Harry Dent, an economist and financial author, has continued to state that the United States may soon face a terrible stock market crash that is much worse than the financial crisis that was seen in 2008.

Dent first made these predictions back in December of last year. However, he recently doubled down on his claims and believes the country will see a massive crash in the near future.

A “Crash of a Lifetime”

In 2023, Dent forecasted that the United States would soon see a “crash of a lifetime.” Now, he’s continuing to make these claims — and opening up about why he thinks this stock market crash may happen.

According to Dent, the “bubble of all bubbles” still hasn’t burst. He believes it will soon.

A Terrible U.S. Stock Market Crash

Dent has also predicted that this upcoming stock market crash will be worse than the financial crisis that was experienced by the country in 2008.

The economist has further blamed how the government has dealt with financial issues in the country, particularly how the economy has been flooded with extra money.

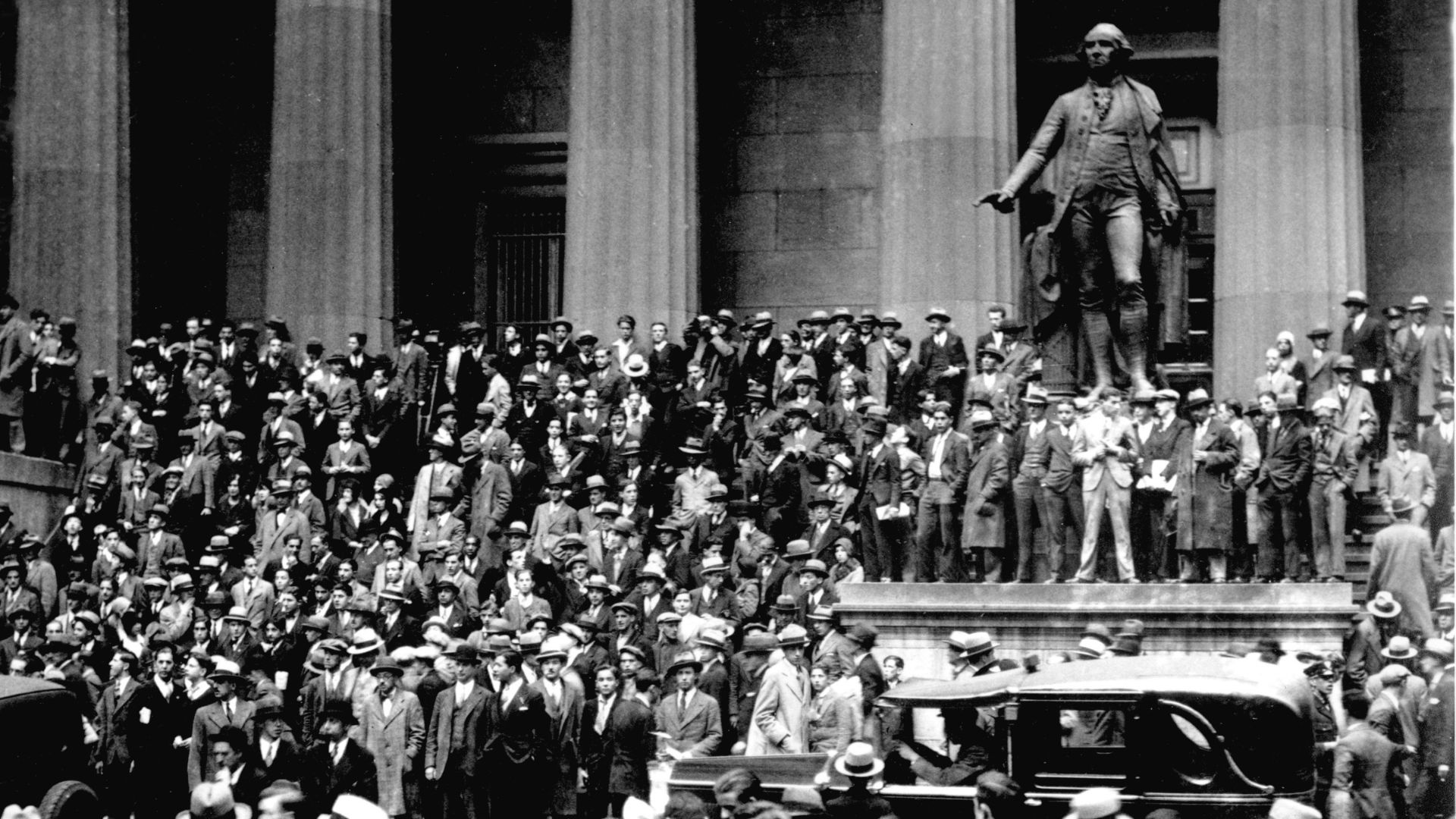

Looking at the Great Depression

To explain why this bubble will lead to what he thinks is a massive crash, Dent compared the present day to what was seen back in the 1920s, during the crash that led to the Great Depression.

“In 1925 to ‘29, it was a natural bubble. There was no stimulus behind that, artificial stimulus per se. So this is new. This has never happened,” he explained. “What do you do if you want to cure a hangover? You drink more. And that’s what they’ve been doing.”

An Ongoing Bubble

Dent has also stated that this current “bubble” has been ongoing for more than 14 years. This fact could be the reason why his predicted stock market crash could be so severe.

Dent said, “This bubble has been going 14 years. Instead of most bubbles [going] five to six, it’s been stretched higher, longer. So you’d have to expect a bigger crash than we got in 2008 to ’09.”

Sustaining the Bubble

The economist also pointed out that the country has never seen what happens when the government continues to sustain a bubble for longer than a decade.

Because this territory has never been traversed before, Dent worries that an upcoming crash could be detrimental to so many.

A Look at the Housing Market

Dent also took the time to analyze the housing market, which he believes is at the center of this potentially tragic bubble. The real estate market has long been crucial to the economy.

In the past, Dent had forecasted that the housing market would see lows similar to what was experienced in 2012. Now, the economist has stated that the price of homes has increased by double what he thinks they’ll soon cost.

A First in U.S. History

Dent also noted that many people own more than one home, which could become detrimental to the housing market.

“No time in history has housing been so widely owned and so many people having second and sometimes third homes just for speculation,” Dent explained.

Who Is Responsible for This Bubble?

According to Dent, the government is ultimately responsible for this decades-long, massive bubble that the economy has found itself in.

He said, “The government created this bubble 100%… totally artificial, injecting a drug to artificially perform stronger. And again, everything from human life to history shows, you don’t get something for nothing, and bubbles always burst… it’s a much, much higher possibility than anybody gives it.”

Analyzing History

Dent has hit back at critics who have claimed that he’s incorrect about his forecasting of financial doom in the U.S.

“Looking at it from history and standing back, nothing’s more obvious,” Dent said. “A lot of other bubbles in history just do not have the steepness or the magnitude. Why? We’ve never realized the power that central banks can have to just print money out of thin air.”

Ongoing Economic Issues

While many data and statistics have proven that the economy is doing well, many Americans have claimed that they don’t see this positive economy.

These negative feelings toward the current state of the U.S. economy come as many consumers struggle to deal with ongoing high inflation. This high inflation has led many Americans to experience price fatigue.

Price Fatigue and a Housing Crisis

Price fatigue has led to many consumers refusing to pay high costs for items, particularly grocery store products and fast food meals.

However, Americans have also struggled with what many have called a housing crisis seen in many states in the country. Housing prices remain incredibly high in various areas — and many regular Americans feel that they can no longer afford to own a home.