Many Americans are feeling financial stress. Due to inflation, an unreliable economy and less than half of Americans not having savings, it’s no wonder money distress is at an all-time high.

A new CNBC Financial Confidence survey finds that 70% of U.S. citizens are under this stress. Other than statistics, many ways prove that financial stress is on the rise throughout all ages of Americans. With their dreams out of reach and inflation on the rise, it’s time to understand why this is happening.

Personal Debts Increase

Borrowing money in the U.S. has become even more expensive in the past few years due to the higher interest rates.

According to the CNBC survey, 58% of American citizens are living paycheck to paycheck. These Americans are typically relying on credit cards to stay afloat. The use of credit cards among the struggling increases their debt even further, but they have no other choice.

Mortgage Rates Climb

Zillow, a real estate firm, reports that the monthly mortgage rate on a normal house has doubled since 2020, with a 96% increase.

Getting onto the housing market now may seem impossible for young Americans trying to save money. It isn’t just mortgages but even rent has increased 3.18% yearly since 2012. It’s no wonder young Americans are feeling this stress knowing they will struggle to rent even a small apartment.

Food Prices

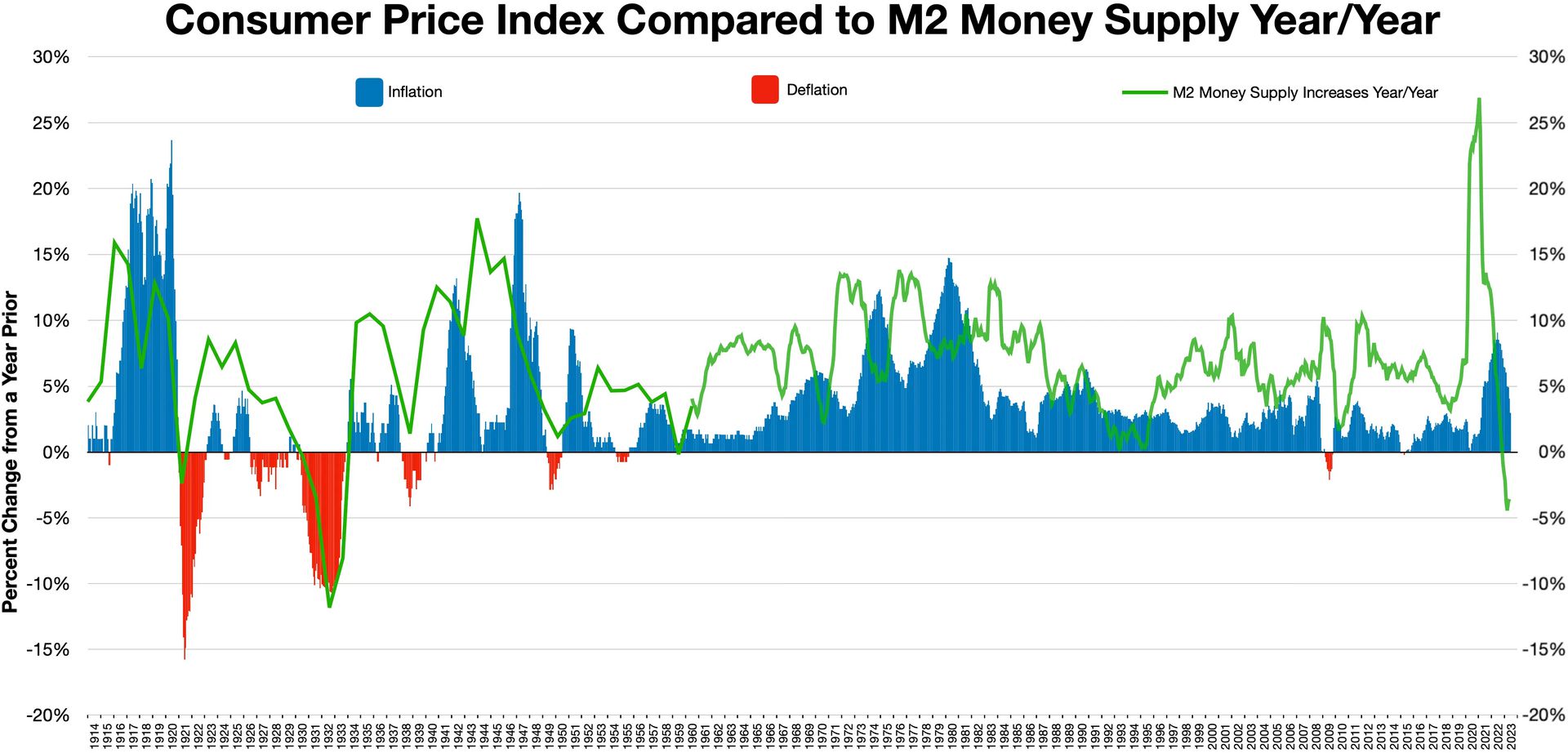

The cost of living in America has increased, and for its citizens, even buying food has become a struggle — adding on to all the financial worries.

In August 2022, the rate of food inflation was at 11.4%, which was the highest it has been since 1979. If the price of food increases, this affects every aspect of the American home. Many households feel stressed about getting food on the table day to day.

Health Care Causing More Problems

Health care sounds stress-free, as it alludes you into thinking that you’ll be looked after and healthier. However, the spiraling cost of medical prices causes more stress and less health than ever.

Six in ten adults have said that they miss out on needed health care because they can’t afford the cost. 21% miss filling prescriptions, and one in ten often half their own medication prescription in order for it to last longer. The extreme financial stress isn’t just worrying for citizens’ homes and food but even more so for their health.

Child Poverty Doubled

According to the U.S. Census Bureau, almost 9 million children are living in poverty.

This 5.2% increase from two years ago means that children are living without many basic amenities. They lack of food, fresh water and sufficient education. This high poverty rate means these children will be suffering from poor health and their own money worries from a very young age.

