Red Lobster, the popular seafood chain, filed for bankruptcy on May 19th, 2023. This news shocked many, especially those who loved their $20 endless shrimp promotion.

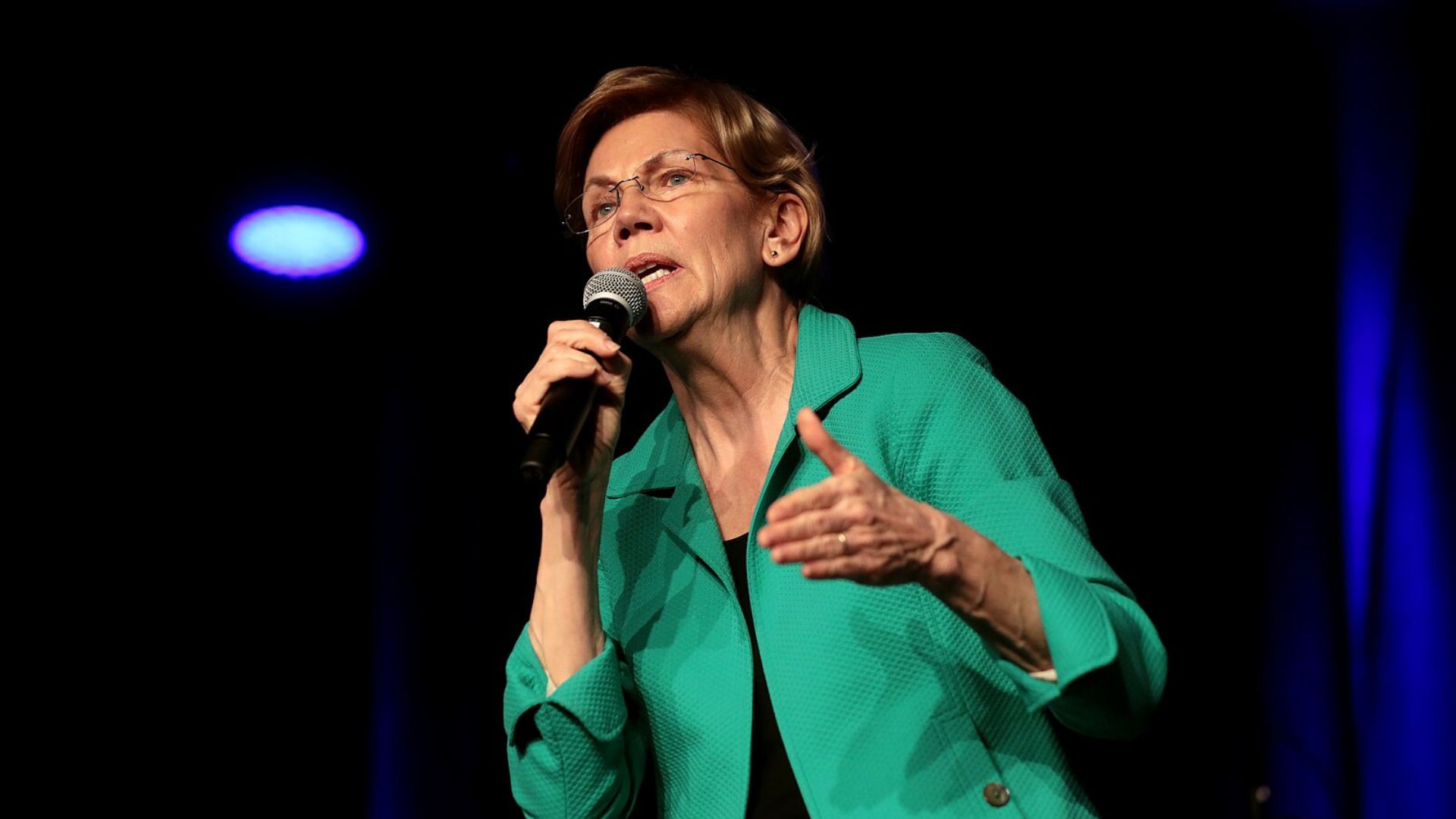

While some blamed the all-you-can-eat menu item, Senator Elizabeth Warren pointed to a different cause. She argued that private equity greed, not endless shrimp, led to Red Lobster’s financial collapse.

