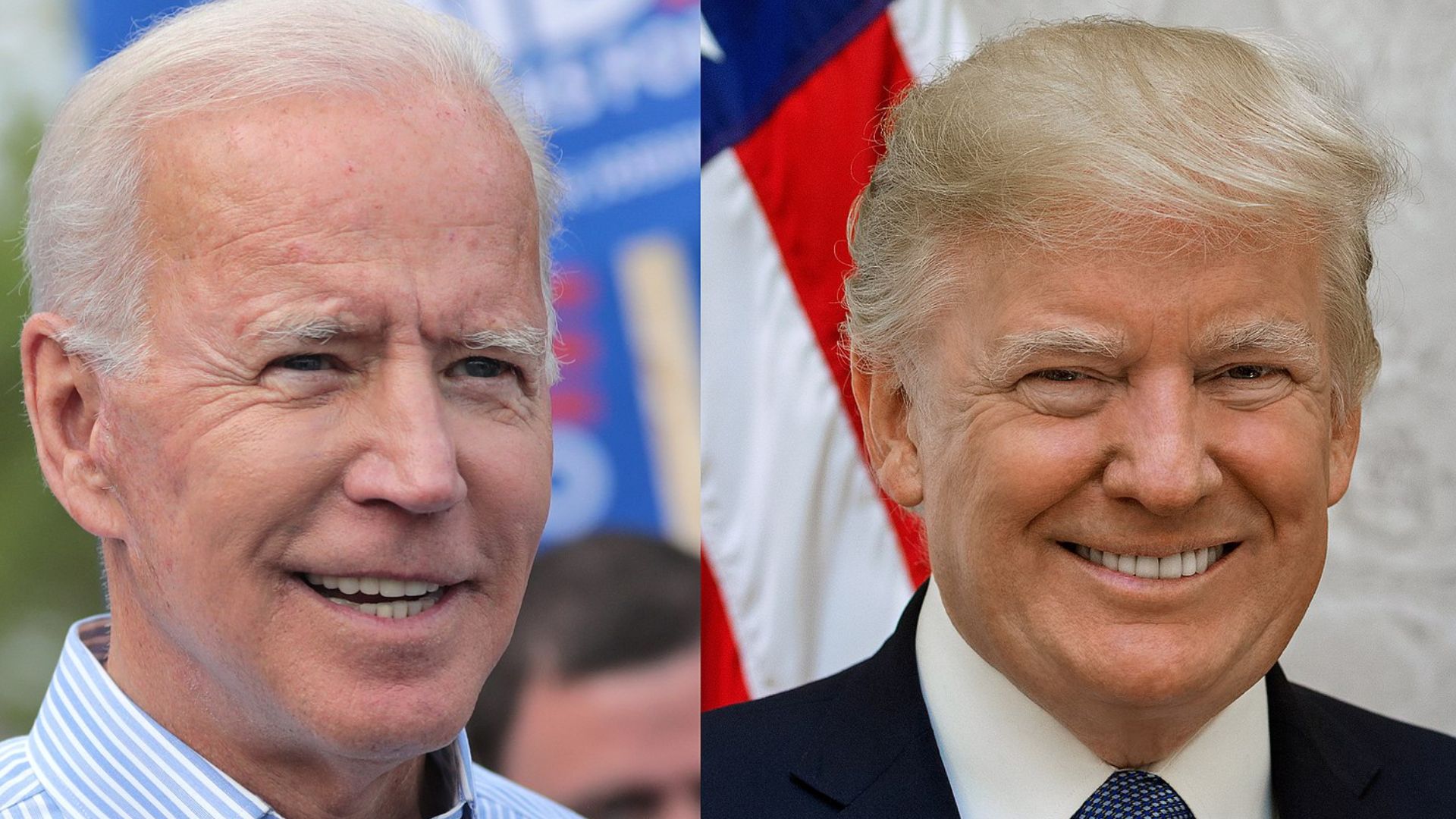

At a lively rally in Wildwood, New Jersey, Donald Trump, the presumed Republican nominee, announced he would implement sweeping tax cuts if he wins a second term.

He positioned his plan in stark contrast to President Joe Biden’s, promising, “Instead of a Biden tax hike, I’ll give you a Trump middle class, upper class, lower class, business class big tax cut.”

A Taxing Year Ahead?

Trump’s promises come at a critical time. The tax cuts from his 2017 law are set to expire by 2025, unless Congress decides to extend them.

This looming deadline sets up a dramatic showdown in tax policy, with significant implications for every American’s wallet.

Biden’s Counter: Tax the Rich

On the flip side, President Biden is playing a different tax tune, focusing on the wealthy.

He proposes eliminating benefits for households earning over $400,000 and wants to hike taxes on affluent Americans and big businesses, starkly contrasting Trump’s approach.

A Tax Plan Still Under Wraps

Despite these promises, Trump hasn’t yet released a detailed tax plan.

This has left voters curious about the specifics of his tax vision, which includes potential cuts for top earners and businesses, heightening the suspense in the fiscal saga.

Strategic Tax Reform Discussions Underway

Trump’s economic team is buzzing with activity, brainstorming to refine their tax reduction strategies.

They’re even considering a flat tax among other bold reforms aimed at reducing taxes further, showing Trump’s commitment to major fiscal changes.

What’s on the Line?

As the tax cut expiration date nears, the stakes are high. Both personal income and business taxes could see an overhaul, depending on who sits in the Oval Office.

This makes the upcoming election crucial for the country’s economic direction.

A Campaign Defined by Tax Policy

The battle lines in this presidential campaign are clearly drawn around tax policies, with Trump advocating widespread tax cuts and Biden calling for targeted tax increases on wealthier citizens.

This fundamental disagreement over fiscal strategy is playing a central role in both campaigns.

Endangered Tax Provisions

The debate extends beyond income taxes, as key provisions like estate tax limitations and certain business deductions are also set to expire.

These elements have been criticized for favoring the wealthy and are part of the broader conversation about tax fairness.

The Impact on Everyday Americans

What do these tax plans mean for the average person?

Trump’s strategy aims at broad cuts, potentially boosting take-home pay across income levels, while Biden focuses on protecting middle-income earners from tax hikes.

The Corporate Tax Question

Trump has hinted at keeping the corporate tax rate at 21%, backing away from his previous push to lower it to 15%.

This decision could be a strategic move to balance budget concerns with business growth incentives.

Election’s Crucial Role in Future Tax Policy

The outcome of the upcoming November election is poised to shape American tax policy for years to come.

Each candidate’s vision offers a distinct direction for the management of the nation’s finances, highlighting the importance of voter choice in these tax debates.

The Voter’s Financial Crossroads

With the election on the horizon, voters are confronted with a pivotal financial decision: which candidate’s tax policy aligns best with their economic needs and future goals?

Their choice will not only impact personal finances but also the economic health of the entire country.