For many, the milestones of adulthood are quickly being dashed by financial hardships, including the idea of a comfortable retirement.

And while every generation is worried about the future, for Generation X (the generation born between 1965 and 1980), retirement seems almost unobtainable. Can Gen X retire comfortably? If so, what will they need? Let’s get into it.

This Is How Much Generation X Will Need to Retire

In a new survey from investment manager Schroders, Generation X will need an average of $1.1 million in savings to retire comfortably.

Sadly, Schroders assumes that most people within that generation will barely meet half that goal.

Data Speculates That Gen X Won’t Have Nearly Enough

In fact, Shroders believes that the average Gen Xer will only have $661,000 by the time they retire.

And it’s not just the investment experts who understand the trouble Gen Xers are in; they know it, too.

Gen Xers Don’t Believe They’ll Ever Have Enough to Retire

It’s important to note that Schroders’ findings are discouraging for all generations. About 49% of Millennials and 53% of Baby Boomers say they have thrown away the idea of a dream retirement, believing it is impossible to comfortably retire without worry.

However, Gen Xers are certainly the most pessimistic, as 61% do not feel that they will be able to achieve the ideal retirement.

And it seems that Gen Xers aren’t just being cynical. Almost 45% of the Gen Xers surveyed confessed that they have not done any retirement planning.

While one in four Gen Xers don’t have a savings account, the concern for those who do have a savings account is still high. Schroders’ research shows that those who are saving for retirement have roughly a third of their retirement accounts filled.

According to research by Prudential Financial, over half of Gen X have little to nothing put away for retirement.

When we look at the average savings for U.S. Gen Xers, the median account balance is $10,000. Out of 65 million U.S. Gen Xers, 35% have less than $10,000 saved. Even worse, 18% have zero savings.

The Savings Gap Is Larger for Gen X than Any Other Generation

In fact, Gen X has a much larger average savings gap than the generations before them at $451,170.

Millennials (people born between 1981 and 1996) are seeing a savings gap of about $403,626, while non-retired Baby Boomers (people born between 1946 and 1964) clock in at $491,496.

Why Does Retirement Look So Bleak for Gen X?

After hearing that Gen X is not only terrified of retirement but also has significant reason to be, as they won’t have nearly enough to be comfortable, the question remains: How did this happen?

Why does the Forgotten Generation’s future look so bleak?

Gen Xers Were the First Generation to Work Without a Pension

The first thing to note is that Gen Xers were the very first generation without any kind of pension plan.

The vast majority of Baby Boomers received a traditional pension, so when they retired, they received a fixed monthly payment for the rest of their lives.

Working With a 401 K Is Much Different Than a Pension

However, Gen X had to quickly learn that 401 k plans are very different than pension plans.

For the first time, they had to put their own money away for the future. And whether they didn’t fully understand or didn’t have enough income to save some, many Gen Xers simply didn’t utilize this saving tactic.

Many Gen Xers Lack Financial Literacy

Some experts say that Gen X’s lack of savings is the result of a defecit of confidence and financial literacy.

Boyden discovered that two-thirds of Gen X workers are afraid of losing their money (with 24% of that slice not understanding how to invest their savings.)

Understanding Long Term Financial Planning is Essential

People who understand long term financial planning routinely scrutinize their retirement savings, have emergency savings, and don’t spend money without purpose.

So it’s no surprise that people with high financial literacy tend to have a better chance of reaching their retirement savings needs (via Goldman Sachs Asset Management and Syntonic).

Retiring Early Minimizes Social Security Benefits

More:

View public domain image source here

Another issue that Gen Xers are facing is that most adults retire around their early 60s, due to health issues and exhaustion, but many cannot obtain their retirement benefits until they are 67 years old.

And even those who do recieve their Social Security benefits early because they desperately need them are actually decreasing the amount they would recieve if they waited just a few more years.

Only 11% of Gen Xers Will Wait Until 70 to Receive Social Security

It’s estimated that only 11% of Generation X are going to wait to receive their maximum Social Security benefit payments at 70 years old.

However, waiting until 70 to receive Social Security benefits would mean they’d earn delayed retirement credits, which will allow an 8% increase to all benefits each year before the 70-year-mark.

Gen Xers Simply Didn’t Plan Ahead

Many argue that the bottom line is that Gen X simply didn’t plan ahead.

They didn’t take the time to understand long-term financial planning, their 401 ks, or even their Social Security benefits. But not everyone believes it was all Gen X’s fault.

Gen X Lived Through a Wildly Tumultuous Economy

Gen Xers have lived through a wild and often tumultuous economy.

From the dotcom bubble to the Great Recession and the housing market crash of 2008, this generation has had several setbacks that made it much more challenging to save than previous generations encountered.