Senator Warren’s Statement

Senator Elizabeth Warren tweeted, “Red Lobster’s bankruptcy was caused by endless greed, not endless shrimp. It’s the private equity playbook: take over a company, loot the profits, load it up with debt, and leave communities, workers, and customers holding the bag.”

Her statement highlights the destructive impact of private equity firms on businesses and their stakeholders.

Thai Union’s Role

Thai Union, a major shareholder in Red Lobster since 2020, played a significant role in the company’s financial troubles. The seafood conglomerate pushed for the $20 endless shrimp promotion to boost shrimp sales.

This decision, intended to benefit Thai Union, cost Red Lobster $11 million and contributed significantly to its financial strain and eventual bankruptcy.

Internal Disagreements

Red Lobster’s management was reportedly initially against the endless shrimp promotion. They foresaw potential financial issues and operational challenges. Despite these concerns, Thai Union’s influence prevailed, leading to the implementation of the costly promotion.

This internal conflict revealed the tension between Red Lobster’s management and its majority shareholder, contributing to the company’s instability.

Impact on Suppliers

Thai Union’s decision to eliminate two of Red Lobster’s breaded shrimp suppliers led to increased costs. This move restricted the company’s supplier options, giving Thai Union exclusive access to the chain’s supply.

According to the bankruptcy filing, this decision “created both operational and financial issues” for Red Lobster, further burdening the company with supply obligations that were financially draining.

Operational and Financial Strain

The bankruptcy filing shed light on how Thai Union’s strategic decisions created significant operational and financial challenges.

The filing stated that these decisions burdened Red Lobster with supply obligations that were difficult to manage. The operational strain from these obligations, coupled with financial mismanagement, pushed the company towards bankruptcy.

Shift in Market Trends

Over the past 20 years, the casual dining market has shifted dramatically. Fast-casual restaurants like Chipotle and Chick-fil-A have captured significant market share with innovative strategies.

Red Lobster struggled to keep up with these changes. The brand’s lack of investment in modern marketing and restaurant upgrades made it difficult to attract younger consumers.

Lack of Investment

Red Lobster’s financial troubles were exacerbated by a lack of investment in key areas. The company did not invest enough in marketing, food quality, restaurant upgrades, and service enhancements.

These shortcomings made it hard for Red Lobster to compete with fast-casual rivals and expand its market share, contributing to its financial decline.

Historical Context

Red Lobster was founded in 1968 and quickly became a pioneer in casual dining. The chain, known for its signature items like hush puppies, expanded rapidly under General Mills’ ownership.

By developing a national seafood distribution system, Red Lobster set new standards in the industry. However, the brand’s momentum waned as competition increased and internal issues arose.

Expansion and Competition

By 1985, Red Lobster had grown to 372 restaurants with $834 million in sales. However, General Mills’ creation of Olive Garden in 1982 soon overshadowed Red Lobster.

Olive Garden’s success and Red Lobster’s operational missteps led to a shift in focus. Red Lobster struggled to maintain its market position as Olive Garden and other competitors gained ground.

Mismanagement Issues

The bankruptcy filing highlighted significant mismanagement issues within Red Lobster. The company claimed that operational decisions by former management harmed its financial situation.

Frequent changes in ownership and strategic missteps further destabilized the company. These issues, combined with the financial burden from Thai Union’s decisions, led to Red Lobster’s bankruptcy.

Reading Between the Lines

Red Lobster’s bankruptcy is a cautionary tale of how private equity decisions can destabilize a once-thriving brand. While the endless shrimp promotion played a role, the underlying issues of operational mismanagement and private equity influence were more significant.

