California has always had a long history of conflicts when it comes to taxations. Ever since California’s voters passed Proposition 13—the famous property tax limit—the state’s always had a problem over how much tax money the governments need (and who should pay up for it).

This battle is seemingly reaching its climax under a ballot measure this fall. But CA Governor Gavin Newsom and the Legislature are asking the California Supreme Court to remove it from the ballot. And so the battle begins.

The Ballot Measure

The ballot measure in contention is backed by the California Business Roundtable. It would require voter approval of new state taxes.

The measure would also increase the limit of voter approval for taxes to two-thirds majority (from the current simple majority) and reclassify many fees as taxes needing voter approval.

The Opposing Sides

The California Business Roundtable’s match in this battle is Governor Newsom and the Legislature (specifically, its Democratic leaders).

They put another measure that would turn the table on the business one and require it to get two-thirds majority to pass. Also, Newsom’s camp had already filed a lawsuit to take the measure off the ballot entirely.

Deep-Pocketed Interests

There’s no doubt that both sides have deep-pocketed interest. The fact that this case is being argued in front of the seven justices of the California Supreme Court shows how much of a big deal it is for either side.

On May 8, lawyers from the opposing sides made their arguments at the Supreme Court. This court would then later have to decide whether the measure can appear on the ballot. The deadline is June 27, the last date for preparing ballots and other materials for the November election.

The Government’s P.O.V.

The attorney representing Newsom’s camp, Margaret Prinzing, argued that the measure would strip the Legislature of its constitutional power to raise taxes. It would also restrict the governor’s authority to enact fees. These are fundamental changes in California’s government system. They would qualify it as a constitutional revision.

Also, she said, if voters were to decide how the state could raise revenue (instead of experts in the government), the government wouldn’t be able to do much when responding to fiscal emergencies.

The Business Side of Things

Meanwhile, Thomas Hiltachk, an attorney specializing in ballot measures with conservative leanings, argued for the business side. He said, “Our constitution, since its inception, has stated that all political power is inherent in the people.”

He meant that the Constitution recognizes voters as the ultimate authority and the measure in question only emphasized that position of authority. Plus, he said, the measure needs to be there to retaliate against the lawmakers’ actions that have weakened previous voter-approved tax accountability measures.

A Widespread Impact

It’s easy to see why the government—both state and local—are opposed to this measure. Without the ability to raise taxes, revenues needed by local communities for essential public services would be curtailed. These services include trash collection, fighting fires, and emergency responses.

Carolyn Coleman, CEO of the League of California Cities, said it would affect more than 100 local measures, with a total of $2 billion in annual funding, at risk. The league, along with firefighters and teachers unions, call the proposal “deceptive” and “an existential threat” to local governments.

Services Residents Need

Coleman emphasized that these taxes would fulfill the services the residents need to live affordably in California. “We’re raising the resources to fill potholes, so that we can support affordable housing in our community, so we can work to address homelessness,” she said.

The local government needs resources to have someone actually answering the phone when residents dial 911 “not in two minutes, but in 30 seconds.” Coleman then concluded, “So this really goes against the essential nature of how local government raises the revenues to provide services that everyone wants.”

Business People Skeptical

The business people, however, are skeptical. Brooke Armour, executive vice president of the California Business Roundtable, negated that not many local initiatives would be affected (only 28, as opposed to Coleman’s figure of “more than 100.”)

The impact is also not as widespread, as it only focuses on tax increases posed through citizen initiatives. Meanwhile, Armour added, special taxes put on the ballot by local elected officials already require a two-thirds vote for approval. All measures raising general taxes would still be approved with a majority vote.

