial turmoil at Oberweis Dairy impacts not only internal operations but also their external partners, including a Hudson-based transportation company owed over $774,000 (via the Daily Herald).

Such debts threaten to strain or sever long-standing business relationships, crucial for daily operations.

Product Innovation and Strategy Adjustments

In response to evolving market demands and past missteps, such as the unpopular amber-colored bottles, Oberweis Dairy may need to innovate its product offerings.

Embracing trends like new dairy products or new flavors might attract a broader customer base and reinvigorate sales.

Financial Management and Restructuring

Oberweis Dairy’s reorganization will likely involve stringent financial management and operational efficiencies.

This restructuring aims to correct past over-investments in distribution and under-investments in manufacturing, aligning expenses more closely with current revenues.

The Role of Market Trends in Dairy Consumption

The decline in traditional dairy consumption (via Axios) presents a challenge for Oberweis Dairy.

To adapt, the company might need to diversify its product line to include non-dairy alternatives or specialty dairy products that cater to changing consumer preferences.

Environmental Considerations

Oberweis Dairy’s use of glass bottles, initially a nod to sustainability, will need reevaluation to balance environmental impact with customer approval.

Future operations must consider more environmentally friendly practices that align with consumer expectations and regulatory standards.

Technological Adoption in Operations

To reduce costs and enhance efficiency, Oberweis Dairy could also consider investing in technology across its operations.

This could include modernizing manufacturing equipment and adopting advanced logistics software to streamline distribution processes.

Long-term Vision and Strategy

For Oberweis Dairy, emerging from bankruptcy will require a clear, sustainable long-term vision.

This vision should include strategic goals for growth, a renewed commitment to core business areas, and an adaptable business model that can withstand market and economic fluctuations.