No Luxury

Vacations, free time activities and even meals are being skipped in order for the average American to afford their homes.

Almost half of Americans are skipping their annual vacations and are even missing out on their usual hobbies due to the costs. Many citizens have been making these sacrifices and more just to keep off the streets. Second jobs are now more common than ever, and skipping meals to keep their homes is on the rise.

No Money to Save

Everyone should have savings in case of a crisis. However, it has become increasingly difficult for many Americans to have savings over $100, an amount which wouldn’t help much in an emergency.

Early in 2024, GOBankingRates conducted a survey which turned out to be extremely worrying. The results show that 36% of Americans over 18 have less than $100 in their savings account. This is exceptionally worrying as financial experts suggest adults should have enough savings to cover a whole year of expenses.

EveryoneIs Affected, Even Higher Earners

Many people believe it is only the poor who experience money worries, but the current economy is surprisingly affecting the higher earners of America.

American citizens making over $100,000 feel financially stressed. Many of these people say they are also living paycheck to paycheck and unable to keep up with their preferred lifestyle. Many of this demographic say they do not have sufficient emergency funds if a crisis was to happen.

Unable to Retire

We may discuss savings with young people, but older Americans are increasingly worried about whether they can afford to retire.

Middle-aged Americans are wrestling with the fact that they may not have enough money to see them through retirement. When they eventually reach an older age, they will have increased struggles and worries of not knowing when their health will deteriorate. This knowledge may force financial panic across all ages.

Financial Stress Among Women

Women have also felt more money anxiety than men. Typically the shopper of the household, they are forced to see the rising prices almost every day.

As revealed by the CNBC report, 72% of women are finally stressed, a full 5% more than men. The cost of child care and lower pay are also a heavy burden set on women.

Economic Strain

The effects of the current economic landscape are clear. Stress and worries in America are at an all-time high.

With the average American struggling to stay afloat, their homes, health, jobs and families are all faced with hardships. All the increases in pricing, mortgages and rents, along with child poverty and the lofty cost of health care all add to the stress of everyday life in America.