The battle for board seats at Walt Disney Co. has intensified, with investor Nelson Peltz and hedge fund Blackwells Capital seeking to influence the company’s direction.

Peltz, supported by ex-Disney CFO Jay Rasulo, aims to drive up Disney’s stock prices, while Blackwells Capital advocates for its three board candidates, challenging current CEO Bob Iger’s leadership.

Walt Disney Company Opposes Both Parties Vying for Board Seats

The Walt Disney Company actively opposes both factions, asserting their lack of requisite expertise.

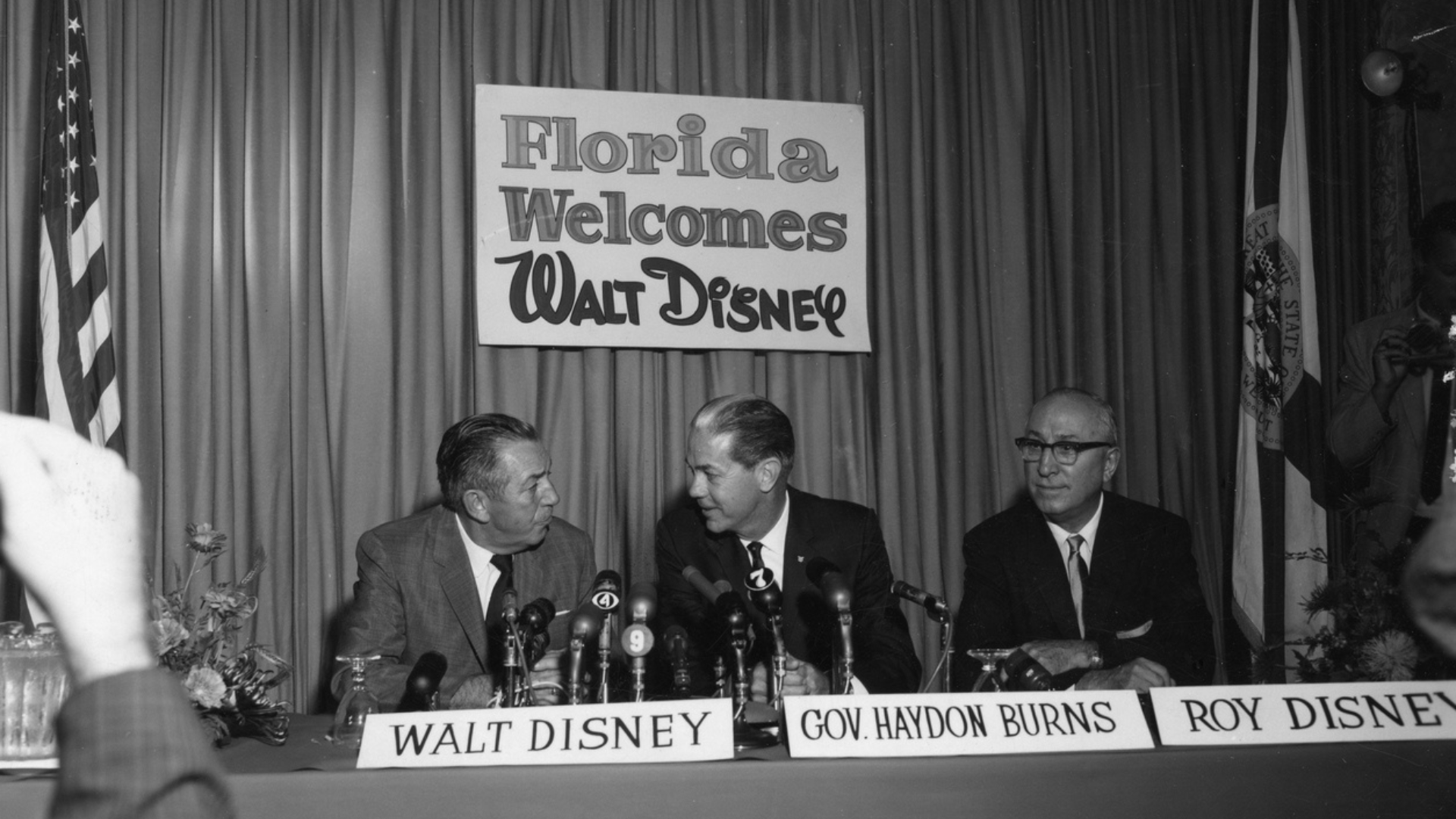

In the ensuing conflict, descendants of Walt and Roy O. Disney have appeared to express staunch support for Iger and the current board, emphasizing the amazing job Iger and his team have done, and the importance of preserving Disney’s legacy and strategic vision.

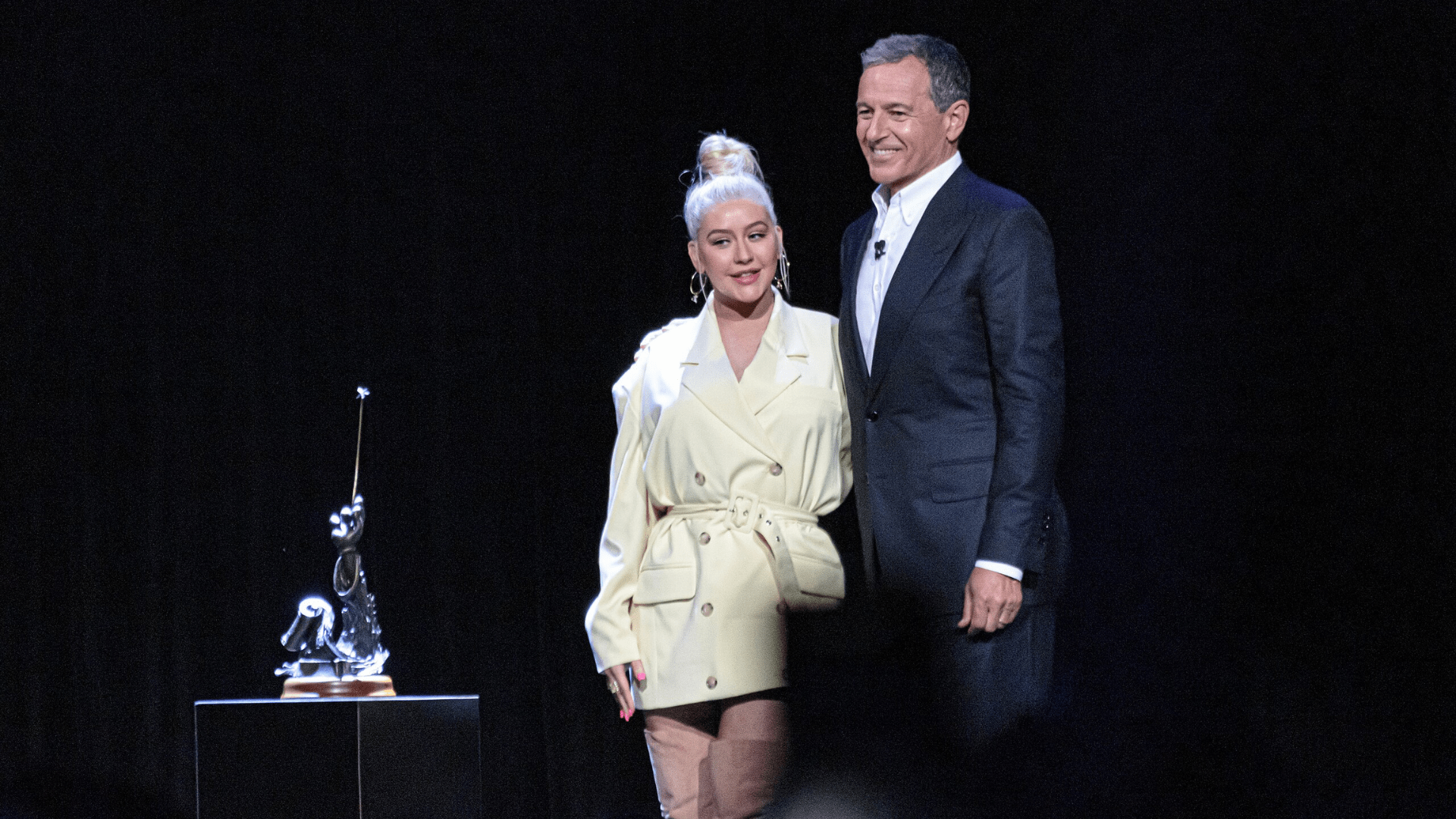

Who is Bob Iger?

