Rite Aid has announced that 39 stores are set to close their doors for good, this follows the decision to declare Chapter 11 bankruptcy back in October.

The strategy? Reduce the total number of stores to 1,600 nationwide.

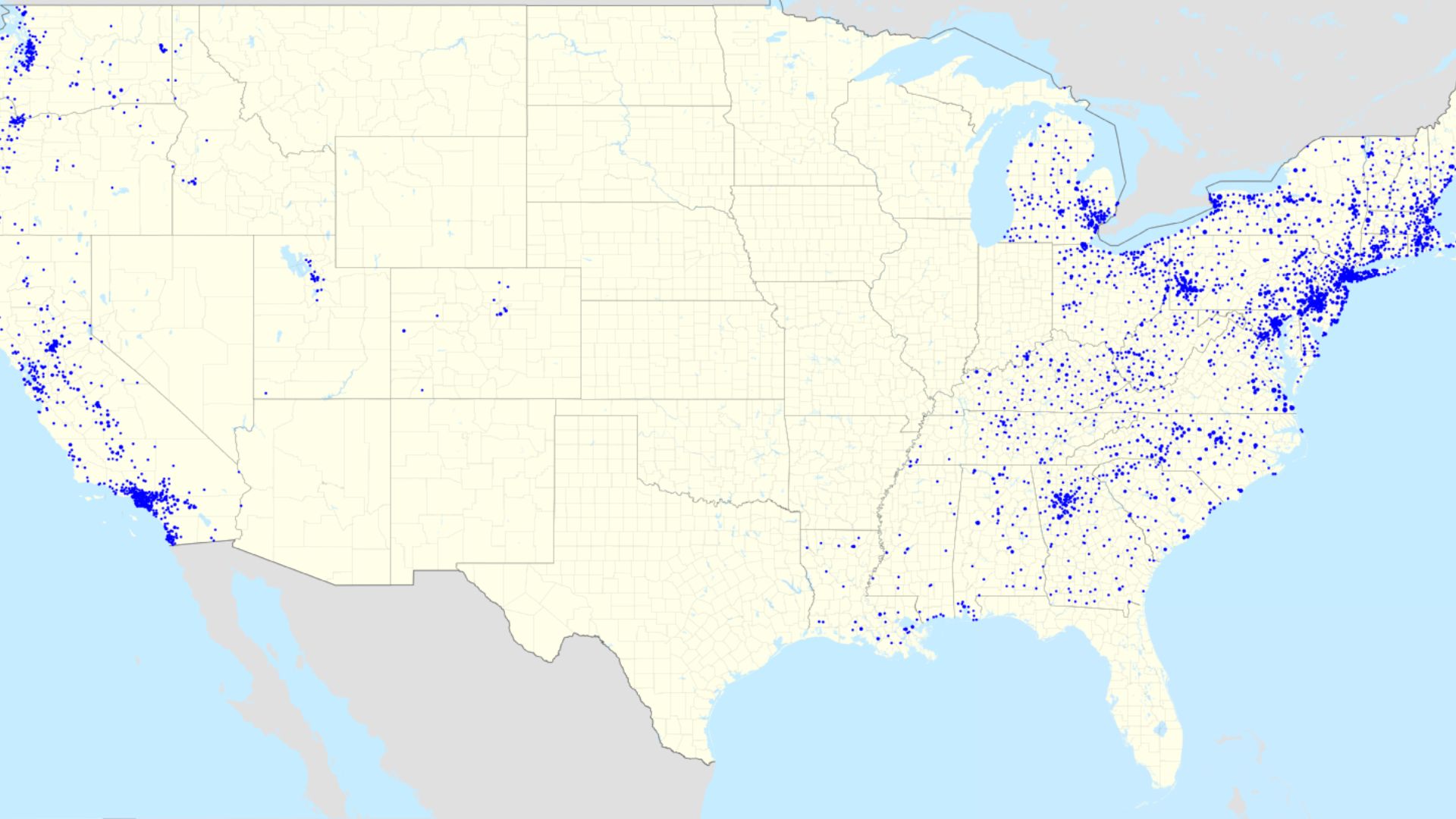

Closures Coast to Coast

The latest closures span from California to New York, signaling a nationwide scale-back.

Supermarket News reports that six stores each in California and Pennsylvania, three in New York, and a single store each in New Jersey and Massachusetts are slated to close. The reasons? A mix of strategic considerations including lease costs and store performances that didn’t hit the mark.

Trimming Down the Empire

Gone are the days of Rite Aid’s sprawling 2,100-store empire.

Now, aiming for agility in a cutthroat market, the pharmacy chain is tightening its belt to a core of 1,600 locations.

Cost-Cutting Measures in Motion

Speaking to SILive, a Rite Aid spokesperson outlined the closures as a critical step toward reducing overhead and supporting the company’s financial health.

The company said “Rite Aid regularly assesses its retail footprint to ensure we are operating efficiently while meeting the needs of our customers, communities, associates and overall business.”

