The United States has long had a huge gap between the rich and poor. However, recently this wealth disparity has only seemed to grow more severe.

As a result, many activists and American people have begun to openly discuss the idea of creating a wealth cap. Now, many politicians have also begun to discuss creating this policy — even though many critics have stated it would hurt the American economy.

Tax The Rich

It’s no secret that several Democratic politicians have argued that capitalism leads to excessive wealth for the 1% of Americans and that a portion of their fortunes should be taxed to help the nation.

Over the past few decades, several politicians have openly alluded to or even called for the implementation of such a tax.

Elizabeth Warren Called For Wealth Tax in 2019

During her presidential campaign back in 2019, Senator Elizabeth Warren embraced an idea that would have imposed a significant tax on the wealthiest inhabitants of the United States.

While it was controversial, with some even claiming such a tax was unconstitutional, it garnered support among many other members of the Democratic party at the time.

Warren’s Ultra Millionaire Tax

Warren’s proposed wealth tax, referred to as the Ultra-Millionaire Tax aimed to generate an additional trillion dollars in revenue for the US.

“On November 1, 2019, Elizabeth proposed an additional 3% surtax on wealth over $1 billion – bringing the total annual rate to 6% on every dollar over $1 billion – which generates an additional $1 trillion in revenue,” said her website.

Yang Cites European Countries as Influence

Andrew Yang, another Democratic presidential candidate from 2019, pointed out that several European nations, including Germany, Sweden, Denmark, and France, have adopted similar wealth taxes.

“If we can’t learn from the failed experiences of other countries, what can we learn from?” Yang asked on stage at the Democratic presidential debate in 2019.