Bob Iger, currently the CEO of Walt Disney Company, returned in November 2022 after serving from 2005 to 2020 and holding subsequent leadership roles. In his recent tenure, Iger has focused on revitalizing creativity, leading Disney’s streaming business, and expanding globally.

Acknowledged as a key business leader, Iger oversaw significant acquisitions, theme park openings, and record-setting film releases. He is renowned for embracing technology, making Disney an industry leader, and launching the successful Disney+ streaming service in 2019.

Disney Descendants Voice Concern Over Nominees

In two open letters addressed to Disney shareholders, the grandkids of Walt and Roy Disney voice their concern over the hedge-fund-backed nominees, accusing them of lacking an understanding of Disney’s cultural significance.

They criticize the candidates’ profit-centric approach, emphasizing the family-built company’s values.

Letters Say Nominees are Motivated Entirely by Self-Interest

The letter contends that these individuals, motivated by self-interest, pose a threat to the company’s cherished past and bright future.

The family strongly emphasizes the importance of continuity in current CEO Iger’s strategy, emphasizing the heroes-and-villains dynamic in Disney stories and identifying the activists as the villains in this corporate saga.

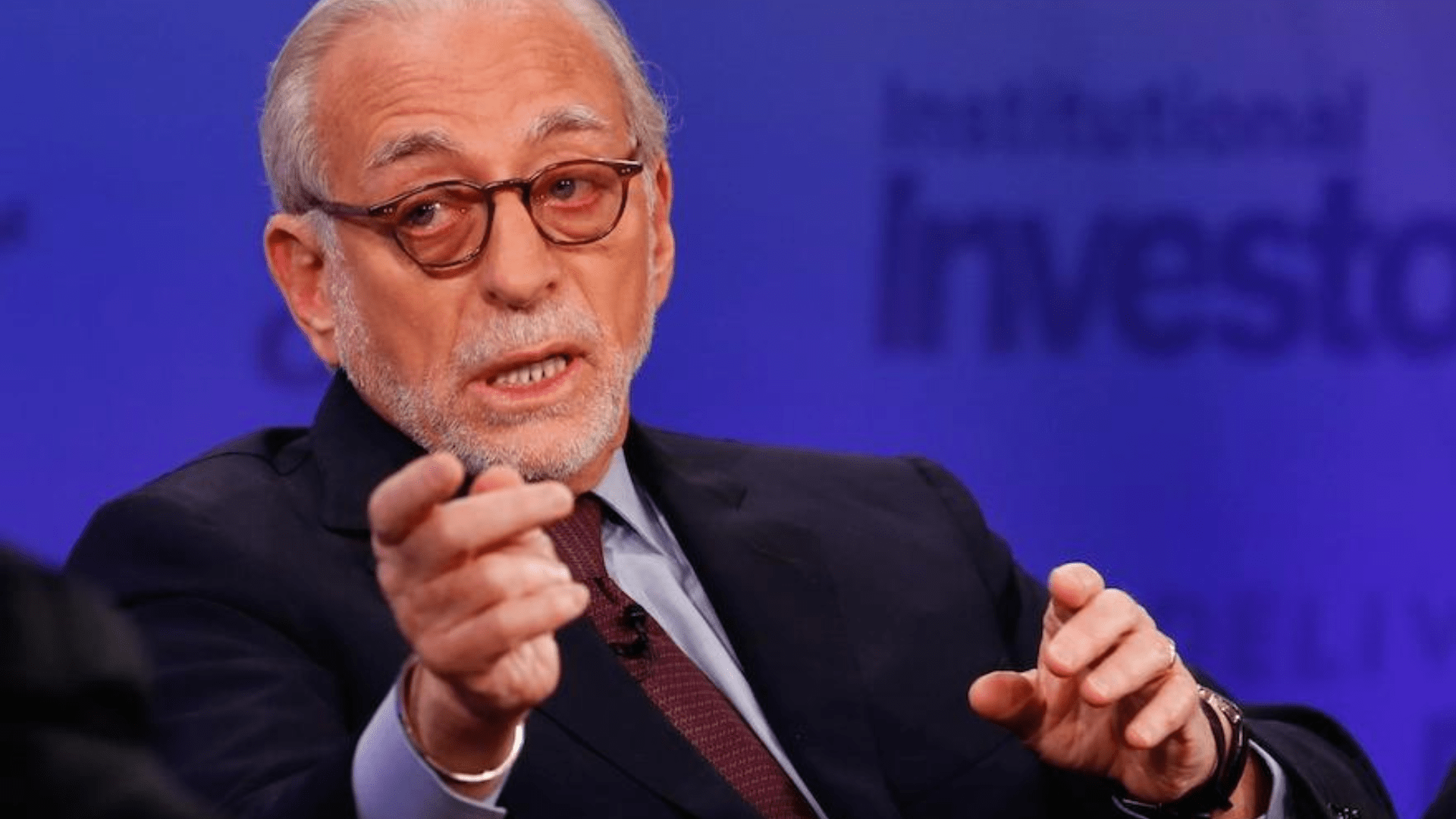

Who is Nelson Peltz? What is an “Activist Investor”?

Nelson Peltz, a distinguished billionaire and “activist investor,” co-founded Trian Fund Management, L.P. in 2005 alongside Peter May and Edward Garden.

Peltz, known for his significant roles on various corporate boards, including Ingersoll-Rand, Mondelez International, and Proctor & Gamble, challenges the negative perception associated with activist investors. He prefers the term “constructivist,” emphasizing his focus on urging companies to improve revenues and invest more in marketing rather than imposing unnecessary changes and influence.

Disney Grandchildren Say Nominees Do Not Value the Company

In the first letter, the grandchildren state that they believe the hedge-fund-backed nominees “have little to no knowledge of what Disney truly means to people like you [the shareholders].”

Further, they strongly emphasized that the nominees are simply “self-anointed ‘activist investors’ who are really wolves in sheep’s clothing” who want to “trick shareholders into opening the door for them.”

Disney Grandkids Express Support for Current Management

A second, less emphatic letter comes from the children of Diane Disney Miller, expressing support for Disney’s current management.

They highlight Bob Iger’s success in navigating the challenges of a modern world while maintaining the company’s commitment to entertainment and exploration.

Current Disney Leadership has Adapted and Remained True to Core Values

The family praises the current leadership for adapting and growing through adversity, aligning with Disney’s core values.

Both letters jointly aim to solidify backing for Disney’s existing leadership, urging shareholders to reject the activist proposals.

