Progressive political changes in California have a tendency to creep across the nation to a federal level. This is especially true under President Biden, as he elected a handful of Californians to top government positions.

Biden elected not only the state’s attorney general, Xavier Becerra, to run the US health department. He also elected another six to various top government positions. That’s why it’s key to pay attention to important tax bills rolling out of California. They could go federal.

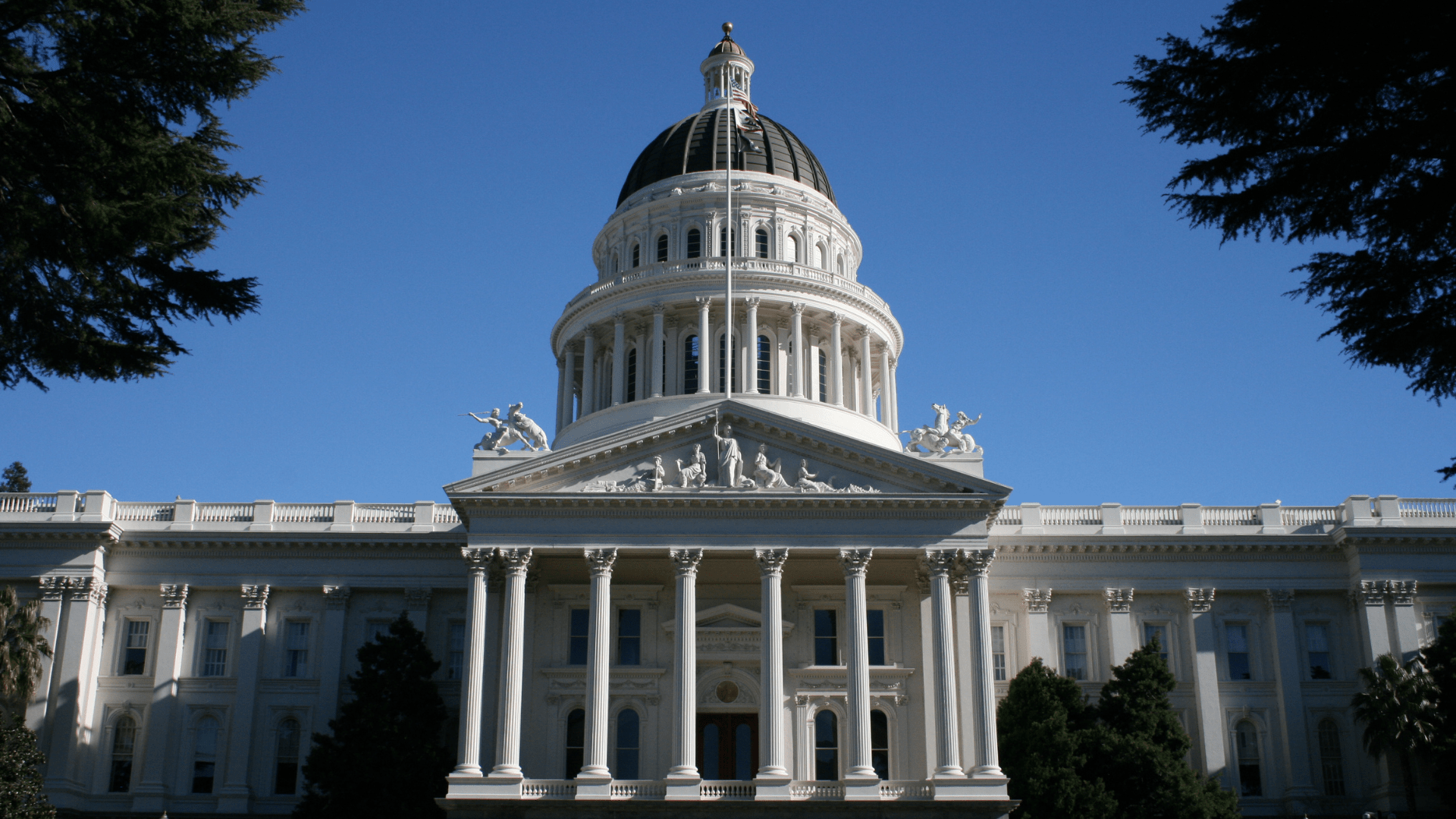

What Is the California Wealth Tax?

New legislation in Sacramento moves to create a wealth tax for the state’s high earners as well as a methodology attorneys can use to seek out and aim their sights on people allegedly ducking taxes.

