Steamboat Springs, a renowned “cowboy ski town,” is facing a severe housing affordability crisis, where even individuals with significant incomes are struggling to find homes.

The city’s predicament was highlighted when it couldn’t find a suitable candidate for a $167,000-a-year human resources position because potential hires could not afford the local housing market. This situation underscores the broader issue of escalating real estate prices in desirable mountain towns.

Healthcare Professionals Priced Out of the Market

NBC News reports that in Steamboat Springs, even healthcare professionals are finding it challenging to secure housing. Doctors, despite being willing to pay over $1 million for a home, find themselves outbid by wealthier, often non-local, buyers.

This has left the Steamboat hospital with unfilled positions, impacting the community’s access to healthcare.

Shift in Housing: Employees Resort to Hotel Living

Loryn Duke, the director of communications for the Steamboat ski resort, highlighted a significant shift in the town’s housing dynamic.

She said, “houses used to be for employees and hotels for guests. Now houses are for guests and hotels are for employee housing.” This reversal signifies the extent to which the housing market has been upended, affecting local workers’ ability to live and settle in the community.

Real Estate Boom Prices Out Professionals

The pandemic-fueled real estate boom has led to a near doubling of house prices in Steamboat Springs, placing homeownership out of reach for many professionals.

As Margaret Bowes, the executive director of the Colorado Association of Ski Towns, stated, “housing is just so through the roof that unless you’re extremely wealthy, it’s unattainable.”This surge in prices has had a profound impact on the local population’s ability to afford homes.

Community Division Over Housing Solutions

Steamboat Springs is witnessing a community divide over how to address the housing crisis.

Efforts to create more affordable housing and regulate short-term rentals have sparked debate among residents. Some community members support initiatives to increase housing stock, while others express concerns about potential impacts on the town’s character and infrastructure.

