The BRICS contingent as of late welcomed six new nations to join them in 2024.

Out of these six, four nations — UAE, Egypt, Iran, and Ethiopia — have decided to accept the invitation.

Ambitious Goals

Argentina said no, and Saudi Arabia is as yet still deciding if they want to join.

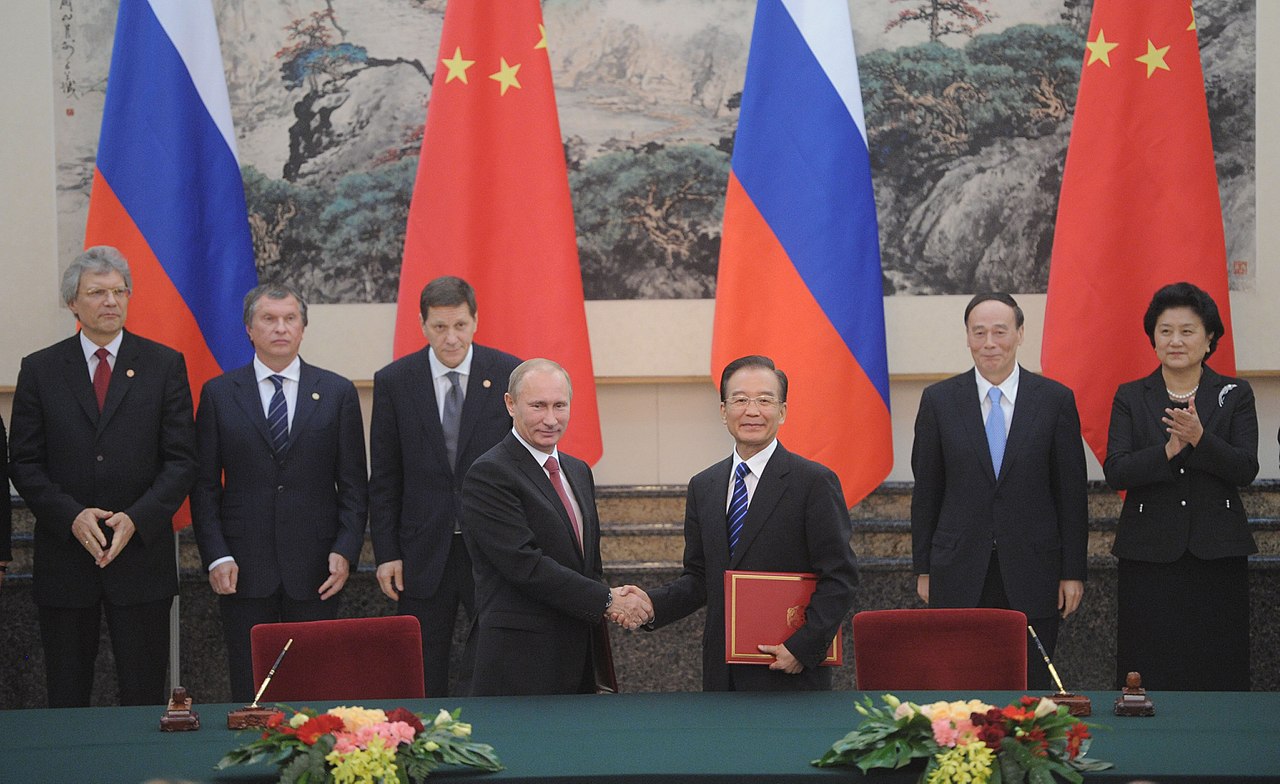

China and Russia are pushing for this development to make BRICS more grounded monetarily and to take on the US and its Western allies.

BRICS Dissent

Yet, not every member of BRICS agrees with these ambitious goals.

India, South Africa, and Brazil are not content with the quick expansion.

Danger to Strategies

They are requesting to pump the brakes and let the new nations get comfortable first.

The concern is that if too many members are initiated at once, it could wreck strategies and economic accords.

China’s Intentions

India is particularly doubtful of China’s intentions with this new expansion.

They think China is utilizing BRICS to push its own plan of international dominance.

Russian Tactics

India likewise thinks that Russia is attempting to utilize BRICS to turn the tables on the US for the sanctions on its economy.

In India’s view, the 2024 development is only a cover for China and Russia’s greater plans.

“Equal Partnership”

India wants BRICS to keep its original spirit of equal partnership” a source said as per The Hindu Business Line.

India is proposing a five-year gap prior to giving more nations access to BRICS.

New Nations

They contend this time is required to get everything moving along as planned with the new nations.

This point has been raised in ongoing discussions with senior authorities and sherpas.

Financial Circumstances

While these discussions are ongoing, the monetary circumstances aren’t looking all that positive.

The US dollar has been thrashing the Indian rupee as of late. The rupee hit a low of 83.63 in June 2024, recuperated a little, but then lowered again to 83.62.

Competitive Dollar

This isn’t simply an issue for the rupee. The dollar has been beating 22 out of 23 significant Asian currencies this month.

Just the Hong Kong dollar has figured out how to hold its ground.

Asian Currencies

The Chinese yuan has dropped to its lowest since December 2023, and the Japanese yen has hit its most fragile point since the 1990s.

Foreign institutional investors (FIIs) have additionally added to the rupee’s fall.

Rupee Performance

Recently, FIIs pulled out $2.6 billion from the Indian financial exchange.

This increased the drop further against the dollar as it attempted to rise again.

This huge outpouring compounded pressure on the rupee as it struggles to compete on the global stage.