Can’t get enough of those five-dollar footlongs? Subway, the sub titan, has been in the process of acquisition via a private equity firm. This has been prompting many to wonder: What can consumers expect from the deal?

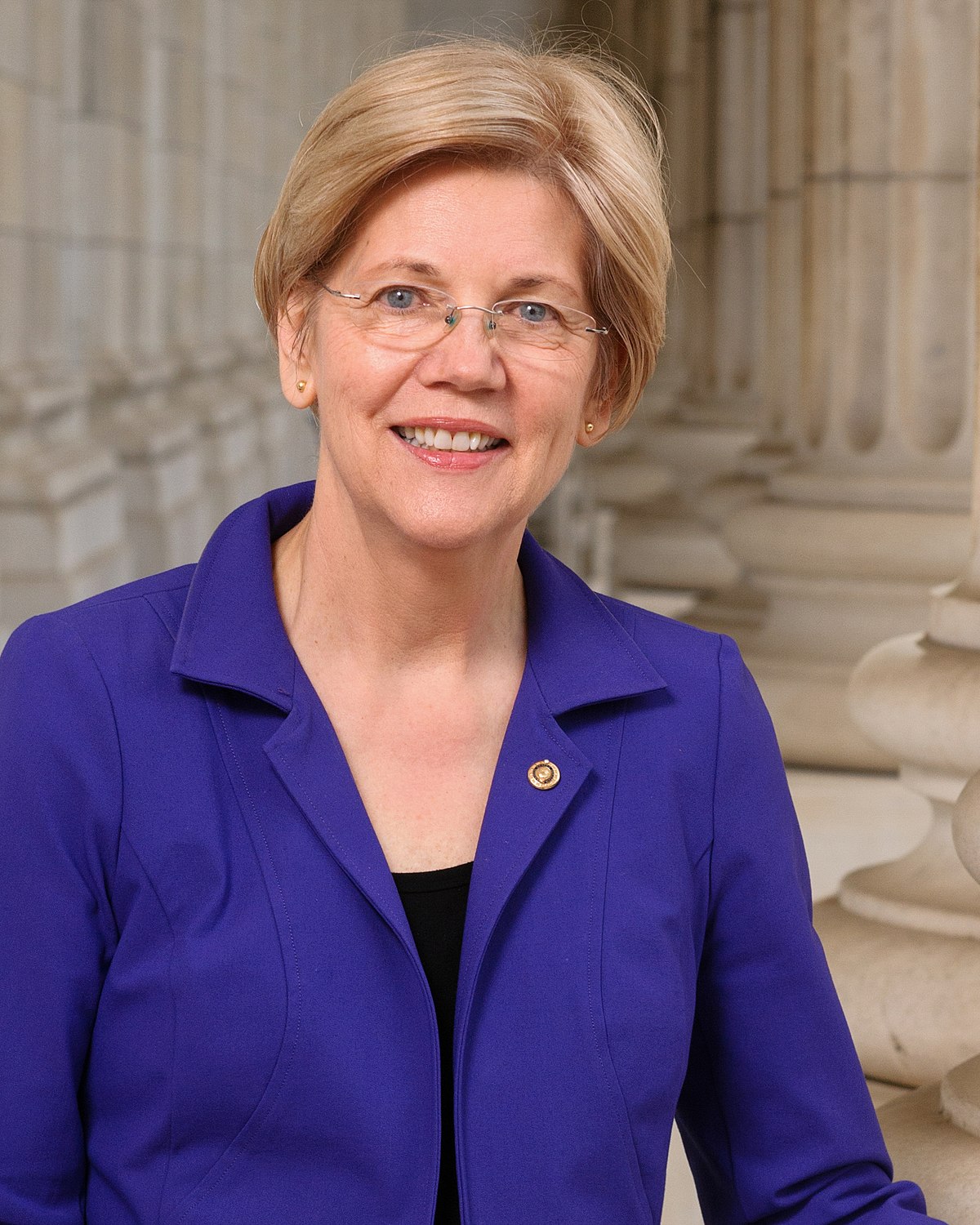

Senator Elizabeth Warren suspects that there could be higher prices on the horizon — stretching the wallets of consumers more than before.

What Does Senator Elizabeth Warren Have to Say?

Senator Elizabeth Warren, a Democrat senator from Massachusetts, has recently started conversations on X regarding Subway’s private equity offer.

“We do not need another private equity deal that could lead to higher food prices for consumers,” she posted on X. This quote alone prompted discourse on-platform, as many commiserate about the rising prices of food.

Could The Subway Deal Actually Result In Higher Food Prices?

Subway currently owns about 40,000 franchise-based sub-shops around the U.S. — which means that the purchase would affect more locations than there are McDonalds or Starbucks locations in the country.

This could have major effects on consumers, as these locations serve hundreds of thousands of people per day. The value of the acquisition is currently sitting at $10 billion.

Who Would Be Affected By Acquisition-Caused Price Changes?

Acquisition-related price changes would theoretically affect everyone involved in the production and consumption of Subway-related goods.

This would include the corporate employees, the line workers making the sandwiches, middle-level managers, franchise owners, food suppliers, tech suppliers, and, of course, you as the consumer. While steps could be taken to mitigate effects, effects would be felt at all levels.

Who Wants To Buy Subway?

Now that we understand the possible effects of the acquisition, let’s take a look at who is leading the charge on the purchase: Roark Capital, known as one of the biggest investors in the food industry.

Roark is known for their other notable investments, such as Jimmy John’s, Arby’s, Schlotzky’s and McAlister’s Deli brands.

Is There A Legal And Ethical Concern Associated With The Purchase?

Many are noting that Roark’s buying patterns and acquisition habits are not truly contributing to the free market — rather, they are saying that it is creating an oligopoly.