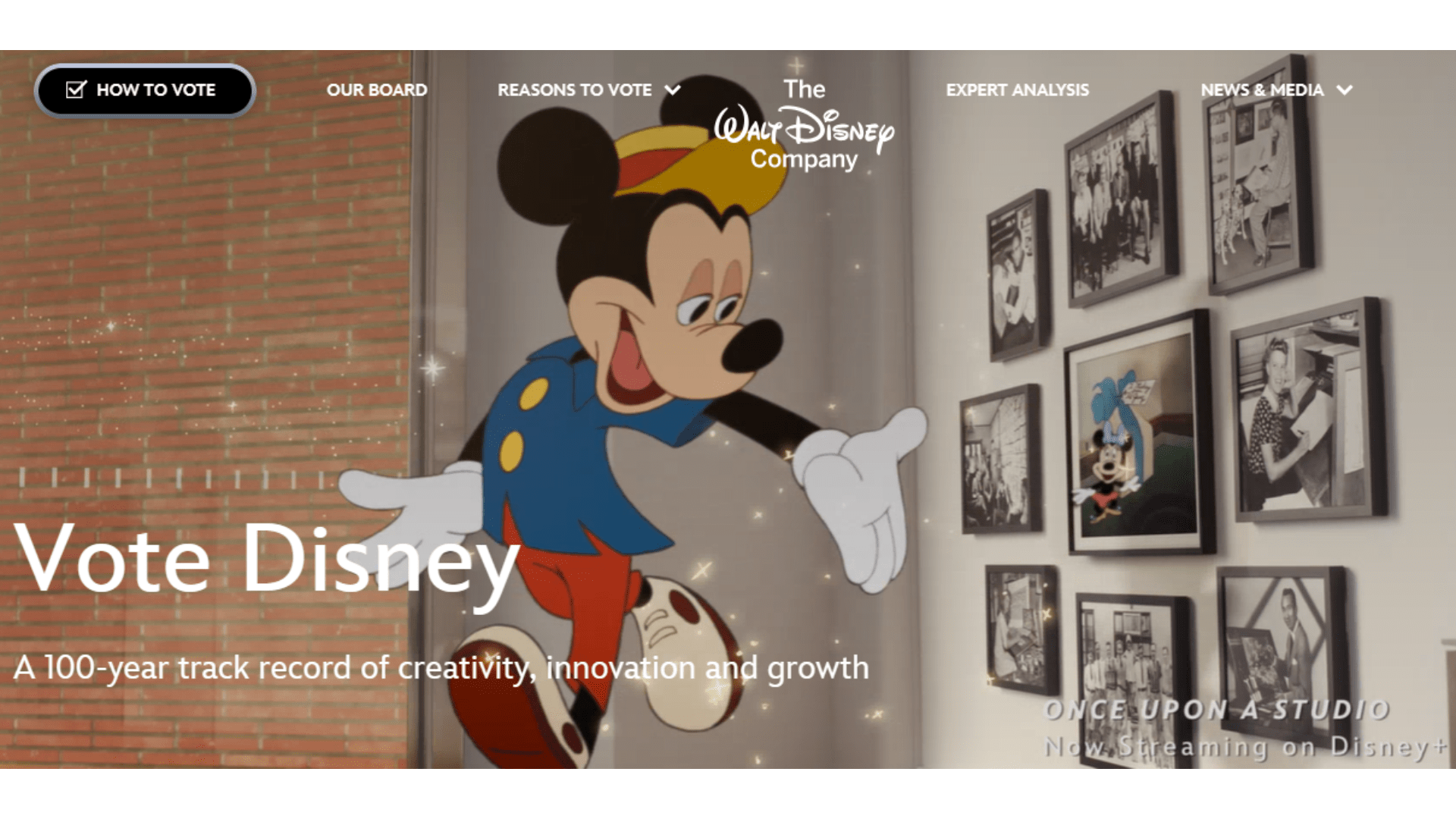

Disney’s Proxy-Vote Campaign Site

Disney’s response to the activist campaigns includes a dedicated proxy-vote campaign site, emphasizing the board and management team’s commitment to sustained growth and shareholder value.

The company acknowledges the challenges posed by activist hedge funds Trian Fund Management and Blackwells Capital, portraying them as seeking undue influence without possessing the necessary skills to address industry-wide challenges. Disney’s proxy campaign encourages shareholders to vote against the activist nominees, reinforcing the stability and strategic foresight of the current leadership.

Coming Disney 2024 Annual Shareholders Meeting in April

As the battle heads toward Disney’s 2024 annual shareholders meeting on April 3, the clash of interests underscores the intricate dynamics of corporate governance.

The descendants’ passionate letters serve not only as a testament to their commitment to Disney’s legacy but also as a rallying cry to safeguard the company’s cultural and creative heritage. In the backdrop, the corporate drama unfolds, shaping the narrative of Disney’s future through the lens of shareholder activism.