New York and California are facing financial challenges and have proposed new legislation aimed at taxing the wealthiest residents.

These states, grappling with shrinking tax revenues, believe targeting top earners is necessary. However, this approach has sparked concern among the wealthy, who argue they already pay substantial taxes.

California’s Budget Deficit: A Deepening Crisis

California is currently struggling with a record $68 billion budget deficit, per official figures released in December.

This financial strain is attributed to the rising cost of goods and services due to inflation, leading to decreased house sales and hiring.

California’s Tax Extension Due to Storms

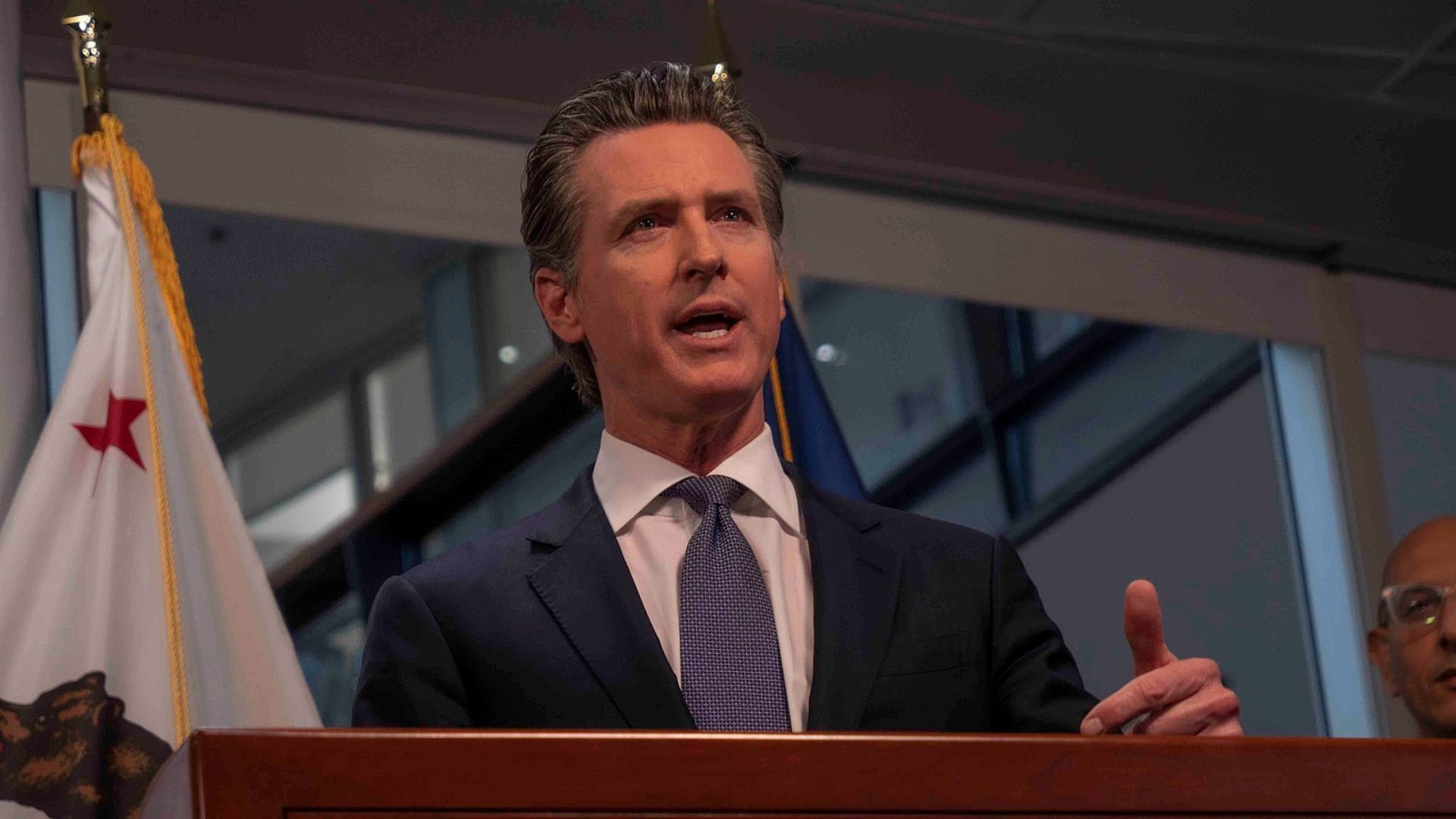

In California, the administration of Gov. Gavin Newsom extended the tax payment deadline due to severe storms last winter.

The decision to delay the 2022 taxes to November 2023 was intended as relief for affected residents but has contributed to the state’s financial challenges, as reported by CBS News.

New York’s Escalating Budget Deficit

New York is also experiencing a growing budget deficit, although currently less severe than California’s.

The state’s budget office, under Gov. Kathy Hochul, released figures, forecasting the deficit to nearly double from $5 billion to $9 billion, and potentially reaching $13 billion by 2025.

Proposed Wealth Tax in California

According to the Los Angeles Times, a proposed California wealth tax suggests imposing 1% on household incomes over $50 million and 1.5% on wealth exceeding $1 billion.

However, Gov. Newsom does not support these levies on the ultra-wealthy, casting doubt on the bill’s passage.

Newsom’s Firm Opposition to Wealth Tax

Governor Newsom has voiced his strong opposition to the idea of a wealth tax, a stance he has maintained consistently over the years.

Politico reports that in a budget presentation in Sacramento, he expressed his frustration with the Wall Street Journal’s editorial board for suggesting he might support such a tax. “Are you supporting a wealth tax? No, yet again. Why the hell do you keep writing about that?” Newsom said, emphasizing his long-held position against the introduction of a wealth tax in California.

