Tax season is rapidly approaching, which means it is time to bite the bullet and start filing as soon as possible. While taxes can bring an added level of anxiety to your life, a new IRS policy change might help relieve some of that stress.

A recent update from the IRS is changing a standard deduction rule for the 2023 tax year, which could put more money in your pocket.

Increases in Standard Deductions Thanks to Inflation

For the 2023 tax year, single filers can see their full standard deduction increase to $13,850, while married couples will see their standard deduction raise to $27,700. This $900 and $1,800 change is due to a pesky little thing called inflation.

Standard deductions rise with inflation. Since inflation has remained at 3.1 percent for January, the IRS is giving Americans a helpful break on their taxes.

Challenges Persist Despite Lowering Inflation

While we are starting to see inflation lower, the price of living is still high. With gas prices, grocery bills, and housing prices constantly on the rise, Americans’ wallets are feeling lighter and lighter these days.

“By adjusting the deduction upwards, the IRS helps ensure that taxpayers’ purchasing power is not eroded by inflation,” Zack Hellman, the owner of Tax Prep Tech, told Newsweek.

Why is Inflation so High?

Before the outbreak of the COVID-19 pandemic, the United States had a prolonged low period of inflation, according to the Bureau of Labor Statistics.

The pandemic caused the country to lock down for an extended time, causing unemployment to rise and the number of job vacancies to increase. While the inflation rate has since declined, its effects on the economy have not.

What Did Inflation Get To?

The US inflation rate was once 0.8% in 2014 according to the US Inflation Calculator.

Even though that was only ten years ago it seems like a far cry from the current inflation rate this year of 3.1%. During the height of the pandemic lockdowns, the inflation rate soared to 7% in 2021. In 2022 it decreased to 6.5% before falling down to 3.4 percent in 2023.

How Does Inflation Work?

Inflation is a measure of the increased price of goods and services in the economy that happens over time. Inflation is typically a normal part of the economy and a response to increasing consumer demand and spending.

As demand rises in the economy, prices naturally go up in response. However, the problem with inflation occurs when this price jump happens in a short period of time. This phenomenon is often called hyperinflation.

Hyperinflation

What America experienced during the heightened times of the COVID-19 lockdowns has been referred to as hyperinflation.

The danger of hyperinflation is that since prices are rising so quickly, people also spend money as soon as they can. People want to lock in a better price because if they wait, the price of what they want will go up. Unfortunately, people spending more only further fuels the price increases that happen as a response to demand, causing inflation to skyrocket.

How is the Inflation Rate Measured?

The inflation rate is typically measured in the United States by looking at the percentage change of certain goods and services in the economy.

This metric referred to as the Consumer Price Index, uses data points from things the average American spends money on. There are many categories but some of the common expenditures include things like the cost of gas, groceries, and rent.

What is the Cost of Living?

Often people refer to the Consumer Price Index as the cost-of-living index. However, measuring the cost of living in the United States is done by a more complicated geometric mean formula.

The Bureau of Labor Statistics will average the price of goods and services in specific categories to get a more accurate reflection of the cost for Americans to exist in the country. The Consumer Price Index is not as helpful for this because it often gives an upper limit to the cost of living and not a reasonable average.

How Does Inflation and Cost of Living Affect Taxes?

It is worth learning about how the cost of living and inflation affect the amount people pay on their taxes, if only for the reason that you can learn how to save money.

Inflation can push people into a higher tax bracket, but they don’t feel any richer because the power of their money has not also increased. This can lead to a situation where you are paying more on your taxes but aren’t enjoying the benefits of a higher income.

America’s Purchasing Power

The Bureau of Labor Statistics estimates the average household income in the United States has typically been increasing year by year.

However, because of inflation and rising prices, the amount of things you can purchase with your money has diminished in recent years. This is called purchasing power and this buying ability of Americans has been weakened thanks to recent high levels of inflation.

What Can Be Done About Inflation?

Unfortunately, the ability of the government and industries in the economy to stop inflation from going out of control is limited.

