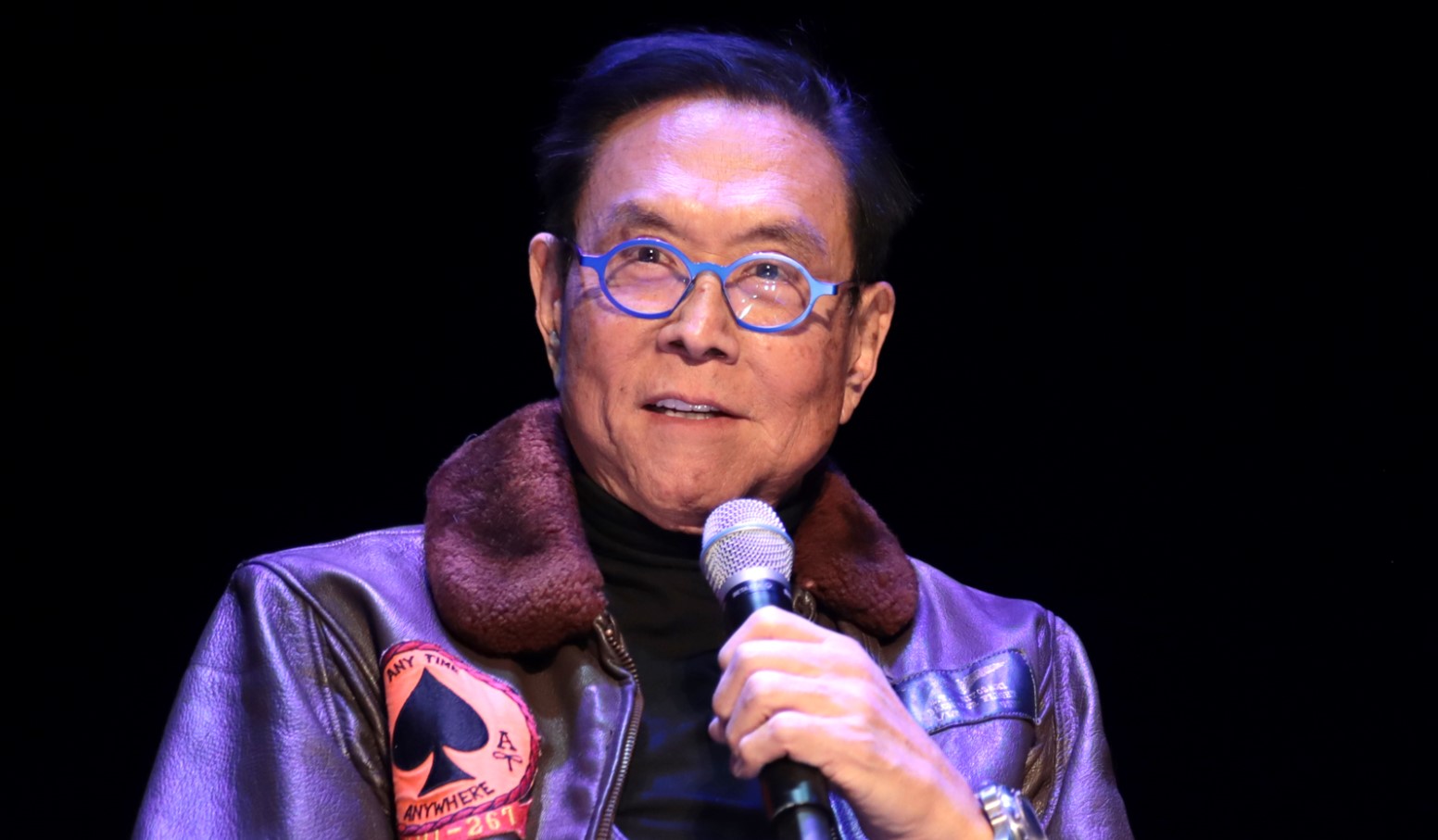

According to financial guru Robert Kiyosaki, “America is broke.”

The esteemed entrepreneur, financial author, and investor is a credible expert in the field of finance. When it comes to fiscal matters, he believes that America is in big trouble. Kiyosaki recently listed a number of reasons why the country is in debt and suggested helpful ways for Americans to protect themselves against a mounting financial crisis.

America’s Financial Situation Is Worse Than it Seems

With the U.S. stock market performing well this year, it’s easy to assume that America is in good financial standing. However, Robert Kiyosaki has warned that things aren’t what they seem.