Turning Real Estate into Revenue

But it’s not just about closing shops; Rite Aid is also offloading its real estate, putting leases and properties on the market in nine states, The Philadelphia Inquirer reports.

A&G Real Estate Partners, which is working with Rite Aid, is selling 16 leases and fee-owned stores, and a piece of land in Pennsylvania.

The Ripple Effect on Local Communities

The store closures ripple through communities, leaving particularly the elderly—who depend on Rite Aid for prescriptions—feeling the pinch.

With pharmacies closing down all over the country, it raises concerns about access to healthcare.

A Calculated Exit Strategy

Closing a store isn’t a decision Rite Aid takes lightly.

The company explains that the decision was based on several criteria, including “business strategy, lease and rent considerations, local business conditions and viability, and store performance.”

Legal Storms on the Horizon

Amidst financial restructuring, Rite Aid is also dealing with legal troubles.

The Department of Justice has launched a lawsuit accusing the pharmacy chain of failing to meet legal standards in its prescription practices.

DOJ Raises the Stakes

The Department of Justice’s allegations are serious, accusing Rite Aid of flouting the False Claims Act and Controlled Substances Act.

These charges put the pharmacy chain in a worrying position.

A Legal Battle Over Opioids

The lawsuit centers around allegations of Rite Aid’s involvement in the opioid crisis.

Attorney General Merrick Garland has made it clear that the department is prepared to use “every tool at our disposal” to ensure Rite Aid is held accountable for its role in this national health emergency.

The Weight of Legal Battles

Rite Aid stands at a crossroads, facing financial strain from its existing debts and the added pressure of defending against DOJ’s charges.

Unlike some competitors, like Walgreen’s and CVS who’ve settled, Rite Aid’s path to recovery is steep, as a result of the dire financial situation the company finds itself in.

A History Marked by Big Bets

Back in 2015, Walgreens attempted to save Rite Aid, but US regulators were worried the merger would breach federal antitrust laws and lead to less competition in the drug store market.

Eventually, a smaller $4.4 billion deal went through in 2017, where Walgreens bought just under 2,000 Rite Aid stores.