The bill proposes a tax imposition of 1.5% on the assets of Californians with a net worth of $1 billion, and places a 1% tax on those with a net worth of more than $50 million.

The Tax Applies to Part-Time Residents

This new tax measure would apply not only to full-time California residents, but to those living in the state part-time as well. How does that play out?

Part-timers would be taxed on a certain share of their wealth based on how many days they actually spend in California annually.

The Tax Applies to Those Who Have Recently Departed the State

Going even further than taxing part-time state residents, the bill also proposes to tax people who have recently moved out of state.

This means that any taxable person trying to leave the state to avoid this cannot do so. You can try to leave, but you’ll nevertheless be required to pay the tax.

What Assets Does the Wealth Tax Apply To?

Essentially, it applies to every asset, including artwork, financial assets held offshore, shares you may hold in a partnership, and even private equity interests.

Pushing things even further, the tax would apply even to assets that are not publicly traded. This means that the state Franchise Tax Board can audit private businesses that are not located in California.

What Does the Wealth Tax Not Apply To?

Interestingly, the wealth tax does not apply to real property. This would of course encourage wealthy people to shift most of their investments into real estate.

Though the motivation behind exempting real property from the tax are of course unknown, this may be a partiality to high-end real estate and Hollywood donors who favor Democratic state officials. It might also be motivated by a desire to alleviate some of the damage to real-estate sales caused by local mansion taxes in San Francisco and Los Angeles.

How Does the Bill Target Tax Dodgers?

The bill extends California’s False Claims Act to both wealth-tax records and statements. This would allow plaintiff attorneys to sue wealthy individuals who are allegedly underreporting on wealth or fudging their paperwork in some way.

Some believe that this is a way of spreading wealth to plaintiff-bar donors, since attorneys who win their cases would be awarded a portion of the state’s recovery.

Where Did the Wealth Tax Come From?

A large impetus for the bill is that lawmakers are searching high and low for revenue to fill what they expect to be a $68 billion hole in the state budget. The Democrats have proposed the tax as an alternative to spending restraint.

The $68 billion budget hole arose from dramatically low tax revenue. The shortcoming is so low that it could result in the largest spending cuts since the Great Recession.

Delay in Tax Collection is a Big Culprit for Tax Shortfall

According to the Los Angeles Analyst’s Office (LAO) between 2022 and 2023, income tax collection fell by 25%. One of the biggest culprits was California’s decision to extend the time people had to pay their taxes until October 2023. This deadline was also later extended into November 2023.

Communication Director for Governor Newsom Erin Mellon responded to the dire deficit projections of the state. “Federal delays forced California to pass a budget based on projections instead of actual tax receipts.”

Resident Exodus is Also a Contributor

California saw a remarkable drop in residents in recent years. In 2021, the state saw its first population decline on record. This deceased the number of people who would pay future tax revenue.

According to the Public Policy Institute of California (PPIC), the state saw an exodus of 281,000 residents in 2021, followed by a 2022 exodus of 211,000 residents. The residents moved to surrounding states and many are unlikely to return in the near future.

The Housing Market Drove Away Residents

In February, the PPIC conducted a survey that asked adults in California about their feelings on political topics and the government. The survey found that 34% of California residents have thought about moving out of the state because the increasing housing prices.

Forbes reported from 2021 to 2022 that housing prices rose by 10%. Housing represents a significant percentage of being people’s budgets.

Rising Interest Rates Effect the Housing Market

Interest rates have been rising in recent years to to the effects of inflation in the economy. As interest rates rise, mortgage rates also increase. These factors contribute to rising prices in the California housing market.

With higher mortgage rates, borrowing becomes more expensive. People will be less likely to enter the market to find a house when they see such a sudden price increase. They will be more likely to choose a home in a cheaper area out of state.

Homelessness Is An Increasing Problem In California

In the PPIC survey, seven out of ten surveyed California residents said they viewed homelessness as a ‘big problem’ in their state. Many residents said that they felt an increase in the presence of homeless people in their local communities.

With the increase in housing prices being an issue, it is not surprising to see an increasing number of people who can no longer afford a home. As people experience more financial hardship, tax revenues will surely continue decreasing.

Businesses Leaving California Contributed to the Tax Deficit

In 2021, a report by the Hoover Institution concluded that nearly twice as many companies moved their headquarters out of California compared to 2020. According to the report, a total of 153 companies moved their headquarters out of California in 2021.

