California’s audited financial statement for the fiscal year 2021-2022 has been published, revealing a concerning financial situation for the state.

Filed 350 days past the due deadline, the report uncovers that California is facing a significant financial shortfall, with $55 billion more owed than the available funds. This alarming disclosure showcases the challenges the state must navigate to rectify its financial health.

The Impact of Unemployment Fraud on California’s Finances

The audit highlighted a major financial misstep, identifying that COVID-era unemployment fraud has cost California $29 billion.

This substantial amount is owed back to the federal government, marking a significant blow to the state’s financial stability.

Economic Prosperity vs. Financial Reality

Despite experiencing massive stock market gains and significant job growth in the high-earning tech field during 2022, California’s financial health has not mirrored this economic prosperity.

The state reported having $256 billion more in liabilities than in unrestricted resources for the year 2022, indicating a discrepancy between its economic success and fiscal management.

Budget Concerns and Economic Challenges

The state’s budgetary decisions have come under scrutiny, with California adopting a budget that saw $234 billion in spending from the general fund against $220 billion in revenue for FY 2021-2022.

This discrepancy highlights the challenges in balancing the state’s budget, particularly in times of economic prosperity that still result in financial shortfalls.

The Growing Budget Deficit

California currently faces a daunting $73 billion deficit for the 2024-2025 fiscal year.

In response, the Democratic legislature has proposed cutting this year’s budget by $2.1 billion and plans to spend $12 billion, or half the state’s rainy day fund, to address this deficit.

Economic Shifts and Increased Expenditures

The state’s job growth forecast has been significantly reduced, from an anticipated 325,000 new jobs to just 50,000.

This downward revision, coupled with an expansion of benefits such as extending taxpayer-funded MediCal to all illegal immigrants, suggests that California’s financial burdens could escalate beyond current projections, complicating efforts to manage the deficit.

Delays in Financial Reporting

State Controller Malia Cohen has noted that the delayed publication of the state’s Annual Comprehensive Financial Report (ACFR) for the fiscal year ended June 30, 2022, marks the fifth consecutive year of delays.

This pattern of late reporting hampers the ability of voters and state leaders to accurately assess California’s financial position, hindering informed decision-making.

Initiatives for Timely Financial Reporting

In a move towards greater fiscal transparency, the State Controller’s Office has set a goal to return to timely financial reporting by FY 2025.

Efforts to achieve this include improving data quality and streamlining processes. These measures are crucial for enhancing the fiscal integrity of the state and supporting economic growth.

Information Technology Challenges

The state’s $1 billion financial software system rollout has faced significant delays, impacting the efficiency of financial processes.

California has extended the timeline for completing this software conversion to 2032, highlighting ongoing challenges in modernizing the state’s financial infrastructure.

Employment Development Department’s Reporting Issues

The audit also pointed out deficiencies in the Employment Development Department’s (EDD) control over financial reporting for unemployment insurance benefits.

Inadequate estimation of ineligible payments has resulted in incomplete and inaccurate financial information, further complicating the state’s financial challenges.

Comparisons with Other States

While California is not alone in facing challenges with unemployment insurance reporting, its situation is notable for the scale of the issues.

Other states, such as Georgia, Illinois, and Nebraska, have also received audit opinions highlighting similar problems. However, California’s financial impact, with $29 billion in net liabilities for improper unemployment payments, stands out significantly.

Potential Federal Intervention

There is a possibility that the federal government could intervene to alleviate some of California’s financial burdens by writing off debts for improper unemployment payments.

Such a move would provide relief to the state as it works to address its fiscal challenges and improve its financial management practices.

