In 2024, a Bank of America survey revealed a striking trend: 81% of Americans have set financial resolutions, with a whopping 45% aiming to bolster their savings. This push toward financial well-being underscores a collective desire to enhance economic security, especially among retirees.

As we navigate through the complexities of modern finances, setting and adhering to these resolutions emerges as a blueprint for a stable and comfortable retirement.

The Essential First Step: Budgeting

Crafting a realistic budget is the cornerstone of financial stability in retirement. Lorna Sabbia of Bank of America emphasizes the need for a budget that reflects current needs and adapts to changing priorities.

“A clear understanding of your monthly cash flow allows you to assess where you may need to make adjustments so you’re not draining your savings,” Sabbia told GOBankingRates. A well-thought-out budget isn’t just a financial tool — it’s a road map to a worry-free retirement, ensuring that your savings stretch further and last longer.

Understanding Your Monthly Cash Flow

A meticulous monthly review of your expenses can illuminate potential savings opportunities. This practice helps to present a clear grasp of your cash flow and is instrumental in identifying areas for financial adjustment.

By keeping a close eye on where every dollar goes, retirees can avoid the pitfalls of overspending and ensure their savings pool remains robust.

Invest Early in Your 401(k) Plan

Long before retirement looms on the horizon, investing in your 401(k) can set the stage for a financially secure future.

It’s vital to start early with consistent contributions, even if they’re modest. With time, these investments grow, thanks to the magic of compounding interest, turning even small savings into significant retirement funds.

Leverage Target Date Funds for Simplified Investing

For those intimidated by the diversity of investment choices, target date funds may be your best friend.

These funds automatically adjust your investment mix as you near retirement, simplifying the process of building a diversified portfolio. It’s an effortless way to ensure your retirement savings are working as hard as you did.

Digital Tools and Resources at Your Fingertips

When it comes to managing your finances, technology can be your ally. Online budgeting tools such as Mint or Empower allow you to track expenses and monitor your net worth all in one place.

Moreover, there are a plethora of retirement calculators available online that can help you determine how much to save each month to reach your retirement goals.

Employee Assistance Programs: A Helping Hand

In addition to digital resources, many employers offer employee assistance programs (EAPs) to help their employees with financial planning and management.

These programs may provide access to financial advisers or workshops on retirement planning and investing. Take advantage of these resources to gain a better understanding of your options and make informed decisions about your retirement savings.

The HSA Advantage: Saving for Health Care

A Health Savings Account (HSA) is a powerful tool for managing health care expenses both now and in retirement.

By contributing to an HSA, retirees can enjoy tax benefits while preparing for future medical costs. The dual benefit of current expense coverage and long-term savings growth makes HSAs an essential part of retirement planning.

Diversify Your Investment Portfolio

Diversification is key to a resilient investment strategy. Retirees may consider exploring various asset classes to mitigate risk and enhance potential returns.

A diversified portfolio can serve as a financial safety net, ensuring your retirement savings continue to grow over time.

Investing: A Path to Growing Wealth

It’s never too late to start investing. Understanding the basics can build confidence and lead to more informed financial decisions.

Starting small and learning as you go can transform investing from a daunting task into an empowering tool for financial independence.

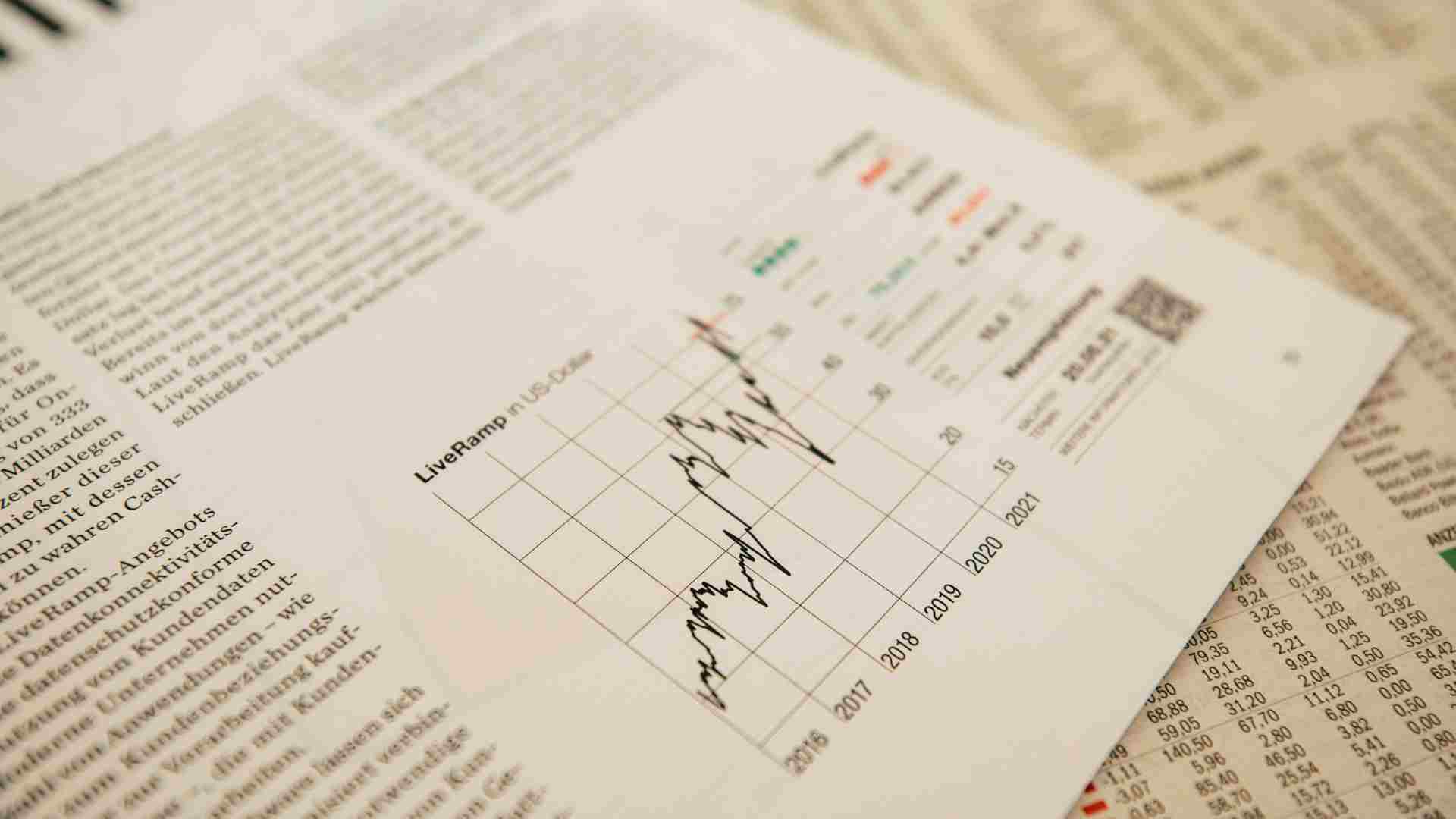

Stay Informed and Proactive

Staying up to date on financial news and trends can help retirees make better investment choices.

Regularly consulting financial advisers and actively diving into financial education resources are key to leveling up your financial game, even in retirement.

A Secure Retirement

Saving for retirement is a journey, not a sprint. By following these simple yet effective strategies, retirees can ensure their golden years are as comfortable and secure as they envision.

With careful planning, informed decisions, and a proactive approach to saving, a fulfilling retirement is within reach for everyone.