After California raised the minimum wage for fast-food workers to $20, many local franchise owners have started to gently raise their menu prices to cope with the extra costs.

There’s a growing concern among them that their regulars might start drifting toward more wallet-friendly options like Chili’s and Applebee’s, which haven’t been hit by the wage increase.

The Casual Dining Edge

Because casual dining chains like Chili’s and Applebee’s do not fall under the new minimum wage law, they are not expected to raise their prices as significantly as fast-food outlets.

Business Insider notes that this price stability could turn them into even more appealing choices for diners, possibly pulling people away from their usual fast-food stops.

The Scope of the $20 Minimum Wage

This wage increase targets fast-food operations with at least 60 locations that skip the full-service experience—where customers pay before they eat.

This model has traditionally kept costs low but is now feeling the squeeze from the wage rise.

Behind the Menu Price Hikes

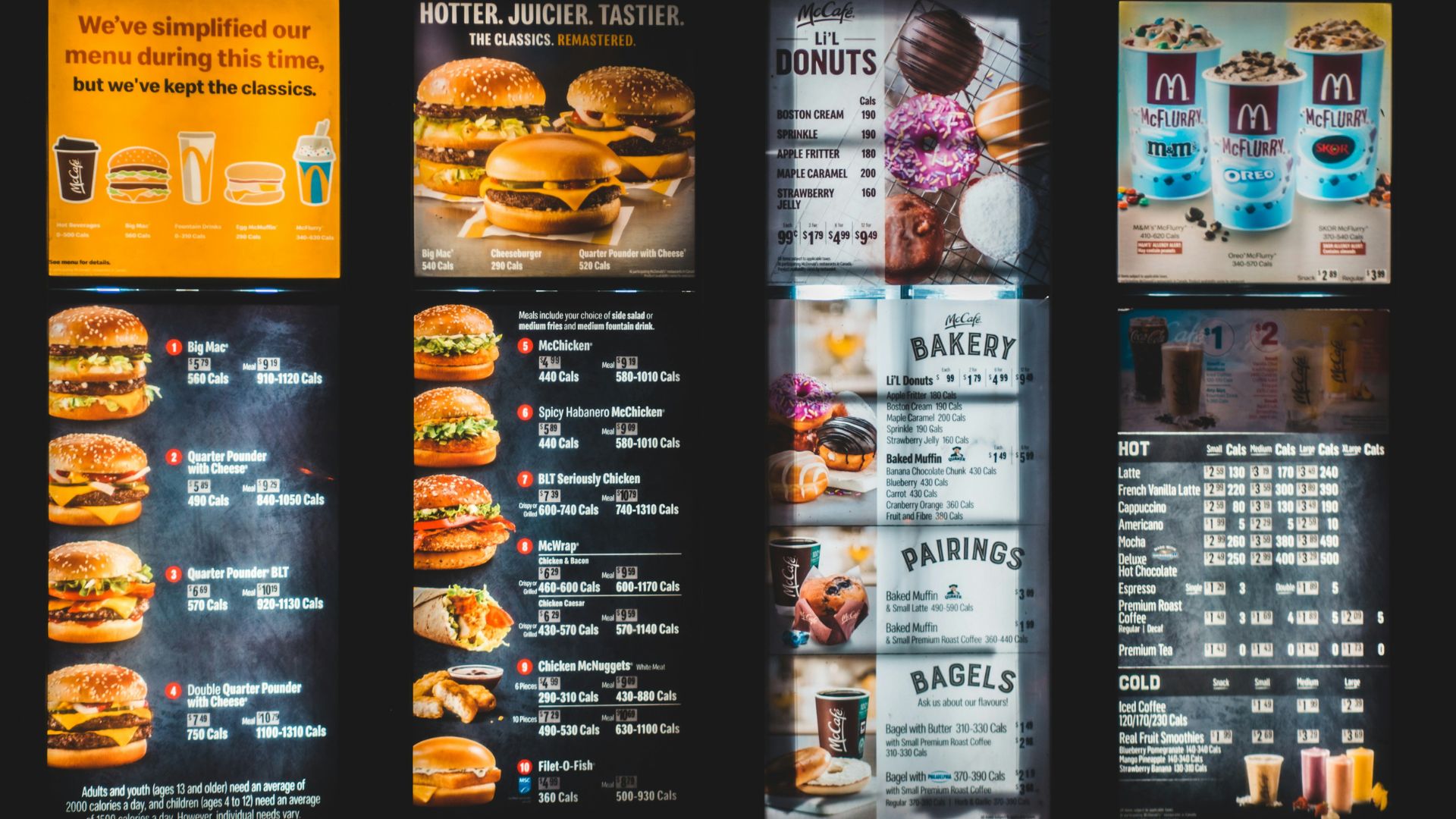

To deal with these higher wages—which are 25% above the state’s general minimum—fast-food restaurants across California are tweaking their prices upwards.

Many owners have said this is a necessary move to keep their doors open and kitchens running.

Easing Into Higher Prices

Instead of shocking their customers with steep overnight price hikes, many fast-food chains are implementing gradual increases.

This tactic aims to soften the blow, helping patrons adjust to the new pricing landscape without drastic changes.