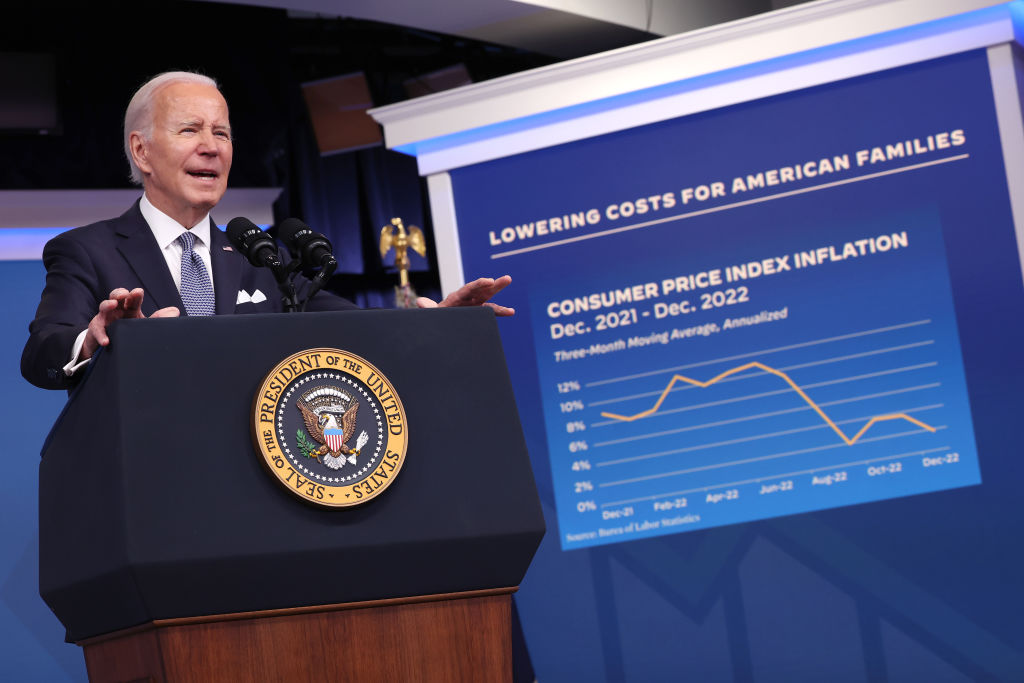

Cost of Living Is Increasing as Gen X Tries to Catch Up

And now, in 2023, those Gen Xers who are finally attempting to get their retirement funds in order are struggling to save anything with the ever increasing cost of living.

Thanks to inflation, groceries, utilities, gas, rent, mortgages, and everything else a person may want or need to purchase is more expensive than ever before.

Time is Running Out for Gen X

As the oldest Gen Xers are less than a decade away from the retirement age of 65 years, time truly is running out.

“Gen Xers are hitting crunchtime for retirement preparation,” Kelly LaVigne, vice president of Consumer Insights at Allianz Life, told Yahoo Finance.

Gen X’s Lack of Savings Will Cause Problems for the Entire Economy

It’s also important to understand that Gen X’s severe lack of retirement savings will cause extreme problems for the country’s overall economy.

First and foremost, if Gen Xers don’t have excess money to spend on non-necessities in their senior years, certain industries will see decrease in profits which could lead to layoffs, closings, and even a plummeting stock market.

If Gen Xers Can’t Retire, Jobs Will Be Harder to Find

As well, there are some Gen Xers who will be forced to work well into their late 60’s and maybe even early 70’s as they simply won’t have enough savings to stop working.

When this happens, there will be less jobs for the next generation, and unemployment could reach record highs.

Financial Gurus Say Gen Xers Should Invest Now

As previously mentioned, many experts argue that one of Gen X’s major problems is that they simply don’t know how to invest.

But they also say that it’s never too late to learn. If Gen Xers who don’t have sufficient retirement savings want to get where they need to be within the next few years, financial gurus say they need to invest as soon as possible.

Experts Urge Millennials and Gen Zers to Learn from Gen X’s Mistakes

Millennials and Gen Zers aren’t far behind their Gen X predecessors, and experts are urging these young professionals to start planning, saving, and investing now so they don’t end up in trouble later.

“It’s a cliché because it is true, if you’re failing to plan, you’re planning to fail,” Deb Boyden, Schroders’ head of U.S. defined contribution, told Yahoo Finance.

When Is the Right Time to Start Thinking About Retirement?

Realistically, the best time to start planning for retirement is as early as possible, which for most people is in their 20’s.

So, to any Gen Zers reading this: Start thinking about saving for retirement and improve your financial literacy!

It’s Never Too Late to Start Saving

But even for those who can’t even remember they’re 20’s experts want them to understand it’s never too late to start saving.

Whatever is saved today will be there for you in retirement when you really need it. So invest, create a savings account, and stop frivolous spending today. You will thank yourself later!