The United States government through the central banking authority known as the FED can set interest rates higher or lower. Higher interest rates can have the effect of slowing down or stopping inflation that is growing out of control, but this process is delicate.

How Do Interest Rates Affect Inflation?

When banks raise interest rates on things like loans, this will naturally cause people to reconsider taking out more money to fund their purchases.

Since inflation grows when consumers are spending, the idea is that a higher interest rate will lower consumer spending and inflation. As consumers hold off on making purchases this will lower demand and the price of goods and services in the economy as a response.

Downsides of Raising Interest Rates

While the strategy of raising interest rates can be a good tool, it does have some drawbacks that make it not ideal.

If interest rates are changed too much or too quickly it can cause a shock to sectors in the economy. For example, these rate changes can cause instability in the stock market leading to investors losing money. Experts also warn that raising interest rates can send the country into a recession.

Pushing Deductions

The IRS pushing the standard deduction people can claim on their taxes will help the average American who is dealing with the combination of high inflation, interest rates, and the cost of living.

For many, it may make the difference between being able to afford their taxes or going into further debt by having to pay interest over time.

Don’t Get Too Exciting About the Extra Money

However, Americans might not see the standard deduction show up as a refund. The amount of money you can earn before it becomes taxable will save you money, but that doesn’t mean that you will necessarily see the money.

“The extra $900 this year won’t necessarily come to you in money back like a refund, but it will help to lower your taxable income and, more importantly, make the process of filing taxes vastly easier,” Beene said.