A Local Owner’s Perspective

Shane Paul, who runs seven Jack in the Box locations in San Diego, has already adjusted his pricing strategy.

He revealed that they have raised their prices about 10% or 11% over the past six to 12 months, marking a significant shift from his usual annual increases of 3.5% to 4%.

Observing Sales Trends

Following these price adjustments, Paul has noticed a concerning trend: Transactions at his restaurants are already “trending down,” he said.

This downturn suggests that customers might be reconsidering their dining choices.

Weighing Dining Options

With the cost difference shrinking, Paul speculates that customers might start seeing casual dining spots as a viable alternative.

He noted that they could enjoy a sit-down meal “for a dollar or two more than us,” which might seem worth it for the added experience.

Industry-Wide Challenges

Echoing similar concerns, Harsh Ghai, owner of around 180 fast-food outlets, said that his recent price hikes are hitting restaurant sales.

Such a trend points to a broader issue within the industry—customers are pushing back against higher prices.

Pricing Dilemmas

Ghai explained the challenges of further price increases. He said that he can’t raise prices any further to absorb the higher wages because customers wouldn’t return.

His comment highlights the tightrope these businesses must walk to remain competitive.

Shifting Competitive Landscapes

Scott Rodrick, who owns 18 McDonald’s franchises, shared his strategic concerns with Business Insider.

He said that the new minimum wage “narrows the competitive gap” between fast-food and casual dining venues.

Analysts Weigh In on Future Trends

Brian Vaccaro and Sharon Zackfia provide expert insights into how these dynamics might play out.

Vaccaro noted that fast-food generally attracts those looking for quick and convenient options. Meanwhile, Zackfia emphasized to Business Insider via email that despite price hikes, “limited service will still be cheaper,” and its core appeal for on-the-go customers remains strong.

Local Economic Impact

The $20 minimum wage boost for fast-food workers in California could lead to increased local spending. Workers with more disposable income are likely to spend more within their communities, potentially boosting local businesses (via The Center for American Progress).

This rise in economic activity might offset some negative impacts on fast-food chains by increasing overall consumer spending power.

Franchisee Strategies for Cost Management

In response to rising labor costs, franchisees might turn to cost-saving technologies such as automated order-taking and food preparation systems.

Others could streamline or adjust menu options to reduce kitchen complexity and waste, thereby maintaining profitability without overly inflating prices.

Impact on Job Market

Of course, the increase in minimum wage may lead to unintended job market shifts within the fast-food industry, such as reduced hiring or fewer hours available for workers.

Some outlets might lean more heavily on part-time staff to keep costs manageable, affecting employment stability for many.

Consumer Response to Price Changes

As fast-food prices rise, or take on new pricing structures such as Wendy’s surge pricing experiment, consumers may alter their habits, visiting less frequently or opting for lower-cost menu items.

This change could particularly affect value-focused customers, potentially leading to a significant shift in sales composition.

Marketing Adjustments

Fast-food chains, facing price hikes, might reinforce their value propositions through targeted marketing campaigns, putting a better angle on the price hikes.

These could emphasize speed, convenience, and new deals to counteract the perception of decreased affordability and keep customer loyalty intact.

Casual Dining’s Response

Observing the narrowing price gap, casual dining chains might launch promotional campaigns highlighting their enhanced perceived value.

By offering special deals or highlighting the quality and ambiance they offer just above fast-food pricing, they could attract more customers looking for dining experiences.

Legislative Outlook

The implementation of the $20 minimum wage could eventually prompt further legislative actions depending on its economic impact.

Potential adjustments might aim to balance the needs of workers with the operational realities of business owners in the fast-food industry.

Comparative Analysis with Other States

Comparing California’s experience with states that maintain lower minimum wages might provide valuable insights.

Newsweek reports that many states provide a minimum wage based on the cost of living, the risk of decreased hours still remains. Further research and analysis of these examples could help shape future policy decisions related to minimum wage in the fast-food industry.

Technological Innovations in Service

Fast-food chains might increasingly invest in technology to mitigate labor costs.

Innovations like self-service kiosks, mobile app ordering, and automated food preparation could become more prevalent, maintaining service speed and reducing the need for a larger staff.

Health and Sustainability Trends

Rising prices at fast-food outlets could steer more health-conscious consumers towards alternatives perceived as healthier or more sustainable, such as plant-based options or locally sourced restaurants.

This shift might be accelerated if casual dining chains emphasize their commitments to quality ingredients and eco-friendly practices, along with their healthier menu options.

Expert Predictions for the Next Decade

Industry experts predict significant transformations in the restaurant sector over the next decade (via Deloitte).

Driven by wage adjustments, consumer behavior shifts, and technological advancements, the landscape of dining out is expected to evolve, with a focus on efficiency and customer experience.

Fast Food vs. Casual Dining

One question still looms: will casual dining restaurants be affected by minimum wage increases in the same way as fast-food chains? While many casual dining establishments do not operate on such tight margins as their fast-food counterparts (via Gitnux), they still face similar challenges with labor costs.

It remains to be seen whether or not the increase in minimum wage will have a significant impact on casual dining establishments, but the gap is close enough that it is worth keeping an eye on as prices continue to rise nationwide.