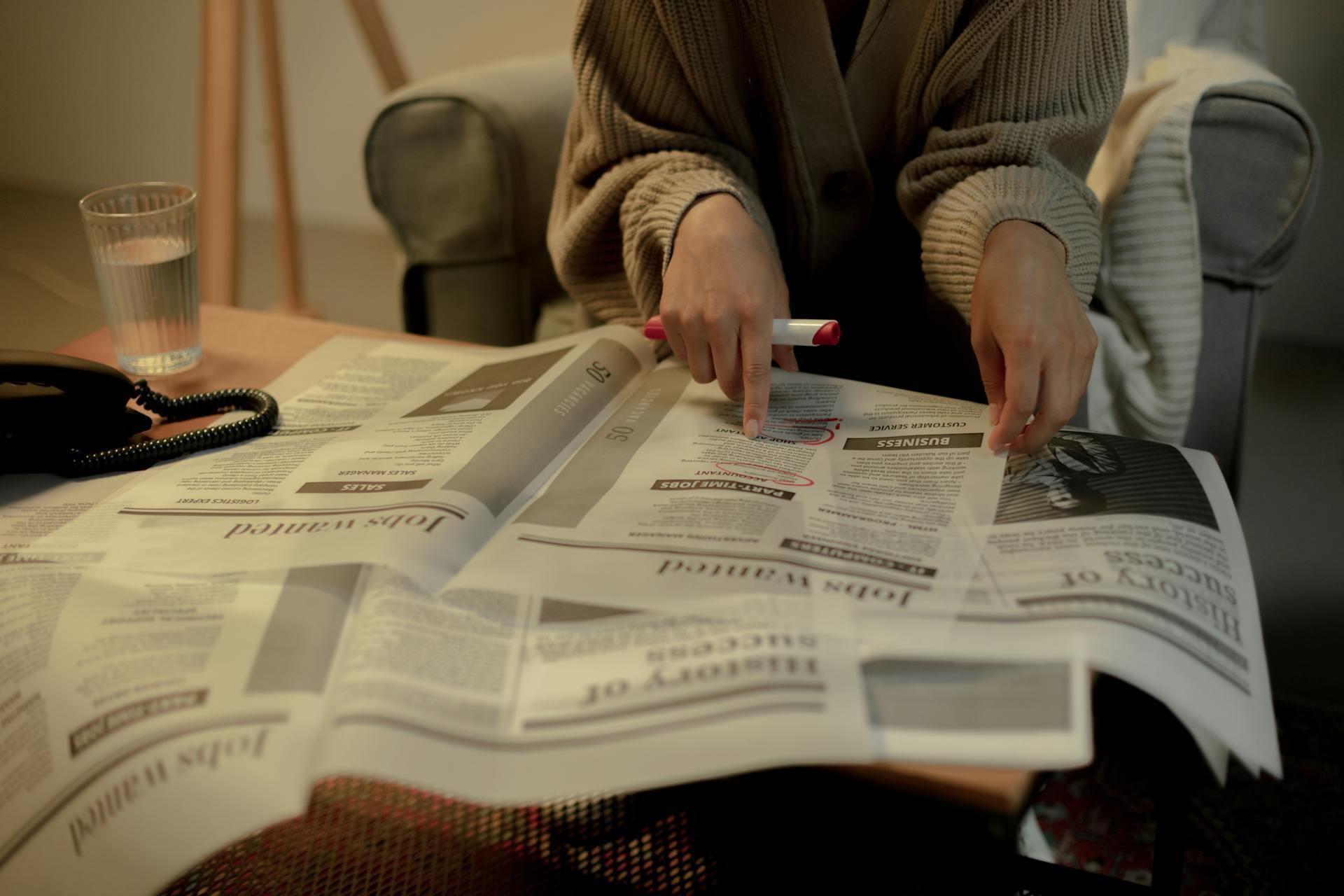

Impact on Employees

The closure of 520 more Rite Aid stores since filing for bankruptcy has led to additional job losses, affecting hundreds of employees across the country.

Rite Aid is offering severance packages and transition support to those impacted, emphasizing their commitment to employee welfare during this challenging time.

Competitor Response

Following Rite Aid’s announcement of store closures, competitors like CVS and Walgreens are likely to capitalize on the new market opportunities.

These companies are likely to expand their presence in affected areas, possibly introducing special promotions to attract Rite Aid’s former customers.

Customer Alternatives

With Rite Aid closing stores across several states, customers are forced to look for alternatives. Local pharmacies, along with national chains such as the aforementioned Walgreens and CVS, are likely beneficiaries.

Online pharmacy services, which have gained popularity, offer another viable option, providing convenience and potentially lower costs for consumers seeking new pharmacy homes.

Local Economic Impact

The closures of Rite Aid stores are set to leave a mark on local economies, potentially leading to decreased tax revenues and lower foot traffic, which could affect nearby small businesses.

Commercial real estate markets might also feel the pinch as prime retail spaces suddenly become vacant, challenging communities to rethink the use of these spaces.

Digital Transformation

In a move towards digital transformation, Rite Aid turned its gaze to digital healthcare solutions back in 2019. Fast forward to October 2023, the journey took an unexpected turn as the retailer filed for Chapter 11 bankruptcy protection.

Rite Aid is now partially selling its Health Dialog business to Carenet Health — a leading provider in healthcare engagement, clinical support, telehealth, and advocacy solutions. The details of this deal remain under wraps, but it marks a significant shift in Rite Aid’s strategy amidst challenging times.

Pharmacy Desert Analysis

The closure of Rite Aid stores could exacerbate the issue of pharmacy deserts, especially in rural and underserved areas.

This reduction in access to pharmacies is concerning for community health, as it might lead to delayed treatments and reduced medication adherence. The impact on elderly populations, who rely heavily on local pharmacies, could be particularly severe.

Pharmacy Affordability Factor

As Rite Aid closes stores nationwide, Optum Rx is emphasizing affordability in the pharmacy sector. Their Price Edge program offers direct-to-consumer discounts and caps costs at $35 for essential medications to improve adherence.

These initiatives are vital as traditional pharmacy options like Rite Aid diminish, ensuring medication remains affordable and accessible.

Sustainability Practices

Amidst financial restructuring, Rite Aid continues to implement sustainability initiatives aimed at reducing its environmental footprint.

These practices include energy-efficient store designs and recycling programs. Although store closures reduce physical presence, Rite Aid remains committed to eco-friendly operations, reflecting its responsibility towards environmental stewardship.

Innovation in Retail Pharmacy

Innovation is key to survival in the retail pharmacy industry. Rite Aid is still exploring cutting-edge technologies like automated dispensing and personalized medicine.

Integrating these innovations could improve operational efficiency and customer satisfaction, making Rite Aid a more formidable competitor against industry giants and new entrants alike.

Strategic Partnerships and Alliances

Rite Aid is still attempting to strengthen its remaining stores’ positions through strategic partnerships, notably expanding its delivery collaboration with Uber Eats to include alcohol in new markets.

This expansion now encompasses nearly 1,000 Rite Aid stores across eight states, offering customers quick and convenient delivery of a wide selection of alcohol brands, alongside household essentials and personal care products through Rite Aid’s digital storefront on Uber Eats.

Community Health Programs

Rite Aid is deeply involved in community health initiatives, aiming to strengthen ties with the communities it serves. Programs focused on disease prevention, health education, and wellness activities are part of Rite Aid’s commitment to public health.

These efforts not only support community well-being but also enhance Rite Aid’s image as a health-centric brand.

Long-term Financial Strategy

Rite Aid is focused on a long-term strategy to emerge from bankruptcy stronger and more resilient. This strategy includes optimizing its store portfolio, reducing debt, and investing in core areas to improve profitability.

Transparent communication about these financial maneuvers is intended to restore stakeholder confidence in Rite Aid’s fiscal health and strategic direction.