An oligopoly, by definition, occurs when there is little to no competition in an area of the free market, due to repeated acquisitions by the same company or entity.

Are Oligopolies Illegal in the United States?

In many contexts, oligopolies are illegal in the United States. This is made possible via United States antitrust laws, which defend consumers and other businesses from oligopolies in three key ways.

For example: The Sherman Act doesn’t allow businesses to enter into horizontal agreements that limit free market trading to their own advantage.

Why Are Oligopolies Illegal?

There are many reasons why oligopolies are illegal. A primary reason, among others, is that an oligopoly could possibly allow a company to spike prices to an irresponsibly high level due to a company’s control of the market and purchasing power.

Assuming oligopolies were to form across industries, the American consumer would be compromised — and they’d be blocked from the benefits of a free market system.

Not Everyone Is Worried However — And Some Even Mock Senator Warren

Senator Warren is no stranger to the crosshairs of an internet brawl. However, many have taken to X to mock her concerns, stating that there’s no real concern and that it’s “just a sandwich.”

People go on to say that consumers can simply “make their own” if prices rise as a result of this acquisition.

Senator Warren Fires Back

Amid the online discussion, Senator Warren released a statement in support of the struggles that lower- and middle-class Americans experience on a daily basis.

“The reality is that for many Americans wanting a quick, affordable lunch, their nearest option is a…sandwich shop…it’s out of touch to say working people can go…somewhere else when executives jack up prices,” she noted.

A Sandwich Shop Monopoly?

The fear is obviously that Roark Capital would be able to control the sandwich shop market in a manner that would become illegal.

In the instance presented, Roark Capital owning multiple “Sandwich shops” could theoretically drive up the cost of sandwiches without any relevant competitor to provide an alternative to consumers. But how legitimate is the concern really?

How Many Sandwhich Shops does Roark Capital Own?

To really determine the level of concern here we’d have to look closer at how many Sandwich shops Roark owns, not just the companies total assets.

Among their businesses are Sonic, Shlotzkys, McCallisters, Jimmie Johns, Carls Jr, Culvers, Arby’s and Buffalo Wild Wings. These aren’t all Sandwich shops per se, but Roark has a strong portfolio in this area.

How Many Sandwich Shop Chains Are Owned By Others?

The counterpoint might be that companies like Quiznos, Panera, Blimpie, and ToGos are all also out there. It’s harder to argue that Roark truly has cornered the market on Sandwich shops.

Then again, the danger is how they can corner the market in some areas, setting precedents that could lead to their unfair advantage in the space. But the FTC is still doing their due diligence. Why?

The Importance of Antitrust Laws

Antitrust laws prevent, essentially, the game from being controlled by the players. If Roark ends up with too much control over the prices within this space they hurt the marketplace.

Laws in place help provide an impartial official, but also prevent collaboration from companies to force certain advantageous outcomes that hurt consumers.

The Many Different Viewpoints Of The Subway Sandwich Debate

Enthusiasts of capitalism rebut Senator Warren’s viewpoint, often criticizing the intense government involvement in the regulation of free trade.

Don Cohen, advocate for big business, notes that “corporations and their enablers have been using these arguments for over (100) years.” Hundreds of people have commented under #Subway-related threads, sounding off on their opinion.

Are Antitrust Laws Against Capitalism Ideals?

There is an age-old argument that Monopolies are a threat to the function of healthy captalism. But there is a similar age-old counterpoint that government interference is as bad or worse.

In many cases it boils down to an individual determination on the lesser of two evils. The case against Monopolies is that they hurt innovation and that competition drives quality.

What Exactly is a Sandwich? And What Isn’t?!

One of the most intrigued side effects of the Roark purchase of Subway is the legal debate over what qualifies as a Sandwich.

In order to determine which of the aforementioned businesses owned by Roark qualify to form a sandwich shop monopoly, the discussion of ‘what is a sandwich’ comes into full view.

What’s Next for Subway?

Roark’s plans for the Subway brand seem clear: international expansion.

Subway has signed many international franchisee deals in the last 3-5 years and expects to continue to add more with this move to Roark. As far as how Subway is run, things shouldn’t change much. Of course the big concern remains how it all could impact pricing.

How did Subway Begin?

Back in 1965 Fred Deluca asked Nuclear Physicist Dr. Peter Buck how to pay his way through College. The plan was to use an investment from Buck to build a Sandwich shop, “Pete’s Super Submarines”

By August of 1965 they had a shop in Bridgeport Connecticut and by 1974 they had 16. By now college tuition was a goal they’d blown past, Pete’s Super Submarines was now Subway, and they had their sites set on the horizon.

The Power of The Franchise

The key to Subway’s rapid growth and dominance in the space was how it transformed into a franchise. But how does a Franchise work?

Essentially a parent company or business grants the rights to a smaller business owner to operate the business using the marketing, tools, recipes, and ingredients in the case of this market. The split in revenue varies, and frequently the arrangement is a win-win though not without it’s share of pitfalls.

So… With Subway Has Roark Formed a Sandwich Monopoly?

Thesling.org created a unique table presenting the top Chains in the space along with sales and share% to indicate (with the asterisk) how Roark’s holdings shake out.

This is far from a final conclusion but it does imply that Roark is in fact becoming quite dominant in the marketplace and there is some cause for concern and further investigation.

Where Does The Subway Acquisition Story Leave Off?

Currently, the Subway/Roark Capital acquisition is on the desk of the Federal Trade Commission. There has been no ruling made at this time.

Capital funding participants and other stakeholders likely will not hear of an outcome until midway into 2024. Ultimately, the Federal Trade Committee works to regulate businesses in favor of the consumer and the American Public.