Many of these were large companies like Tesla, Charles Schwab, and Oracle. Some are moving to places like Texas, which is an attractive location because it has no personal tax rate.

California’s Unemployed Workforce Rate

The jobless rate in California has been on the rise which will have an obvious impact on tax revenues. The Legislative Analyst’s Office (LAO) reported that there were 200,000 more unemployed workers in December 2023 compared to the summer of 2022.

In that time, the percentage of unemployed workers rose from 3.8% to 4.8%. Many businesses are cutting payroll costs to combat the tougher economy and cannot afford to expand their operations..

How Much Revenue Would the Wealth Tax Generate?

The proposed tax could raise as much as $21.6 billion in revenue for the state. Unfortunately, this is less than half of the budget deficit.

It also doesn’t adequately address the $27 billion increase in spending for Medicaid over the last four years. Medicaid spending is expected to grow even larger this year as the state extends the program’s eligibility to all of the state’s undocumented migrants.

Medicaid in California

In California, the Medicaid program is called Medi-Cal. In 2023, Governor Newsom’s Budget predicted that Medi-Cal spending would reach $139 billion that year. This is an increase of over nearly $18 billion over the previous year.

Over 15 million Californians rely on this program. This equates to nearly 40% of all California residents relying on Medi-Cal to cover their healthcare expenses.

