Novo Nordisk was the business of 2023, becoming known as one of Europe’s most highly valued companies as its weight reduction drug Ozempic took off drug store shelves and shaved a few inches off customers’ waistlines.

That is if its U.S. clients could manage to meet the astronomical price tag set by the company.

Senate Testimony

Lars Fruergaard Jørgensen, CEO of Novo Nordisk, has now offered to testify before the U.S. Senate to defend the substantial markup that Americans pay in comparison to Brits and Europeans.

A monthly prescription for Wegovy costs approximately $1,349 in the United States, whereas Ozempic from Novo Nordisk costs just $92 in the United Kingdom and $140 in Germany.

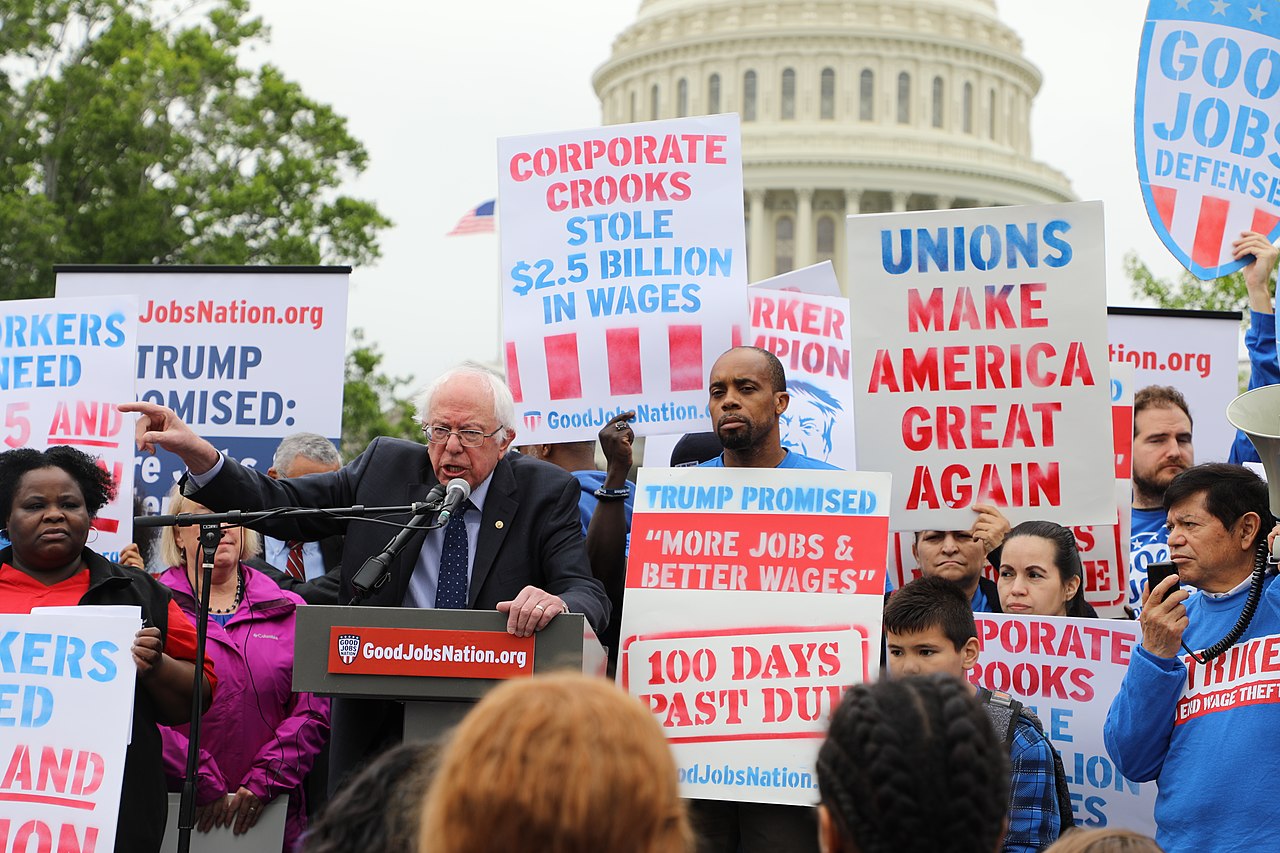

Sanders Request

The Senate Committee on Health, Education, Labor, and Pensions, which is chaired by Senator Bernie Sanders, was going to vote on Novo president Doug Langa’s behalf, which would necessitate that he testify before the committee.

Sanders stated in a prepared statement last week, “The American people are sick and tired of being ripped off by giant pharmaceutical companies who make huge profits every year while charging us outrageous prices.”

Higher Prices

“It’s obvious. It’s simple,” Sanders stated, “We want Novo Nordisk to stop ripping off the American people and charging us prices that are far higher than they charge in other countries.”

Sanders went on to say: “That’s what I want to see. That’s what the American people want to see.”

CEO Steps In

Langa would have faced Senators in July if they had cast a favorable vote. However, Novo Nordisk CEO Jørgensen has now offered to testify before the committee in September to support Novo’s pricing strategy.

According to Sanders’ assertion, Novo Nordisk is the most recent victim in a prolonged conflict with the pharmaceutical industry, which has a long history of extensive lobbying to maintain profits at the expense of consumers.

Pharmaceutical Industry

In his remarks, Sanders also criticized Merck, a German pharmaceutical company that also produces diabetes medication.

In May, after past critique from Sanders, Novo wrote to the Senator explaining that the U.S. medical framework was at fault for the enormous cost difference compared to Europe.

List Price

According to Bloomberg, the pharmaceutical company claimed that it retained only about 60% of the list price of Wegovy and Ozempic because a portion of its revenues in the United States went to middlemen in a manner that it does not in the United Kingdom or Europe.

Novo’s argument that the U.S. medical care framework was to be faulted for its strict pricing strategy was sabotaged by a landmark study into Ozempic creation costs.

Ozempic Production

In research distributed in the JAMA Network, researchers found Ozempic could be produced for 89 cents to $4.73 for a month’s supply. Scientists said that cost would incorporate a net revenue for Novo.

The drugmaker hasn’t revealed the amount it costs to deliver its hunger suppressants yet has expressed that under current economic conditions, it expects the net cost of Ozempic and Wegvy to decline over time.

Company Profits

Due to rising demand from individuals attempting to lose weight for Novo Nordisk’s GLP-1 medications, which were originally developed to treat diabetes, shares rose by 53% the previous year.

It overtook the luxury giant LVMH as Europe’s most valuable company in January, becoming only the second European company in history to surpass $500 billion in valuation.

Novo Valuation

The company valuation likewise makes it more valuable than the whole economy of its native Denmark.

Novo’s net profits were raised by 51% to DKK83,683 million ($12 billion) in 2023 and rose a further 28% in the first quarter of 2024 contrasted to a similar period last year.

Market Dominance

Novo, like all pharmaceutical companies, will want to make the most of its drug exclusivity before rivals can produce their own appetite suppressants.

However, CEO Jørgensen will need to be pretty convincing come September to make that happen with lawmakers who don’t like it.

Novo Ambitions

According to the company they are preparing to make significant investments in order to increase public access to the medication.

Novo intends to make around $6 billion in capital expenditures while spending $11 billion in order to secure production facilities from Catalent Inc.

Sander’s goal to confront the disparity between production costs and profit margins will require a smart line of questioning in the Senate.