As Red Lobster navigates its restructuring, it must find ways to adapt and compete in the evolving dining landscape.

Shift in Dining Preferences

Consumer preferences have shifted significantly towards healthier and more sustainable dining options. Red Lobster’s traditional menu, heavy on fried and buttery seafood, struggled to adapt to these trends.

As more diners seek out organic and locally sourced foods, the chain’s offerings appeared outdated, contributing to a decline in customer loyalty and foot traffic.

Rise of Plant-Based Diets

Similarly, the growing popularity of plant-based diets posed another challenge for Red Lobster.

With an increasing number of consumers reducing or eliminating animal products from their diets, the seafood chain’s menu lacked sufficient plant-based options.

Demand for Sustainable Seafood

Sustainability has become a crucial factor for modern diners, especially regarding seafood. Although it was a focus, Red Lobster’s sustainability practices were likely not highlighted enough to appeal to eco-conscious consumers.

Competitors that emphasized sustainably sourced seafood likely gained a competitive edge, drawing customers away from Red Lobster, which struggled to align its practices with market demands.

Impact of Food Delivery Services

The rise of food delivery services such as Uber Eats and DoorDash transformed dining habits. While many restaurants adapted by optimizing their menus for delivery, seafood dishes in general weren’t exactly the go-to options that consumers were picking.

These difficulties hindered the chain’s ability to capitalize on the delivery trend, further affecting its sales and market presence.

Preferences for Quick Service

Consumers’ preference for quick, convenient dining options has grown, with fast-casual restaurants like Chipotle and Chick-fil-A thriving as a result.

Red Lobster’s full-service dining model, requiring more time and often higher prices, became less attractive. This shift towards fast-casual dining put additional pressure on Red Lobster to modernize its approach or risk falling behind.

Effects on Suppliers

Red Lobster’s bankruptcy had a ripple effect on its suppliers, particularly small businesses dependent on the chain’s orders.

The chain’s decision to consolidate suppliers under Thai Union strained relationships and created vulnerabilities in its supply chain.

Increased Costs and Limited Options

The decision to eliminate two of Red Lobster’s breaded shrimp suppliers increased costs and restricted its supply chain flexibility.

This move not only raised operational expenses but also limited the company’s ability to negotiate better prices and manage inventory efficiently. The resulting financial strain contributed to the overall economic challenges leading to bankruptcy.

Alternative Supply Chain Models

To mitigate supply chain issues, Red Lobster could consider adopting more diversified and flexible supply chain models.

Establishing relationships with multiple suppliers, investing in sustainable sourcing, and leveraging technology for better inventory management could reduce costs and improve resilience.

Successful Competitor Strategies

Competitors like Olive Garden and Texas Roadhouse succeeded by staying attuned to market trends and consumer preferences. Olive Garden’s menu innovations and consistent marketing campaigns helped it remain relevant.

Texas Roadhouse’s focus on quality and customer experience built strong brand loyalty. Red Lobster can learn from these strategies to modernize its approach and re-engage customers.

Industry Best Practices

Implementing industry best practices such as customer feedback integration, continuous menu updates, and investment in employee training can enhance operational efficiency and customer satisfaction.

By adopting these practices, Red Lobster could rebuild its brand reputation and competitive edge, ensuring long-term success in a challenging and evolving dining landscape.

Digital Transformation

Digital transformation has been pivotal for many competitors. Implementing robust online ordering systems, enhancing mobile app functionality, and leveraging data analytics for personalized marketing can significantly improve customer engagement.

Red Lobster can adopt these technological advancements to streamline operations, attract tech-savvy diners, and create a seamless dining experience, both online and in-store.

Turnaround Strategies

Red Lobster can explore several turnaround strategies to regain its market position. Rebranding efforts focusing on sustainability and health-conscious menu options can attract new customers.

Embracing digital marketing and delivery services can also expand reach and convenience. Time will tell which strategies will work for Red Lobster, but a combination of these approaches could revitalize the brand and drive business growth.