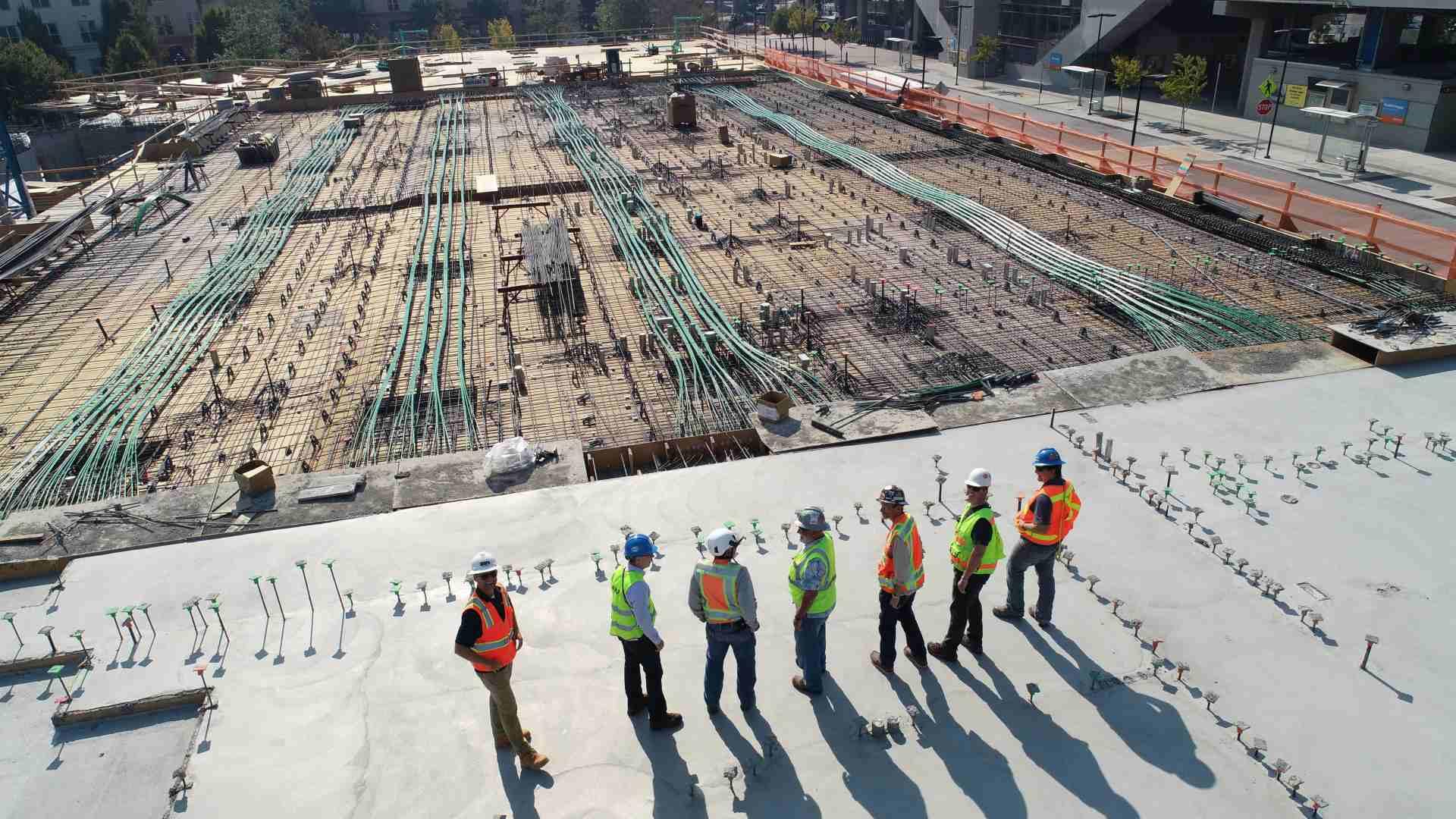

Controversy Surrounds Brown Ranch Development

The proposed Brown Ranch development, intended to alleviate the housing shortage by creating over 2,200 units, has become a point of contention in Steamboat Springs.

While some residents see it as a vital step toward providing affordable housing, others, like Jim Engelken, worry about its scale and the adequacy of the planned infrastructure. He said “We’re concerned that the infrastructure won’t be in place in this new, large, separate portion of our city, and it will create a second-class neighborhood. That the people living there will be treated like second-class citizens who don’t have access to public transportation or city parks, and we don’t know how many of them are coming from outside.”

Hospital Ventures into Housing to Retain Staff

UCHealth Yampa Valley Medical Center is addressing its staffing challenges by constructing 42 apartments with rents capped at around 30% of the employee’s income. This move reflects the hospital’s struggle to maintain staff amid soaring housing costs.

Soniya Fidler, the hospital’s president, emphasized the necessity of this initiative, stating, “It is hard because we are here to deliver health care, we’re not here to deliver houses. Usually, if we have the dollars to spend, it is on state-of-the-art equipment and upgrading our facilities.”

Steamboat’s Identity Threatened by Housing Market

The housing affordability crisis in Steamboat Springs is not only a financial issue but also a cultural one.

The town’s character, known for its authentic, cowboy ski town feel, is at risk as real estate prices escalate, NBC News notes.

Residents Forced to Leave Due to High Housing Costs

The escalating housing costs in Steamboat Springs have compelled some residents to leave, altering the town’s demographic and community fabric.

The rising cost of living is making it increasingly difficult for long-term residents and new arrivals to afford living in the town, impacting its diversity and vitality.

Rapid Rent Increases

Luis Gaspar’s experience in Steamboat Springs vividly highlights the town’s escalating housing issue.

Initially finding a one-bedroom apartment for $1,100 a month, Gaspar witnessed his rent skyrocket to $2,300 within two years, a striking reflection of the broader housing affordability crisis in the area. This dramatic increase in living costs represents a significant challenge for residents, particularly those in service jobs, which are prevalent in Steamboat Springs.

High Living Costs Force Difficult Decisions for Locals

The financial strain of Steamboat Springs’ housing market compelled Gaspar, like many others, to relocate despite his attachment to the community.

He shared his predicament, stating, “Unless you have a really good salary in Steamboat, which is really hard to find because everything is a service job, it’s impossible. That is why I had to leave. The community is great and everything, but I am working two, three jobs, 12 hours a day, just to make it by.”