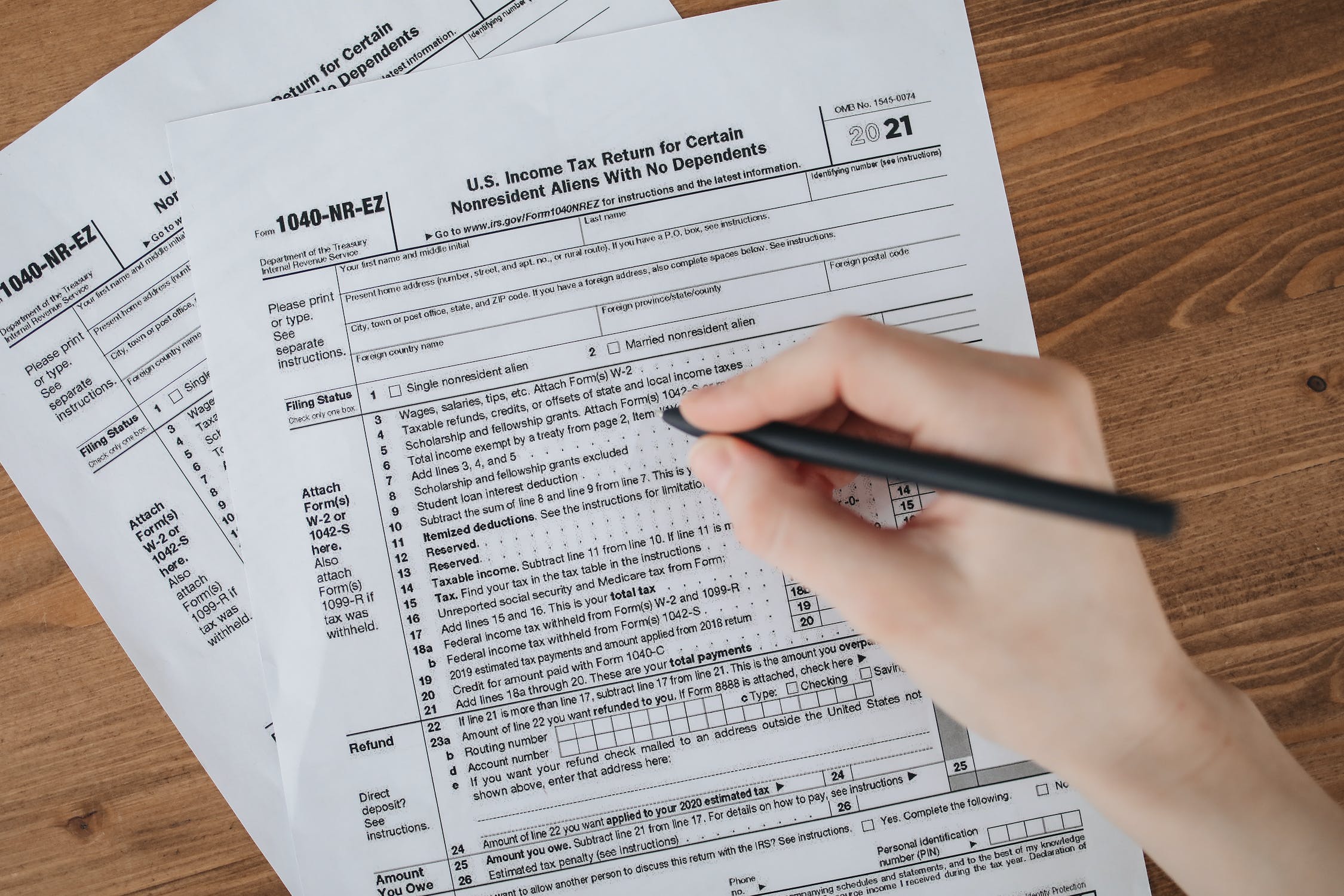

Who Does This New Change Benefits

Renters are most likely to take advantage of the standard deduction. Homeowners, who are more likely to itemize their specific deductions with their mortgage interest and real estate taxes, are less likely to benefit from the adjustment this year.

“Renters now have a larger deduction without the ownership issue,” Eric Green, top national tax attorney at Green & Sklarz and owner of The Tax Rep, told Newsweek. “I don’t know that it equalizes it, but it certainly helps those who don’t own a home or financially are blocked out of home ownership.”

More Benefits for Those 65 Years or Older

If you are a taxpayer who is over 65 years old or has a disability, there is an extra standard deduction this year. The additional amount adds $1,850 for single filers and $1,500 for married people.

Along with a new standard deduction rate, the IRS has updated its income tax bracket, which could help taxpayers save even more money.

Did This Eliminate the Tax Bracket Creep?

The federal income tax brackets were raised for 2024 thanks to–you guessed it—inflation. This means that the IRS is helping prevent “tax bracket creep.”

Also known as fiscal drag, the tax bracket creep is a phenomenon that occurs in progressive tax systems like the one in the United States that could push you into a higher tax bracket due to your wages.

Are You In the Same Tax Bracket?

To address bracket creep, some tax codes are indexed for inflation. This means the income thresholds for each tax bracket are adjusted annually to reflect inflation.

Even if you make more money in 2024, the recent inclusion of inflation into the tax code could keep you safe from that tax bracket that could have you paying more at the end of the day.

Will the Tax Code Affect Your Paycheck?

When the IRS raises federal income tax brackets, you might find yourself in a lower tax bracket than you did the year before. This is most often true with people who do not see a change in their income.

According to CNET, this “means you’ll be on the hook for less federal tax next year and will have less money withdrawn from your paycheck.”

Other Tax Changes That Could Help You Out

Would you be excited to hear that more changes to this year’s tax filings could help you out in the long term? Luckily for those who are collecting Social Security, they will receive a 3.2 percent cost-of-living adjustment in 2024.

This perk comes with an additional perk. Since the first of January falls on a holiday, there will be an increased SSI payment at the end of December.

Enhancements to Tax Credits and Deductions for 2024

The last notable change that the IRS announced is a series of increases to the popular tax credits and deductions for 2024.

These changes will include a higher maximum for the Earned Income Tax Credit, adjustments to the gift tax exclusion, and an increase to the foreign earned income exclusion.

Happy Tax Season!

The recent IRS policy changes for the 2023 and 2024 tax years offer a glimmer of relief for taxpayers amidst the anxieties of tax season. It seems that the IRS is trying to help relieve some of the financial stress a lot of us have been experiencing.

While these changes may not directly translate into immediate refunds for everyone, they serve to ease taxable income and simplify the tax-filing process for millions of Americans.