Navigating Uncharted Waters

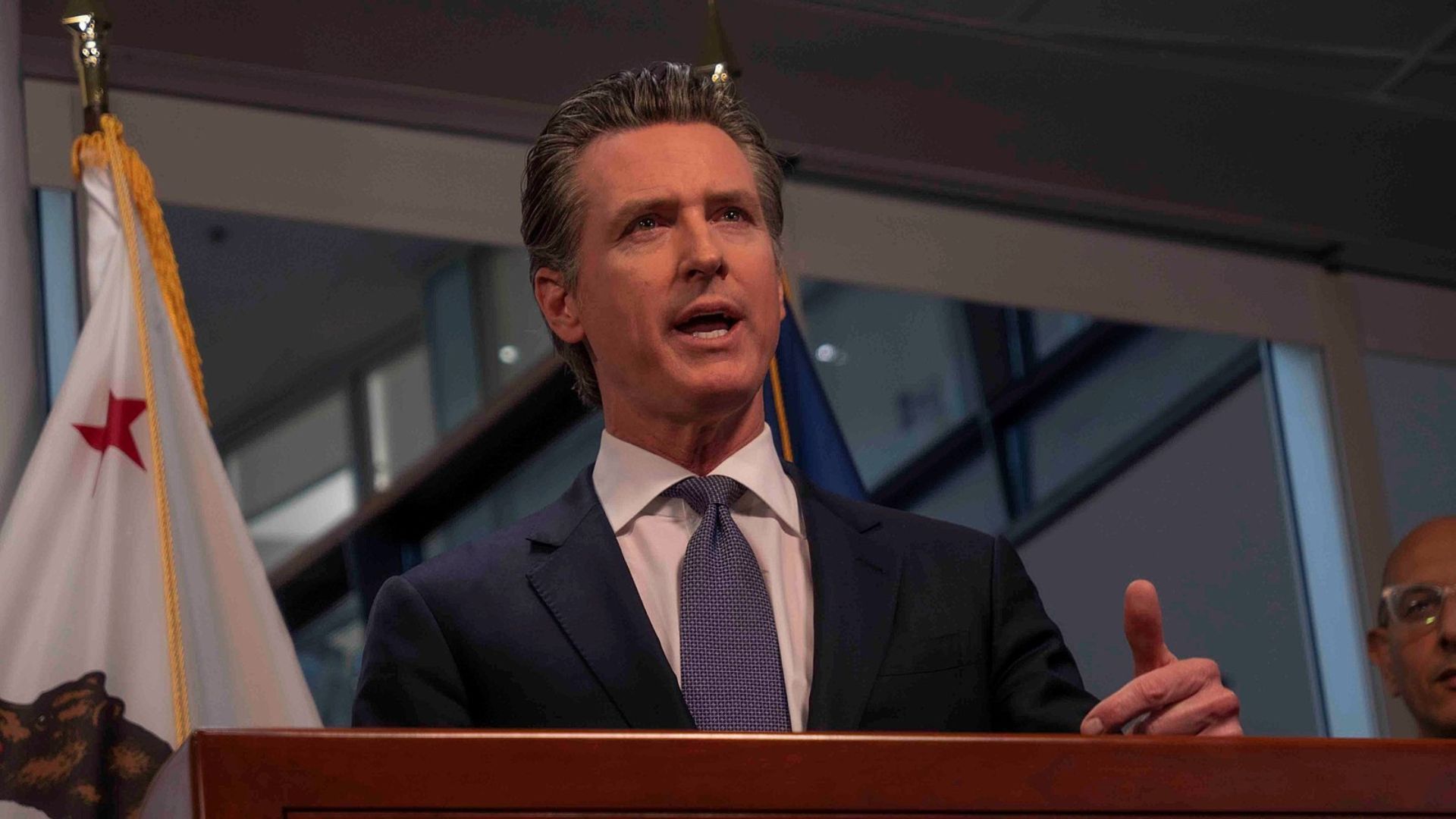

Governor Newsom’s monumental task of cutting $38 billion from the country’s largest state budget within three months, is further complicated by the inexperience of the team surrounding him.

None of the lawmakers working with him have previously faced such a daunting financial challenge.

Legislative Inexperience

Only eight state lawmakers with experience from the Great Recession are in office, and none hold significant positions of power.

This situation presents a unique challenge, as expressed by Jesse Gabriel, the newly appointed Assembly Budget Committee chair, “This is going to be a new experience for almost everybody, including me.”

Dominance of Budget Talks

California’s budget concerns have overshadowed almost every aspect of governance in Sacramento. The discussions about the budget are not only prevalent but also have significantly influenced the legislative agenda, limiting lawmakers’ ambitions.

This situation is further complicated by the overall inexperience of the legislators, who are now forced to learn and make decisions quickly.

Democratic Leaders Face Tough Decisions

The new Democratic leadership is tasked with guiding their caucuses through the process of making deep spending cuts, a situation unfamiliar to many members.

The reality of the budget crisis has led to intensive discussions and a series of meetings focused on achieving consensus on the necessary fiscal adjustments.

