On February 7, prosecutors in Manhattan indicted a huge real estate developer and several executive conspirators in court. They are alleged to be responsible for defrauding investors, subcontractors, and the government of New York City in a multi-year scheme that drained them upwards of $86 million.

The prosecutors allege that these stolen assets were used to cover shortfalls of other projects and were sometimes diverted to personal bank accounts.

What Are the Allegations?

Real estate developer and managing director Nir Meir, executives at HFZ Capital Group, and executives at Omnibuild construction firm are accused of stealing funds from their investors and shorting subcontractors on their projects. Prosecutors accused Meir of running the scheme over the five years he worked at the company.

The specific charges include larceny, conspiracy, tax fraud, money laundering, falsifying business records, and more.

Nir Meir, Prolific Real Estate Developer

As the managing director of HFZ, Meir was one of the most powerful real estate developers in New York City, appearing alongside HFZ founder Ziel Feldman on lists of giants in the industry. The HFZ development of luxury property The XI would have made Meir and HFZ responsible for one of the most recognizable skylines in the city and possibly the world.

HFZ became an industry favorite for its prolific output of luxury condos during the 2010s, filled with masterful designs and amenities.

Who Is HFZ Capital Group?

HFZ Capital Group was launched in 2005 by Ziel Feldman, whose name is excluded from the current indictments against Meir and several HFZ executives. Since its founding, the private company has managed billions of dollars in real estate development.

They are headquartered in New York City. In 2013, they made a high-profile purchase of four rental buildings in Manhattan for more than $610 million.

Omnibuild Construction Inc.