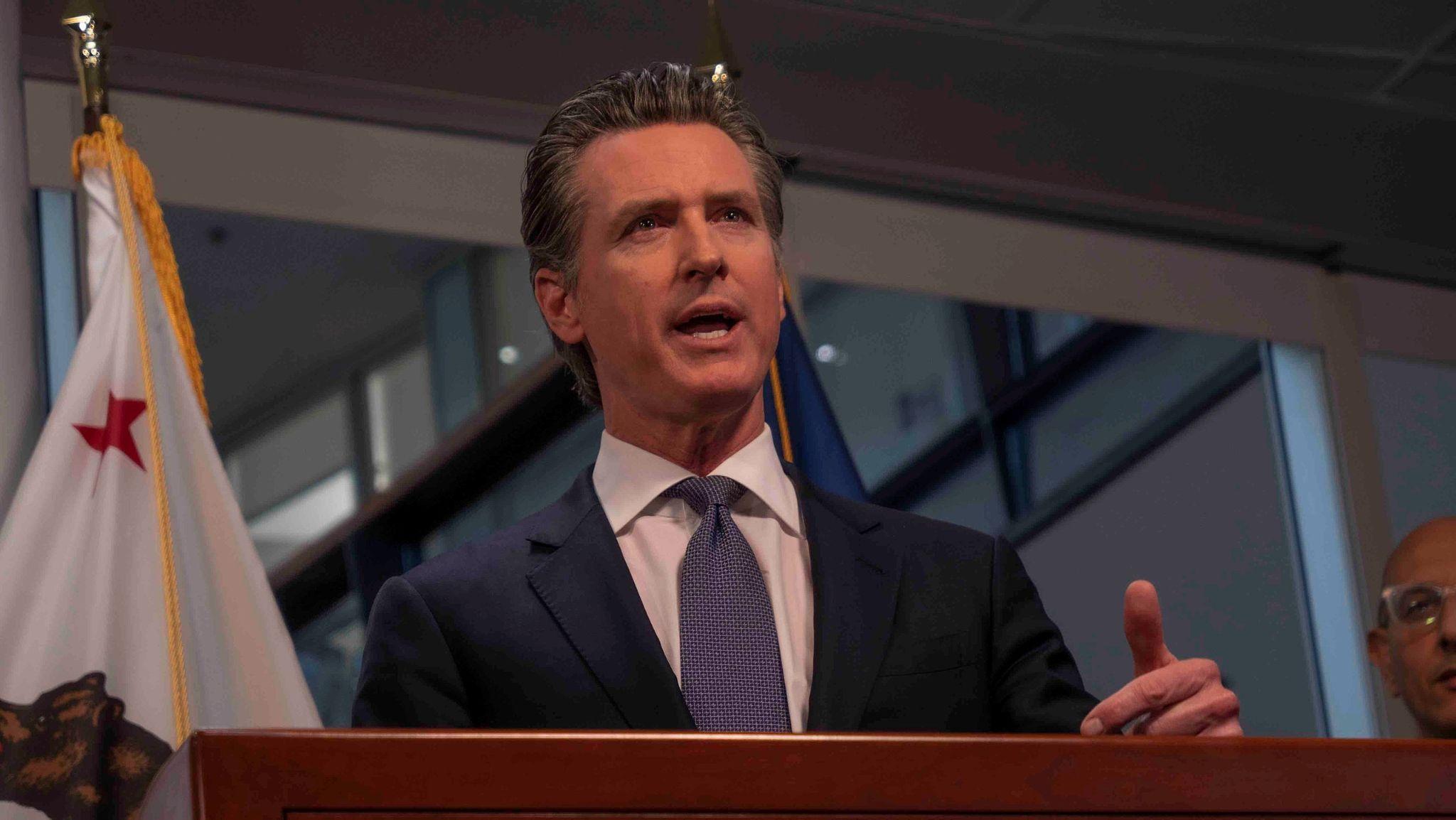

Trying to Live With High Taxes

The measure’s supporters insist on keeping the measure on the ballot as a way of ensuring that California’s taxes don’t get even higher. Even now, the state already has some of the highest taxes, causing it to be the state with the highest costs of living.

“The whole issue here is that they are scared to death of the people of California being empowered to vote on state and local taxes,” said Rob Lapsley, president of the California Business Roundtable.

The Government Just Wants Self-Protection

Newsom and the Democrats dominating the state’s government have been fielding criticisms over high taxes, among many other issues in California’s economy. They’ve been said to make California too expensive for its 39 million residents.

But a Newsom spokesman said the governor’s opposite attitude towards the measure doesn’t mean he supports higher taxes. He’s only trying to protect the government from a crisis. Spokesman Bob Salladay said in a statement, “You can both be opposed to new taxes and to destructive ballot measures that would hamstring government from protecting itself in a crisis.”

Decision Still Pending

It’s too early to tell which side is winning the battle. The Supreme Court justices grilled both sides sharply, but they still haven’t shown any clues as to what their ruling would be like.

They were observed to be sympathetic to the state’s concerns about the impact of this initiative. But they also seemed to seriously consider the appropriateness of taking the decision away from voters. Meanwhile, Californians may have to wait until after the November elections for this battle to be decided.