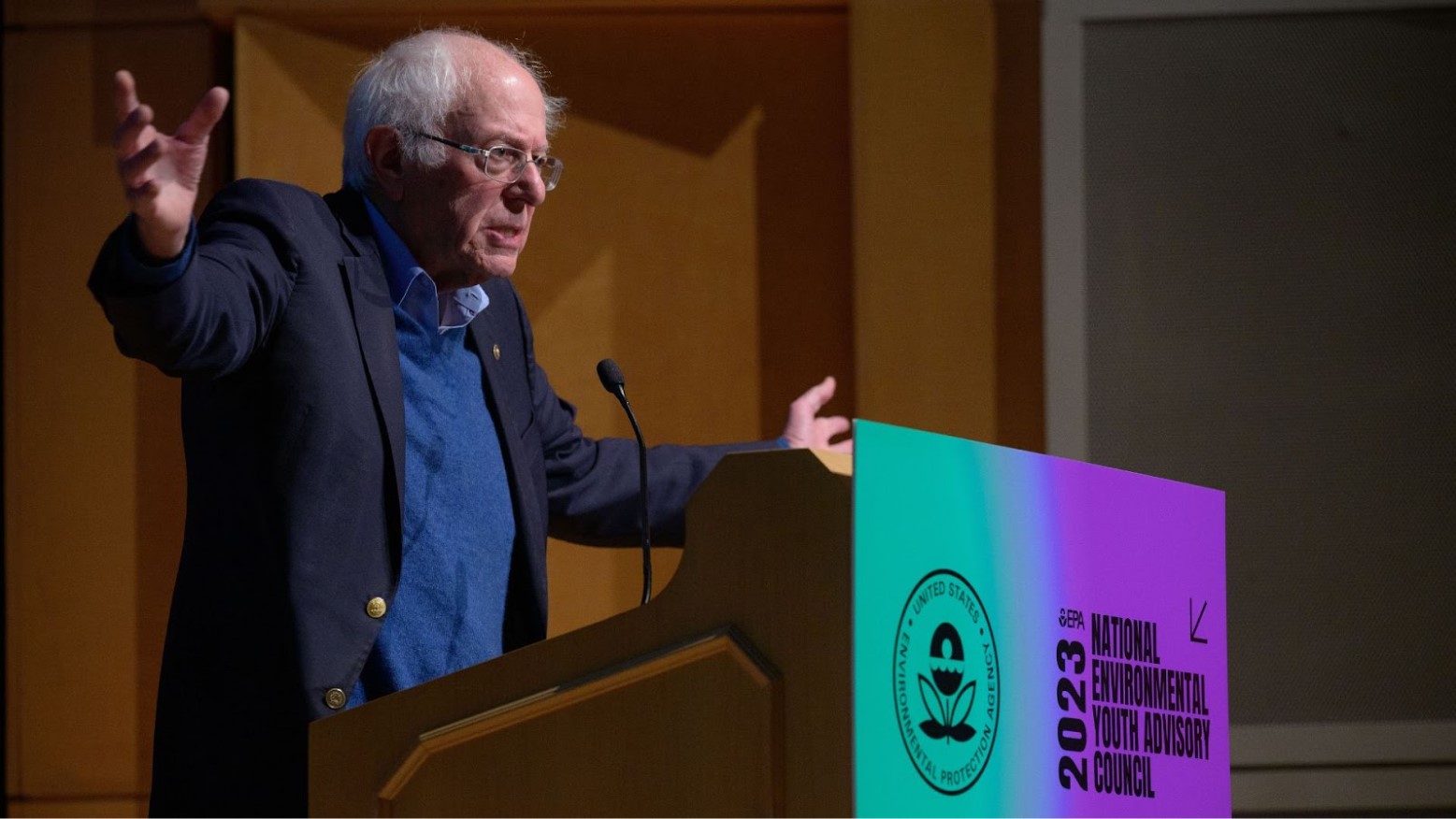

Senator Bernie Sanders’ Proposals

In recent years, Progressive politician Bernie Sanders hasn’t outright called for imposing a wealth cap on citizens in the United States, but he has alluded to the idea.

The Vermont Senator has openly talked about how unequal the country is for years now and would undoubtedly jump at the chance to usher in a wealth tax.

Sanders Unhappy With the 1%

Sanders has called out many corporations and wealthy Americans for the disparity in the U.S., especially in regards to the low amount of taxes the 1% seems to get away with.

This has led the Senator to suggest on numerous occasions that something must be done to make the rich pay their fair share of tax.

A Wealth Tax

To put money into fixing the wealth disparity in the country, Sanders has claimed that a wealth tax on the wealthiest people in the nation should be adopted.

This move would tax any income over $1 billion at 100%.

The Rich Can Survive With Less Than $1 Billion

During an interview with HBO’s Max’s Who’s Talking to Chris Wallace, Bernie was asked about his long-standing view of taxing the extremely wealthy.

When asked if the US government should confiscate any personal wealth over $999 million, Sanders replied, “Yeah.”

People Can Survive on $999 Million, Says Sanders

Speaking on the possibility of a future wealth tax being placed on billionaires, Sanders alleges they would get by just fine.

“You may disagree with me, but I think people can make it on $999 million,” he said,

Do Billionaires Increase Employment

During a separate interview, Sanders spoke about his book It’s OK to Be Angry About Capitalism and responded to questions about whether billionaires increase employment.

“You can have a vibrant economy without [a handful of] people owning more wealth than the bottom half of American society,” he said, adding that if he had things his way, those making “a whole lot of money” would have to “pay a whole lot of money.”

Sanders Wealth Tax Plans

During his 2020 presidential campaign, Sanders referenced an idea that aimed to introduce a wealth tax back in 2019.

Per Fortune, “The Vermont independent senator called for the richest 0.1% of American households—or those with a net worth of more than $32 million—to be liable for a new annual tax, with the tax rate increasing with net worth.”

Wealth of Billionaires Cut in Half

During his numerous campaign speeches, Sanders argued that his plan could break up the concentration of wealth in the US.

Sanders argued during his campaign that “under this plan, the wealth of billionaires would be cut in half over 15 years, which would substantially break up the concentration of wealth and power of this small privileged class.”

AOC’s Plans

Sanders isn’t alone in Congress when it comes to trying to impose some level of a wealth limit.

Fellow progressive House Representative Alexandria Ocasio-Cortez has also publicly talked about fixing the income inequality in America.

Ocasio-Cortez Wants to Introduce a Wealth Tax

Ocasio-Cortez, like Sanders, has agreed to raise tax rates for the 1%.

The representative has also pointed out that the U.S. had higher tax rates for the wealthy in the mid-20th century.

A 70% Tax

Ocasio-Cortez, as well as other progressives and organizations, have claimed that a 70% tax on the wealthiest people in America could help decrease overall inequality in the country.

These taxes could help rectify the issues that many claim capitalism has created, particularly when it comes to the poor and working class.

Elizabeth Warren’s Policies

Senator Elizabeth Warren, a Democrat who is also often called a progressive, has tried to put forth various policies that would, in some way, implement a form of a wealth limit.

Warren also hasn’t fully called for a wealth cap. However, she is also a supporter of higher tax rates for the 1% in the country.

California Representative Believes Tax System is Inadequate

According to California State Representative Alex Lee, the current tax system allows the rich to avoid paying taxes.

“Our current taxation system is inadequate; it’s not very successful at taxing the ultra-wealthy,” he said. “[Facebook CEO] Mark Zuckerberg or [Google co-founder] Larry Page can largely avoid the California income tax” if they don’t sell their stock.

It’s Time the Ultra Rich Pay

Lee believes the US government is now in a position to demand that the nation’s wealthiest residents pay their fair share of taxes.

“The working class pays their fair share — it’s time the ultra-rich pay.”

Supporters of a Wealth Tax

Those in support of a wealth tax or wealth cap have claimed that income inequality can be fixed by spreading money around, thereby creating a more balanced country with various resources to help all, rather than only a few.

These types of taxes and caps could further narrow the large wealth disparity seen in the country at the moment.

Support From the Rich

The introduction of a wealth tax has garnered attention from not only many of America’s leading politicians but also some of its wealthiest citizens.