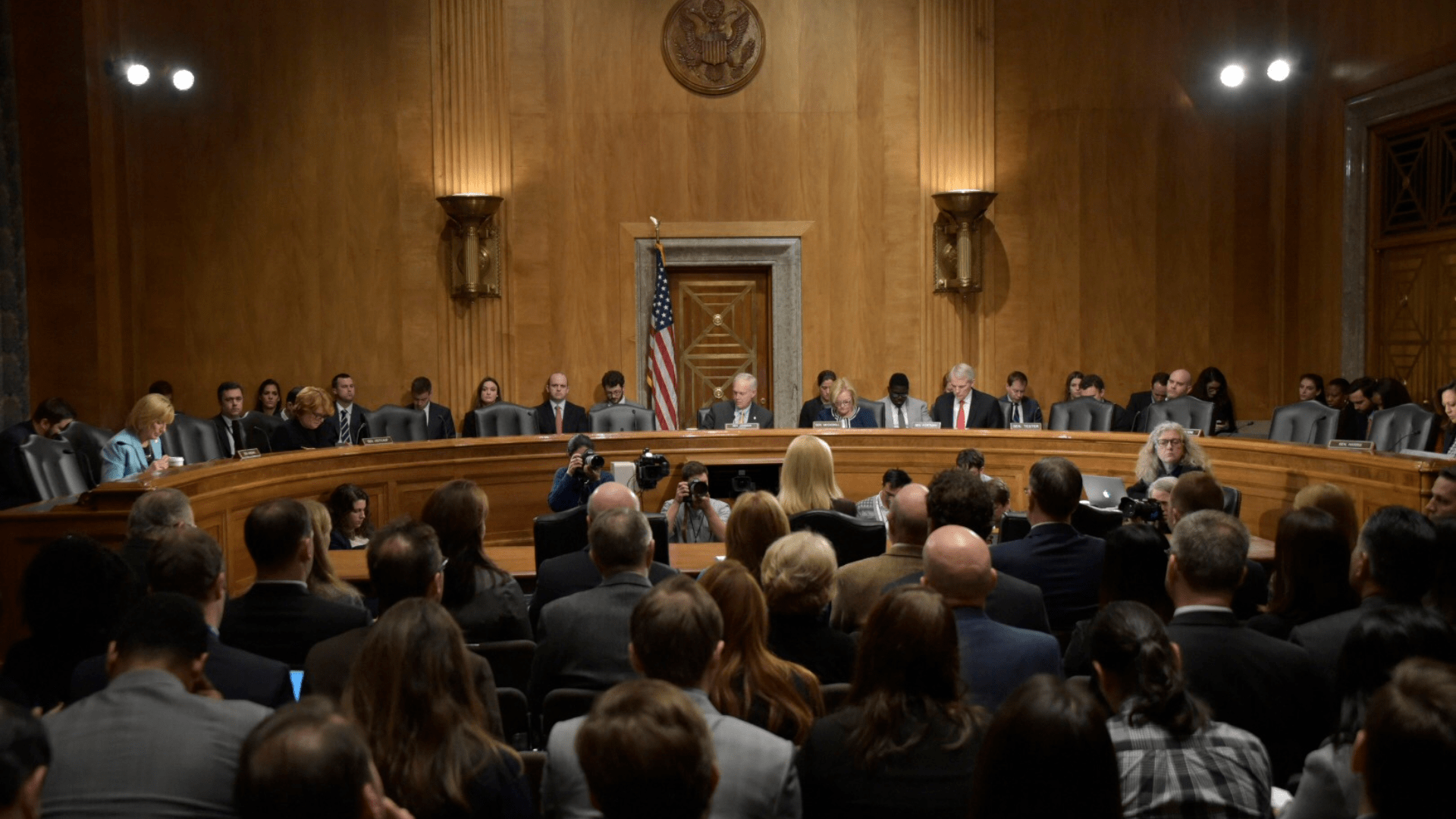

The Hearing on the Wealth Tax

On Wednesday, January 12, a hearing was held in the California Legislature regarding the new wealth tax. It seems the concept of this particular bill is far too radical to be passed at this time.

Republicans and Democrats alike rejected the bill, and it was put into a suspense file.

Why Was the Wealth Tax Rejected?

The bill was rejected primarily because the wealth tax legislation was somewhat half-baked and had far-reaching implications that were unsavory. It was also highly unpopular among the public.

The bill, if it did pass, would’ve completely done away with Proposition 13’s limits on taxing property. Governor Newsom himself also shot down the bill, stating that it was not an appropriate measure to take to relieve the state’s budget shortfall.

What Is Proposition 13?

Proposition 13 is a 1978 amendment to the California Constitution that limits tax rates and assessment increases on real estate properties.

The Proposition made all real property in the state have a restricted rate of increase on assessments set at no greater than 2% each year. It also established a property tax limit at 1% of the assessed property value. The wealth tax would’ve effectively canceled this Proposition out, which was highly unsavory to many members of the California Legislature.

How Will California’s Budget Deficit Be Addressed?

The budget deficit will be addressed in other ways, including delayed budget increases for the California State University and the University of California. Governor Newsom also plans to cut back some proposed programs that would provide services to vulnerable populations.

Newsom also plans to cut $1.2 billion from a $4.6 billion budget to address the state’s homelessness issues. Finally, a proposal to cut environmental programs is included in the governor’s plan to address the deficit.

Another State Tax Increase?

Besides the wealth tax bill that loomed for about a year and then quickly deflated in its January 10 hearing, another tax increase actually made it through the policy pipelines recently.

The top effective marginal tax rate on wage income will increase in 2024 to 14.4% from 13.3%. This is due to a new law that does away with a $145,600 wage ceiling on a 1.1% state employee payroll tax meant to fund expanded paid family leave.

Democrats Intent on Taxing the Rich

Democratic strongholds like California and New York are putting forward steps to try to tax their wealthiest residents. Political messages that critique the richest in the society play well with their voters.

Many high-profile candidates, including Joe Biden, have proposed some form of extra taxation on ultra-wealthy citizens. Democrats typically don’t advocate for cutting spending, and would rather make up for rising government spending with increased tax revenue.

Possibility of Rich Residents Leaving Due to Wealth Tax

‘Tax the rich’ policies proposed by Democrats may just result in wealthy residents leaving the state to protect their wealth. If Democrats implement a wealth tax the wrong way, it could actually lead to a decrease in tax revenue.

The government could put itself into a vicious cycle where it continually increases taxes to replace the lost tax revenue from rich residents leaving, causing more to leave in turn.

Wealthy Californians are Already Leaving

Fox Business in December 2023 reported that wealthy California residents are already leaving the state. From 2020 to 2021, there were 27,300 fewer tax returns filed from wealthy residents making more than $200,000.

The Tax Foundation examined IRS data to see that states like California, New York, and Illinois ranked the highest for income tax losses due to interstate migration.

Impact to Governor Newsom’s Reputation

Governor Newsom’s involvement with the latest push for the wealth tax could be used against him in the politically. Newsom could be a potential presidential nominee for the Democrats in future election cycles.

He has a reputation for being a centrist on fiscal policy, but by supporting a wealth tax, he might suffer political attacks from opponents who would hope to label him as a radical progressive.

New Taxes, More Spending

The proposed (and failed) wealth tax bill is yet another example of the state government’s seemingly insatiable desire to implement new taxes to fund various spending efforts.

The failure of the radical wealth tax has saved the state’s wealthiest for now. However, the state will certainly need to find new ways to tax its citizens if it wants to continue rolling out new program proposals. It’s certainly possible that the middle class could be targeted next.