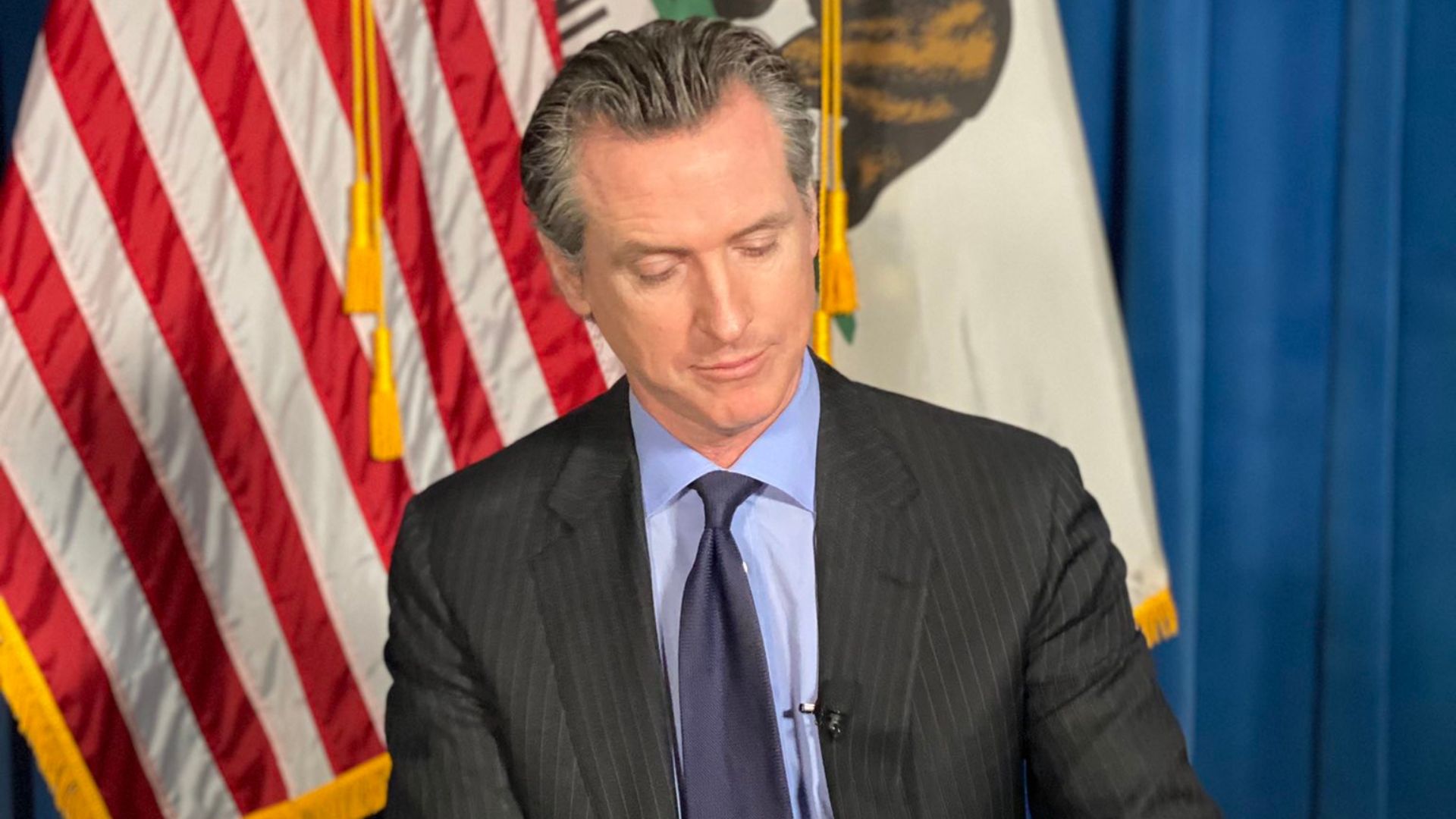

Shift in Committee Roles

The budget crisis has transformed the roles of Budget and Appropriations committees from overseeing spending increases to identifying areas for significant cuts.

This shift represents a stark contrast to previous periods of financial abundance. Assembly Appropriations Chair Buffy Wicks acknowledges the challenge, emphasizing the unfortunate nature of the current budget constraints.

Preliminary Agreement on Budget Cuts

A preliminary consensus has been reached to reduce the deficit by at least $12 billion ahead of final budget negotiations.

However, the methods for achieving these cuts remain under discussion. The Senate has taken a proactive stance by proposing a package of $17 billion in spending cuts, delays, and borrowing, with the endorsement of Governor Newsom.

Leadership Changes Amid Fiscal Crisis

Recent leadership changes in the legislature have placed new individuals in key budget-related positions at a critical time.

These changes illustrate the urgent need to address the budget shortfall effectively, requiring a departure from past practices of fiscal generosity to a more cautious and measured approach to budget management.

Seeking Guidance from Experienced Mentors

In facing the budget crisis, newer lawmakers have sought advice from more experienced colleagues and predecessors.

This mentoring process is vital for understanding the complexities of state budgeting and developing effective strategies for addressing the current fiscal challenges.

The Crucial Role of Staff and Institutional Knowledge

The legislature’s reliance on experienced staff members has become more pronounced due to the significant turnover among lawmakers.

The institutional knowledge and expertise of these staff members are critical in navigating the budget negotiation process and ensuring continuity in fiscal policy making.

New Perspectives on Fiscal Management

Despite the challenges posed by the turnover in legislative and administrative positions, new leaders bring valuable perspectives and experiences to the table.

These fresh insights, combined with the guidance of seasoned staff and mentors, are essential for developing innovative solutions to the state’s budgetary problems.

The State’s Fiscal Resilience

While California faces a potential $73 billion deficit, its financial situation is not as precarious as during the Great Recession.

The state’s reserves and unspent funds from previous years provide a buffer, allowing for strategic decisions on budget management without resorting to drastic cuts.

Simplified Budget Approval Process

The process for approving the state budget has been simplified, requiring only a simple majority.

This change facilitates more straightforward budget negotiations and decision-making within the Democratic majority. Despite the challenges, this procedural advantage aids in addressing the state’s fiscal issues in a timely and effective manner.