Addressing the Budget Deficit Without New Taxes

Governor Newsom has reiterated his approach to addressing California’s $38 billion budget deficit.

Politico reveals that he plans to achieve this through a combination of budget cuts and the use of reserves, rather than implementing new taxes. His administration has been clear in rejecting the idea of a wealth tax, a position he reaffirmed in response to the Wall Street Journal’s editorial.

Misrepresentation in the WSJ Editorial

The Wall Street Journal ran an editorial featuring a photo of Governor Newsom, discussing a wealth tax bill set for a legislative hearing.

Newsom had already rejected the $20 billion proposal, but the editorial did not mention his opposition. It suggested, “Democratic legislators are proposing a wealth tax as an alternative to spending restraint,” ignoring Newsom’s stated position.

Newsom’s Critique of Conservative Media

Politico details that Governor Newsom is known for his critiques of conservative media outlets, including Fox News. He frequently engages in debates with figures like Sean Hannity.

His reaction to the Wall Street Journal editorial is part of a larger pattern of responding to what he perceives as biased reporting from conservative news sources.

Concerns Over California’s Image

Governor Newsom expressed concern about the impact of the Wall Street Journal’s editorial on California’s image.

He mentioned receiving numerous phone calls about the potential new tax and stressed that the state suffers due to misrepresentations, according to Politico. Newsom views these actions by the Journal and similar outlets as attempts to undermine California.

Impact on Newsom’s Political Future

The narrative around wealth taxes and fiscal policies could influence Governor Newsom’s political future.

Known as a potential contender for the 2028 presidential race, Newsom is aware that his association with California’s progressive tax proposals could affect his national image. He has a record of fiscal centrism and is generally cautious about tax hikes, as per information from Politico.

The Challenge of Passing Wealth Tax Bills

Despite a Democratic majority in California’s legislature, wealth tax bills have struggled to gain traction.

Politico explains that the state’s tax structure relies heavily on revenue from wealthy individuals, making the introduction of new taxes a contentious issue.

Ideological Clash in Fiscal Policy

Governor Newsom views the discussion around wealth taxes as an ideological battle. Politico reports that he accuses conservative media outlets like the Wall Street Journal of being “ideological warriors” rather than “truth-seekers.”

His strong statements reflect his frustration with what he sees as deliberate misrepresentations of his fiscal policy stance.

Stagnation of Wealth Tax Proposals in Sacramento

In California’s political landscape, wealth tax proposals have not made significant progress. Governor Newsom’s opposition plays a key role in this stagnation, as per Politico.

The difficulty in advancing these proposals is indicative of the broader challenges in implementing new tax measures in the state’s existing fiscal framework.

Newsom’s Approach to Fiscal Policy

Governor Newsom is distinguished by his approach to fiscal policy, leaning towards fiscal conservatism within California’s predominantly progressive political environment.

He prefers addressing budget issues through cuts and the use of reserves instead of imposing new taxes, The New York Times reports. This approach marks a central aspect of his governance and financial management strategy.

The National Implications of State Tax Policies

The debate over wealth taxes in California has implications beyond the state, potentially affecting national politics.

As Governor Newsom considers a future presidential campaign, his handling of state tax policies and the associated public perception could play a crucial role in shaping his political journey on the national stage, according to Politico.

Balancing State and National Political Goals

In his role as California’s Governor, Newsom faces the challenge of balancing state responsibilities with his aspirations on the national political scene.

Politico explains that his decisions, particularly regarding taxes, are not just about state governance but also about crafting a national image that resonates with a wider audience.

New York Considering Higher Taxes on the Wealthy

The Tax Foundation also reports that New York is contemplating higher tax rates for individuals earning over $450,000 annually and is also considering increasing capital gains taxes for billionaires.

This approach aims to address the state’s financial needs by targeting higher-income residents, reflecting a trend of states reevaluating their tax policies to manage deficits.

Wealthy Individuals Leaving California and New York?

Evidence suggests that wealthy individuals in California and New York are relocating, possibly to avoid higher taxes.

In California, records show a decline of 500,000 people between April 2020 and July 2022, as reported by the Los Angeles Times.

The Search for Lower Taxes

Fortune reports that many high earners are reportedly moving to states with lower or no income tax, such as Florida, Nevada, and Texas.

This migration reflects a search for more favorable tax environments and could significantly impact the tax revenues of states like California and New York.

Tax Policy in the 2024 Presidential Election Spotlight

The issue of state taxation is emerging as an important topic in the 2024 presidential election.

The election is scheduled for Nov. 5, with President Biden representing the Democratic Party and former President Donald Trump for the Republican Party.

Contrasting Tax Plans of Biden and Trump

CNN notes that President Biden has announced plans to increase individual, corporate, and capital gains taxes if reelected.

In contrast, former President Donald Trump, known for reducing taxes during his tenure, proposes introducing a baseline tariff on all U.S. imports and further cutting the corporate income tax rate, per CNN.

The Popularity of Taxing the Wealthy

A poll conducted by YouGov indicates that taxing the super-rich is a popular concept among both Democratic and Republican voters.

Many Americans believe that those with substantial incomes should contribute more in taxes.

2025: Anticipating a Major Tax Code Overhaul

The Tax Cuts and Jobs Act of 2017, introduced during Trump’s presidency, is set to expire in 2025.

CBS News reveals that this expiration means that the next president, whether it’s Biden, Trump, or a potential candidate like Florida Gov. Ron DeSantis, will possibly face the task of rewriting the tax code.