Restrictions on Short-Term Rentals to Ease Housing Crunch

In an attempt to address the housing shortage, Steamboat Springs has implemented restrictions on short-term rentals, following the lead of other tourist destinations.

While this measure aims to free up more homes for long-term residents, it has ignited a debate about its effectiveness and potential unintended consequences.

The Housing Crisis Is Happening Across the Country

Steamboat Springs is not the only place that is experiencing problems in the housing market. In fact, this phenomenon of housing affordability is being experienced in a good portion of the country.

The median house price in the US is now six times the median income, which is significantly higher than it was just a decade ago.

Housing Affordability in the US

According to a Redfin report at the end of 2023, only 16% of houses listed on the market in the United States are considered affordable.

This was the lowest amount on record since Redfin started tracking this data. In 2022, 21% of the houses listed on the market were affordable for the typical household, and this trend is not showing signs of slowing.

Why is Housing So Expensive?

There is a combination of factors leading to the current housing affordability crisis in America. As previously mentioned, one problem is a lack of housing supply. In a free-market economy, one of the ways it deals with scarcity is by skyrocketing prices.

This means that houses will never truly run out for people, but only the ones that can afford an inflated price will actually be able to buy one.

Pandemic Consequences

During the COVID-19 pandemic, people were locked away in their homes. They were forced to avoid large gatherings of people and many were unable to work at their normal jobs.

This situation created a host of downstream effects, one of them being a lack of housing construction. Construction companies struggled to both get materials to build houses and also struggled to hire workers.

Where Were Less Houses Being Built?

Peter Boockvar, chief investment officer at Bleakley Advisory Group commented on a drop in single-family housing construction observed in 2021.

“I have to blame the difficulty in procuring lumber and other products, along with labor issues for the miss, in addition to likely cancellations due to skyrocketing costs for single family starts,” Boockvar said.

Single-Family Homes Were Built Less

According to the National Association of Home Builders, the housing construction share of single-family homes fell from 44% to 41.3% between 2020 and 2022. These more affordable single-family homes were being built less compared to multifamily home construct which saw a 7.1% increase.

This puts strain on the average home buyer because a multifamily home often requires more money upfront that people can’t afford.

Interest Rates

Another factor in the background of the housing crisis is inflation in the economy and interest rates. The Federal Reserve has been keeping interest rates high to mitigate the effects of inflation.

With a higher interest rate, a homeowner will have to make higher monthly payments, and a buyer have a harder time affording a house.

Higher Prices

The prices of houses have continued to soar in recent years. The average price of a house in the United States grew by 6.5% year over year in December 2023. This price increase has been discouraging new home buyers from investing in houses while homeowners are less content to sell because the value of their homes keeps increasing.

Since there is a lack of supply in the market, even if someone wanted to buy a home, they would have to pay an exuberant premium in many cases.

Inventory of Homes

Data from Redfin suggests that the number of seasonal inventory homes available had decreased by 50 percent in 2021 compared to the place it was in February 2020.

Typically, the housing market has the highest inventory in the Spring and Summer months. However, this is also the time when it has the greatest competition. Since fewer homes are available, this makes the competition even more intense, which will drive the price up further.

Consumer Price Index

The Consumer Price Index (CPI) is a measure of how much certain goods in the economy cost. The government measures the price of certain items like food, gas, and rent over time to determine how they impact household wealth and the affordability of living in an area.

The price people pay to live in a house, apartment, or other shelter accounts for nearly 40 percent of the CPI. This means that even a small increase in housing prices can devastate a family’s budget.

Biden Tax Credit

The Biden Administration recently announced a plan to combat the high cost of housing seen in places like Steamboat Springs and other similar areas across the country.

This plan would call for a $10,000 tax credit for new homebuyers and people who want to sell their starter homes. Some see this move as a step in the right direction, but think it will ultimately not be enough to fix the problem for good.

A Continuing Problem

There are many proposed solutions to the current housing affordability gap felt by many Americans, but it remains to be seen which will actually work. Governments are trying out policies on both the local and national levels to try to improve the lives of average American families who are increasingly unable to live where they want.

However, until the housing supply can catch up and the economy itself can get back on the right track, these solutions may only be temporary fixes.