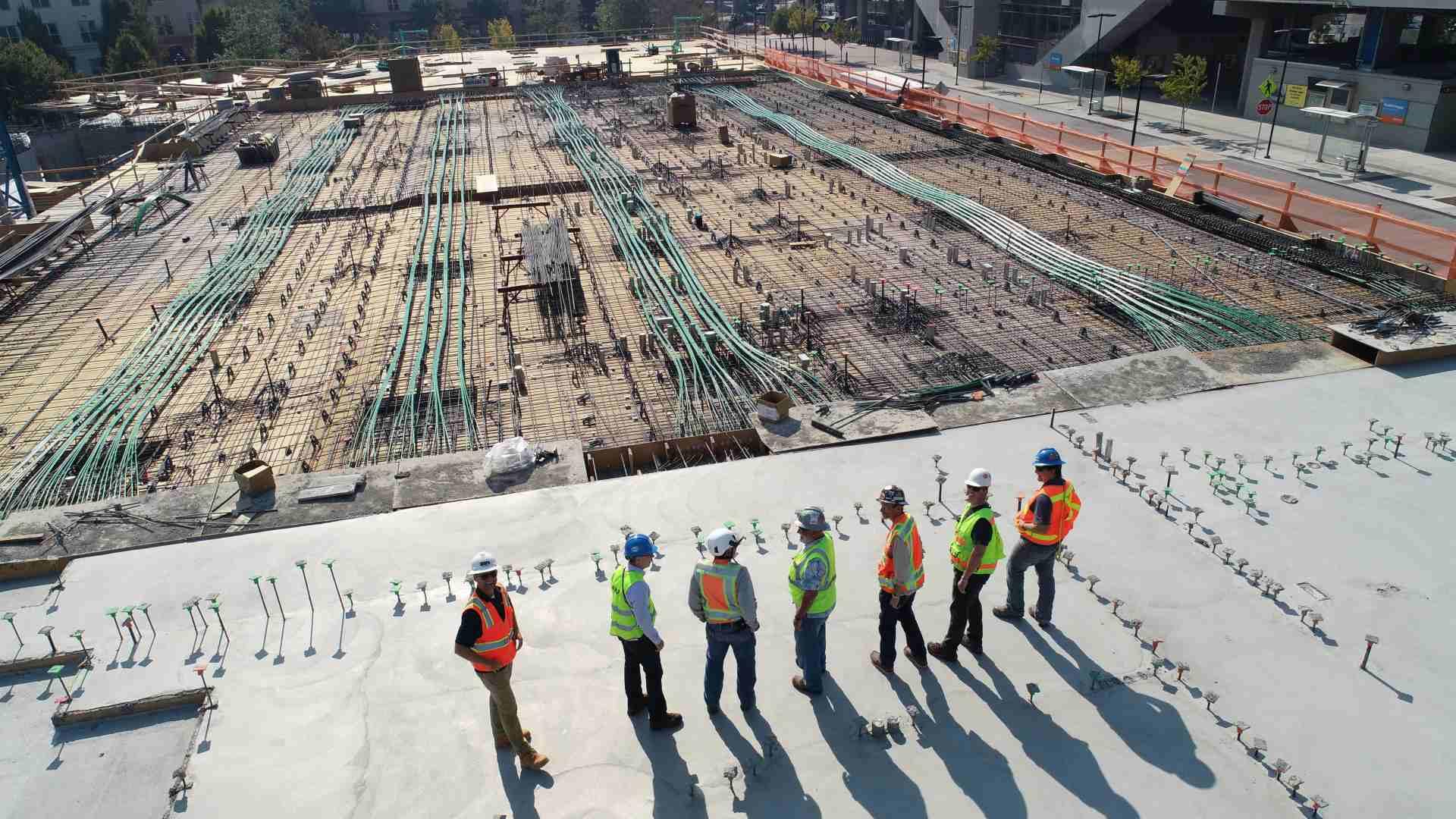

The construction management firm Omnibuild was founded in 2007 and is one of the leading firms in New York. They are a mid-sized firm that has completed more than 20,000 feet of vertical building space in New York.

Their projects have produced almost 8 million square feet in total. They made the ENR list as one of the top 400 contractors in America.

Luxury Manhattan Condo “The XI”

HFZ purchased a full block in Chelsea, Manhattan, to develop a luxury two-tower property called ‘The XI.” At the time, the $870 million purchase in 2015 was one of the highest amounts ever spent to buy a development site in Manhattan. The goal of the project was to have a 137-room hotel, 247 condominiums, and nearly 90,000 square feet of retail space.

The project went into foreclosure in 2021 before it could even be completed. It was opened under the name One High Line under different owners.

Mismanagement of The XI’s Funds

In the indictment, prosecutors assert that Meir was responsible for manipulating the funds meant to develop The XI to be transferred to different places than what they were meant for. Meir allegedly diverted $253 million over four years into various LLCs, skirting legal requirements for them to be used on project development.

Through this mismanagement, Omnibuild and its subcontractors were shorted more than $37 million.

Who Are the Other Conspirators?

Prosecutors allege that Omnibuild executives John Minigone, Roy Galifi, and Kevin Stewart were part of a conspiracy to inflate their monthly invoices in an attempt to hide the financial wrongdoing.

Meir’s HFZ colleagues, Anothony Marrone and Louis Della-Peruta, were also named in the indictment for their involvement in the scheme. The indictment also alleges that Meir told an HFZ accountant to forge bank statements to account for the missing investor funds.

The Boldness of the Scheme

One of the bank statements that was allegedly forged attempted to make an account that only had $814 in it look like it has over $24.6 million. The alleged scheme took place over several years.

During that time, financial struggles by HFZ prompted these investors to ask questions and take a closer look at their financial records. Some of the alleged forgeries took place to convince these investors that their funds were not mismanaged.

Manhatten District Attorney’s Comments

Alvin Bragg Manhattan District Attorney said, “These indictments depict allegations of widespread fraud within the real estate industry primarily spearheaded by one man: Nir Meir.” (via New York Post)

As the charges are brought to trial, there will surely be more details that are submitted to the court that will further flesh out the state’s case.

Total Stolen from Investors

Bragg carefully outlined the seriousness of the investigation and the amount they suspect was ultimately stolen.

“In total, we allege these defendants’ conspiracies netted them a total of $86 million stolen from investors, contractors, and the City of New York. My Office’s Rackets Bureau is laser-focused on fraud in the construction and real estate industries and will continue to root out people who steal from investors and corrupt the market,” Bragg said.

The Status of the Accused

Meir was arrested in Miami Beach Florida on February 5. He will need to go through an extradition process before he can formally appear in a New York court. The three Omnibuild executives and the company itself have pled not guilty to the charges brought by prosecutors.

HFZ Captial Group has also entered a non-guilty plea, along with Marrone. The remaining HFZ defendant, Della-Puerta, is expected to do the same.