According to Kiyosaki, not only is the country in massive debt, but America is also on the verge of a devastating crash landing. The “Rich Dad Poor Dad” author insists that America is in dire straits, and President Biden is largely to blame.

Kiyosaki’a Words of Wisdom About the Country’s Fiscal Struggles

Robert Kiyosaki, whose estimated net worth is around $100 million, recently offered his unfiltered opinion on America’s financial situation in a series of tweets. “Don’t they know the stock market is up because Biden raised [the] debt ceiling,” he wrote.

“America’s debt is going up … so [the] stock market [is] going up.” The businessman, who boasts more than 2.4 million followers on X, the platform formally known as Twitter, then added his brutally honest assessment, saying, “America is broke.”

Fitch Ratings Agrees with Robert Kiyosaki

While Kiyosaki’s evaluation of America’s financial state is concerning, things only got worse once Fitch Ratings seemed to agree with him. Not long after Kiyosaki’s tweets, Fitch lowered the country’s “long-term foreign-currency issuer default rating.”

The United States once held the highest rating (AAA) but has since been downgraded to an AA+ rating. While the downgrade was a tough pill to swallow, Fitch expects that America is likely to experience “fiscal deterioration over the next three years.”

Issuing a Warning to Americans

Fitch also estimates that there will be a “high and growing general government debt burden” and an “erosion of governance” for the United States in the coming years, putting the country at risk for significant financial strain.

Kiyosaki offered a firm warning to the American people through his X account, tweeting, “First shoe to drop. Fitch rating services downgraded the U.S. credit rating from AAA to AA+. Brace for a crash landing.”

Kiyosaki Suggests Investing in These Three Things

The money maven continued his tweeting spree saying, “Sorry for the bad news yet I have been warning for over a year the Fed, Treasury, big corp CEOs have [been] smoking fantasy weed.”

Despite the negative outlook for America’s financial future, Kiyosaki did offer three trinkets of hope for Americans who are looking to prepare for the country’s inevitable fiscal downfall. Instead of the U.S. dollar, he suggested investing in “gold, silver, [and] Bitcoin.”

Gold and Silver Won’t Lose Their Value

Gold and silver continue to be great investments because their value doesn’t depreciate. Unlike U.S. currency, gold and silver are scarce natural resources of the Earth.

Their rarity gives them value that regular currency could never compete with. When money depreciates due to inflation, gold and silver remain highly valuable. The purchasing power of the U.S. dollar is a lot less when it’s up against soaring prices of necessities like food and housing.

Gold and Silver Are Internationally Accepted as Currency

Gold and silver are recognized as extremely valuable currency no matter where you are in the world.

In case of a major crisis such as war or “political unrest,” gold and silver become even more highly sought-after as a reliable form of currency. When it comes to the stock market, eager investors can buy funds of SPDR Gold Shares and iShare Silver Trust.

Bitcoin is The New Gold

Bitcoin is another safe bet according to Kiyosaki. While gold is timeless, cryptocurrency is its new-age equivalent.

Kiyosaki tweeted, “Bitcoin to $120K next year,” to predict that it will increase in value over the next several months. One of the biggest draws to Bitcoin is that only 21 million coins will be produced. Much like with gold and silver, it is finite, which makes Bitcoin a frontrunner in terms of financial investments.

Adapting to the Future of Finance

Because the economy is always changing, it’s important for Americans to evolve when it comes to financial planning.

Bitcoin is also an attractive option because it operates independently from the U.S. banking and financial systems. If the economy is plummeting, Bitcoin is a solid way to store and transfer monetary value. An additional upside is that Bitcoin is a universal currency, meaning it can be sent and received anywhere in the world.

Firmly Believing in the Power of Gold, Silver, and Bitcoin

For quite some time, Robert Kiyosaki has been saying that gold, silver, and Bitcoin are the way to go. In August 2023, he tweeted a lengthy rant preaching the importance of these three assets.

“Saying for years gold & silver [are] GOD’S money,” he wrote. “BITCOIN [is the] peoples $.” The entrepreneur added that it would be bad if the stock market crashed and gold and silver skyrocketed in price. He further stressed that “savers of fake US $” would be in serious financial trouble.

He Really, Really Likes Gold

Kiyosaki never misses an opportunity to emphasize the importance of gold. He once tweeted, “Gold has magical, spiritual, & mysterious power. Gold is stored financial energy and why for centuries humans have sought, bought, & fought for it.”

The famed financial advisor encourages everyone to acquire gold in favor of cash. “Gold attracts wealth, good luck, & bad luck,” he wrote. “Treat Gold with respect & God may bless you with gold’s financial magic.”