In recent years, Mark Cuban, Ray Dalio, and the heiress of Disney, Abigail Disney, have shown support for the introduction of higher taxes for the richest Americans.

Billionaires Call to Be Taxed More

Many of the world’s wealthiest billionaires made their statement clear at the World Economic Forum in Davos this year: they want to be taxed more to help with public services around the world.

In an open letter to world leaders, a portion of the text read, “Our request is simple: we ask you to tax us, the very richest in society,” according to The Guardian.

This Won’t Alter Our Standard of Living

The letter was signed by people from over 17 countries, including actor Brian Cox, screenwriter Simon Pegg, Valerie Rockefeller, and Abigal Disney.

According to their collective opinion, the wealth tax “will not fundamentally alter our standard of living, nor deprive our children, nor harm our nation’s economic growth. But it will turn extreme and unproductive private wealth into an investment for our common democratic future.”

Proud to Pay

“We are also the people who benefit most from the status quo,” they said in a letter titled Proud to Pay.

“But inequality has reached a tipping point, and its cost to our economic, societal and ecological stability risk is severe – and growing every day. In short, we need action now.”

Poll Suggests Super Rich Support Wealth Tax

A poll carried out by the campaign group Patriotic Millionaires reached out to more than 2,300 millionaires from G20 nations.

They discovered that nearly 60% of those involved in the poll supported the introduction of a 2% wealth tax.

British Farmer Suggests Rich People Want to Be Taxed More

A British farmer and entrepreneur who founded his own vegetable delivery company claims the results from the Patriotic Millionaire poll speak for themselves.

“This poll seems to show that the whole world, including the richest people, wants to tax the super-rich. So where on Earth is the leadership from our elected representatives who have the power to actually do it? We, the very richest, are sick and tired of inaction, so it’s hardly surprising that working people, at the sharp end of our rigged economies, have lost all patience,” he said.

Actor Calls Out Billionaires

Cox, who starred as fictional billionaire Logan Roy in Succession, claims, “We are living in a second ‘Gilded Age.’

He continued, “Billionaires are wielding their extreme wealth to accumulate political power and influence, simultaneously undermining democracy and the global economy. It’s long past time to act. If our elected officials refuse to address this concentration of money and power, the consequences will be dire.”

American Citizens Want Billionaires Taxed More

A YouGov poll published in 2023 appears to suggest that even the American people are on board with the introduction of a wealth tax.

Over 57% of the poll participants said that American billionaires weren’t taxed enough.

The Rich Should Help Fund Public Programs, Says Poll

A poll released several years ago by Reuters and Ipsos revealed participants believe America’s wealthiest citizens should help fund public programs.

Nearly 4,500 Americans claim the very rich should “contribute an extra share of their total wealth each year to support public programs.”

Helping the Economy

Advocates of wealth caps and taxes have also stated that these policies could further push the spending of money, which would only help the economy in the long run.

For example, the wealthy would be more inclined to spend their money, rather than hold on to a surplus amount. This money could then be invested or spent, which would help the U.S. economy.

Moving Money Around

However, some analysts do point out that the opposite could happen. If a wealth cap existed in the U.S., then the wealthy could simply move their money around to hide their mass wealth.

They could relocate their money or assets to other countries or areas where they wouldn’t be taxed at a higher rate. In this way, they could still hold on to their money.

Improving Social Welfare Programs

One of the main reasons why many support the idea of a wealth tax or cap is because of the severe inequality in the United States. Many Americans see how well the rich thrive — and how poorly everyone else lives.

If a wealth tax or cap existed, then this money could be redirected to improving various social welfare programs run by the government. This would help the entire U.S. society.

More Tax Could End Homelessness in the US

“A world without homelessness is possible; a world with universal child care for every family is possible,” said Will Guzzardi, an Illinois state representative.

“We don’t think it’s possible because they tell us it’s not possible. They tell us that because they don’t want to pay what they owe.”

The Concerns of Critics

However, critics of any type of wealth cap or tax have stated that these policies could completely hinder innovation, technological developments and advancements, and entrepreneurship.

These detractors have claimed that many entrepreneurs put money into technological advancements because of the idea of wealth. If they do not have the opportunity to become rich, they may not willingly partake in these developments.

Tax The Poor

Back in 2022, GOP Sen. Rick Scott proposed a plan to ensure the bottom half of income earners in the United States would pay some tax, an idea that received considerable backlash.

“All Americans should pay some income tax to have skin in the game, even if a small amount,” reads Scott’s 11-point plan. “Currently, over half of Americans pay no income tax.” However, many are under the impression that this would only further drive the lower earners into poverty.

One’s Personal Right

Even though good could come from these taxes and caps, many believe that a wealth cap infringes on their right to enjoy their own life — and their own money that they worked hard to earn.

As a result, the idea of imposing a wealth tax on American businesses and citizens will likely remain a hotly debated issue for the foreseeable future.